Region:Middle East

Author(s):Shubham

Product Code:KRAD6589

Pages:85

Published On:December 2025

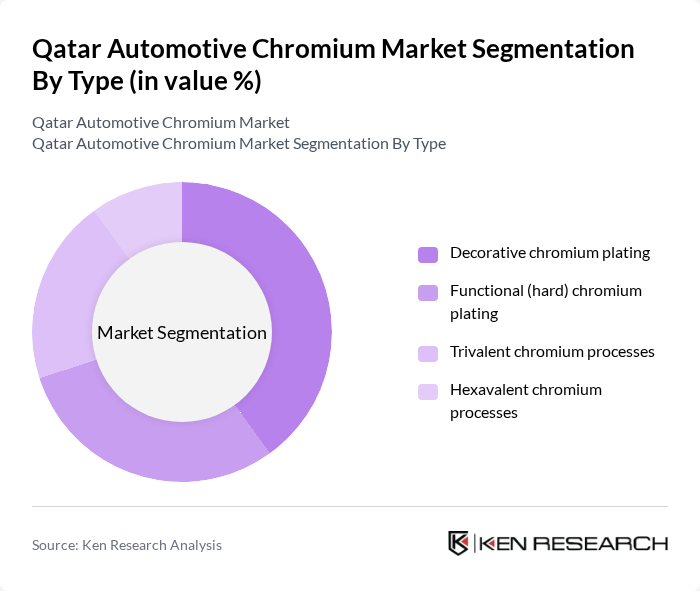

By Type:The market can be segmented into four types: Decorative chromium plating, Functional (hard) chromium plating, Trivalent chromium processes, and Hexavalent chromium processes. Each type serves different applications within the automotive industry, with decorative plating primarily used for aesthetic purposes on exterior trims, grills, badges, and interior accents, while functional plating is applied on components such as shafts, pistons, and tooling where wear resistance, low friction, and corrosion protection are critical. Trivalent chromium processes are increasingly used as an alternative technology to reduce environmental and health risks associated with hexavalent chromium baths while still providing high-quality decorative and protective coatings.

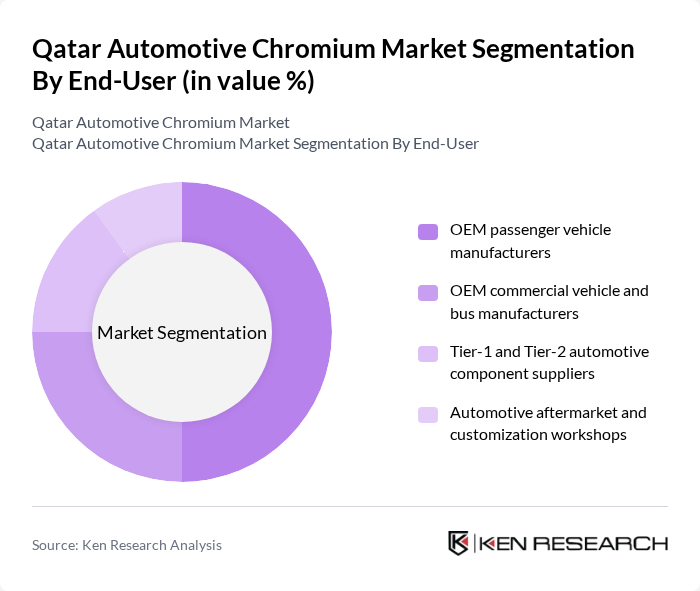

By End-User:The end-user segmentation includes OEM passenger vehicle manufacturers, OEM commercial vehicle and bus manufacturers, Tier-1 and Tier-2 automotive component suppliers, and automotive aftermarket and customization workshops. In Qatar, most demand is linked to global OEM brands represented through local distributors and service centers rather than full-scale vehicle manufacturing, meaning that a large portion of automotive chromium use is tied to imported components and local finishing, refurbishment, and customization. Each segment plays a crucial role in the demand for chromium plating, with OEM-linked dealer networks and their Tier-1/Tier-2 supply chains accounting for the bulk of high-specification plated parts, while the automotive aftermarket and customization workshops drive incremental demand for cosmetic upgrades, re-chroming, and personalization services.

The Qatar Automotive Chromium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Chrome & Electroplating W.L.L., Qatar Technical International Metal Industries (QTIMI), Qatar Galvanizing Company W.L.L., Qatar Industrial Manufacturing Company Q.P.S.C., Qatar Fuel Additives Company Limited (QAFAC), Qatar Steel Company Q.P.S.C., Baladna Automotive & Industrial Coatings (Qatar), Jaidah Automotive, Abdullah AbdulGhani & Bros. Co. W.L.L. (Toyota & Lexus Qatar), Saleh Al Hamad Al Mana Co. (Nissan, Renault, Infiniti Qatar), Al Fardan Automobiles (BMW & MINI Qatar), Nasser Bin Khaled Automobiles (Mercedes-Benz Qatar), United Cars Almana (FCA / Stellantis brands Qatar), Qatar Free Zones Authority (automotive and surface-finishing clusters), Qatar Science and Technology Park (advanced materials & surface technologies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar automotive chromium market appears promising, driven by increasing investments in electric vehicle production and advancements in recycling technologies. As the government prioritizes sustainable practices, the automotive sector is likely to see a shift towards more eco-friendly materials, including chromium. Additionally, strategic partnerships between local manufacturers and global automotive companies will enhance innovation and efficiency, positioning Qatar as a competitive player in the regional automotive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Decorative chromium plating Functional (hard) chromium plating Trivalent chromium processes Hexavalent chromium processes |

| By End-User | OEM passenger vehicle manufacturers OEM commercial vehicle and bus manufacturers Tier-1 and Tier-2 automotive component suppliers Automotive aftermarket and customization workshops |

| By Application | Exterior trim (grilles, emblems, door handles, mirror housings) Interior trim (knobs, bezels, decorative inserts) Wheels, exhausts, and under-the-hood components Functional wear- and corrosion-resistant parts |

| By Substrate | ABS and other plastics Steel and stainless steel Aluminum and alloys Others |

| By Distribution Channel | Direct supply to OEMs Local chrome plating job shops Industrial chemical distributors Import-based traders |

| By Vehicle Category | Luxury and premium vehicles Mass-market passenger cars Light commercial vehicles Heavy commercial vehicles and buses |

| By Region | Doha Al Rayyan Al Wakrah & Mesaieed industrial area Rest of Qatar |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Production Managers, Quality Control Engineers |

| Suppliers of Chromium | 80 | Procurement Managers, Supply Chain Analysts |

| Automotive Industry Experts | 60 | Market Analysts, Industry Consultants |

| Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

| Automotive Research Institutions | 40 | Research Scientists, Academic Professors |

The Qatar Automotive Chromium Market is valued at approximately USD 15 million, driven by the increasing demand for automotive components that utilize chromium plating for enhanced durability and aesthetic appeal, particularly in premium and luxury vehicles.