Region:Middle East

Author(s):Dev

Product Code:KRAC3334

Pages:100

Published On:October 2025

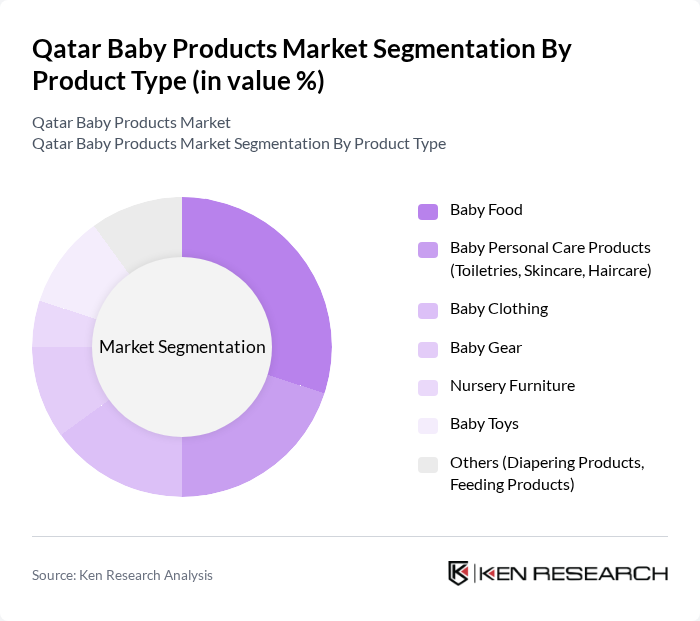

By Product Type:The product type segmentation includes various categories such as Baby Food, Baby Personal Care Products (Toiletries, Skincare, Haircare), Baby Clothing, Baby Gear, Nursery Furniture, Baby Toys, and Others (Diapering Products, Feeding Products). Among these, Baby Food is currently the leading subsegment due to the increasing focus on nutrition and health among parents. The demand for organic and fortified baby food products is particularly high, reflecting a trend towards healthier eating habits for infants. Baby Personal Care Products are also experiencing robust growth, driven by rising interest in premium and organic formulations.

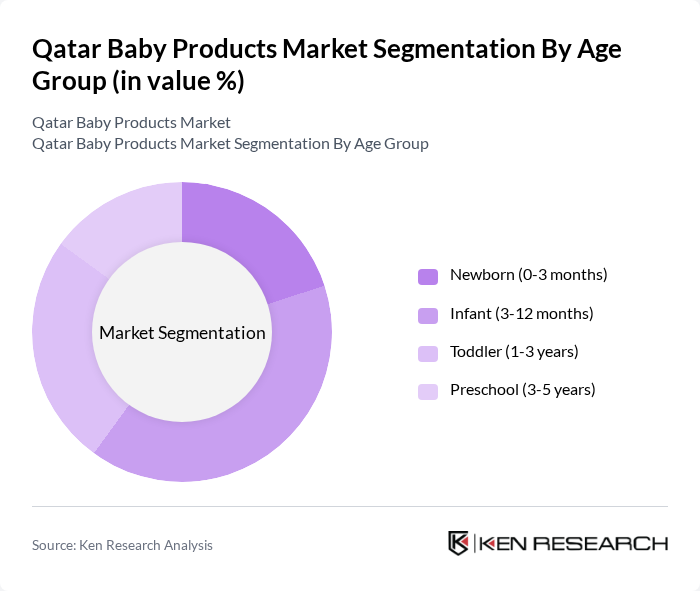

By Age Group:The age group segmentation includes Newborn (0-3 months), Infant (3-12 months), Toddler (1-3 years), and Preschool (3-5 years). The Infant segment is the most significant, driven by the high demand for baby food and personal care products tailored for this age group. Parents are increasingly investing in specialized products that cater to the developmental needs of infants, leading to a robust market presence in this category. The Toddler segment also shows notable growth, reflecting increased spending on toys and gear as children become more active.

The Qatar Baby Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble, Johnson & Johnson, Nestlé S.A., Unilever, Kimberly-Clark Corporation, Philips Avent, Chicco, Munchkin, BabyBjörn, Bumbo, Medela, Graco, Britax, Evenflo, Clek contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar baby products market appears promising, driven by demographic trends and evolving consumer preferences. As disposable incomes rise, parents are increasingly willing to invest in premium and organic products, reflecting a shift towards quality and sustainability. Additionally, the growth of e-commerce is expected to enhance market accessibility, allowing consumers to explore diverse product offerings. With a focus on innovation and eco-friendly solutions, the market is likely to witness significant transformations, catering to the needs of modern families in Qatar.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Baby Food Baby Personal Care Products (Toiletries, Skincare, Haircare) Baby Clothing Baby Gear Nursery Furniture Baby Toys Others (Diapering Products, Feeding Products) |

| By Age Group | Newborn (0-3 months) Infant (3-12 months) Toddler (1-3 years) Preschool (3-5 years) |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Pharmacies E-commerce |

| By Brand Type | International Brands Local Brands |

| By Price Range | Premium Mid-range Budget |

| By Product Category | Health and Safety Products Feeding Products Diapering Products |

| By Consumer Preference | Eco-friendly Products Organic Products Traditional Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Baby Products | 60 | Store Managers, Category Buyers |

| Online Baby Product Sales | 50 | E-commerce Managers, Digital Marketing Specialists |

| Health and Safety Products | 40 | Pediatricians, Child Safety Experts |

| Baby Clothing and Accessories | 55 | Fashion Retail Managers, Product Designers |

| Toys and Educational Products | 45 | Toy Manufacturers, Educational Consultants |

The Qatar Baby Products Market is valued at approximately USD 390 million, driven by factors such as increasing disposable incomes, a rising birth rate, and heightened awareness of child health and safety among parents.