Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5923

Pages:97

Published On:December 2025

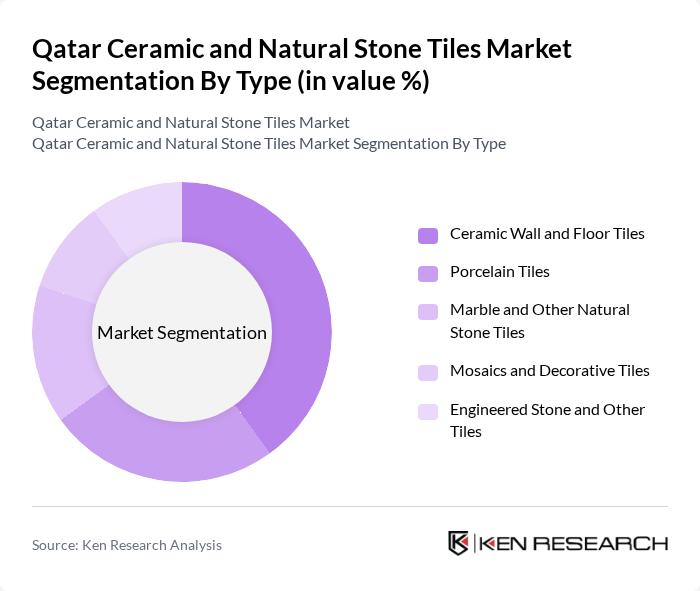

By Type:The market is segmented into various types of tiles, including Ceramic Wall and Floor Tiles, Porcelain Tiles, Marble and Other Natural Stone Tiles, Mosaics and Decorative Tiles, and Engineered Stone and Other Tiles. Among these, Ceramic Wall and Floor Tiles dominate the market due to their versatility, affordability, and wide range of designs that cater to both residential and commercial applications.

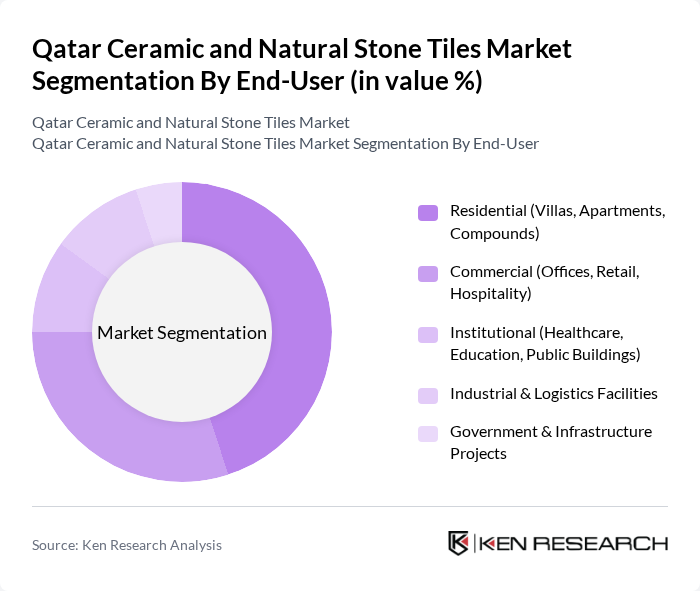

By End-User:The end-user segmentation includes Residential (Villas, Apartments, Compounds), Commercial (Offices, Retail, Hospitality), Institutional (Healthcare, Education, Public Buildings), Industrial & Logistics Facilities, and Government & Infrastructure Projects. The Residential segment is the leading end-user, driven by the growing population and increasing disposable income, which has led to a surge in new housing developments.

The Qatar Ceramic and Natural Stone Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Anis Trading Company (Tiles & Sanitary Ware), Al Wajba Establishment for Marble & Ceramic, Al Jaber Tile & Marble Factory, Qatar Marble & Stone Company (QM&S), Royal Ceramics – Royal Group Qatar, Al Rawnaq Trading Company, Al Mana Maples (Flooring & Interior Solutions), Al Emadi Stones, Al Mirqab Marble Factory, Qatar National Import & Export Co. (QNIE – Building Materials Division), Al Darwish Engineering – Tiles & Finishes Division, Al Sehmiah Cement Products & Interlock, Al Muftah Trading (Tiles & Sanitary Ware), Porcelanosa Group – Qatar Operations, RAK Ceramics PJSC – Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar ceramic and natural stone tiles market appears promising, driven by ongoing investments in infrastructure and a growing emphasis on sustainability. As the government continues to support construction projects, the demand for high-quality tiles is expected to rise. Additionally, the integration of smart technologies in homes will further enhance the appeal of innovative tile designs, creating new avenues for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ceramic Wall and Floor Tiles Porcelain Tiles Marble and Other Natural Stone Tiles Mosaics and Decorative Tiles Engineered Stone and Other Tiles |

| By End-User | Residential (Villas, Apartments, Compounds) Commercial (Offices, Retail, Hospitality) Institutional (Healthcare, Education, Public Buildings) Industrial & Logistics Facilities Government & Infrastructure Projects |

| By Application | Indoor Flooring Wall Cladding and Backsplashes Wet Areas (Bathrooms, Kitchens, Pools & Spas) Outdoor & Façade Applications Countertops and Worktops |

| By Design | Marble-look and Stone-look Designs Wood-look and Concrete-look Designs Traditional / Islamic and Geometric Patterns Minimalist and Contemporary Designs Customized and Premium Designer Collections |

| By Size | Large Format Tiles (? 60x60 cm) Standard Size Tiles (30x30–60x60 cm) Small Format and Mosaic Tiles (< 30x30 cm) Slabs and Jumbo Formats |

| By Finish | Polished / High Gloss Matte / Satin Textured and Anti-Slip Honed / Brushed and Special Finishes |

| By Distribution Channel | Direct Sales to Projects (Developers, Contractors, Government) Specialist Tile & Sanitary Ware Showrooms Building Material Retailers & DIY Stores Distributors & Wholesalers Online and Omnichannel Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 120 | Homeowners, Interior Designers |

| Commercial Tile Applications | 100 | Facility Managers, Architects |

| Construction Industry Insights | 80 | Contractors, Project Managers |

| Retail Tile Sales | 70 | Retail Managers, Sales Executives |

| Export Market for Tiles | 60 | Export Managers, Trade Analysts |

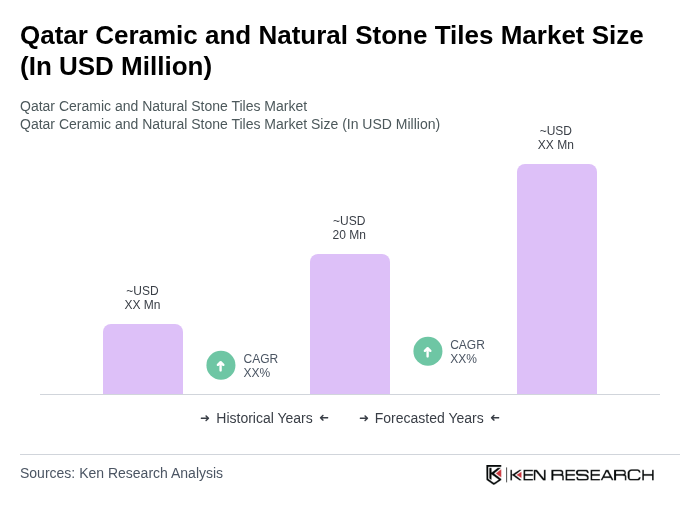

The Qatar Ceramic and Natural Stone Tiles Market is valued at approximately USD 20 million, driven by significant growth in the construction sector, supported by government investments in infrastructure and real estate development.