Region:Middle East

Author(s):Rebecca

Product Code:KRAD6137

Pages:92

Published On:December 2025

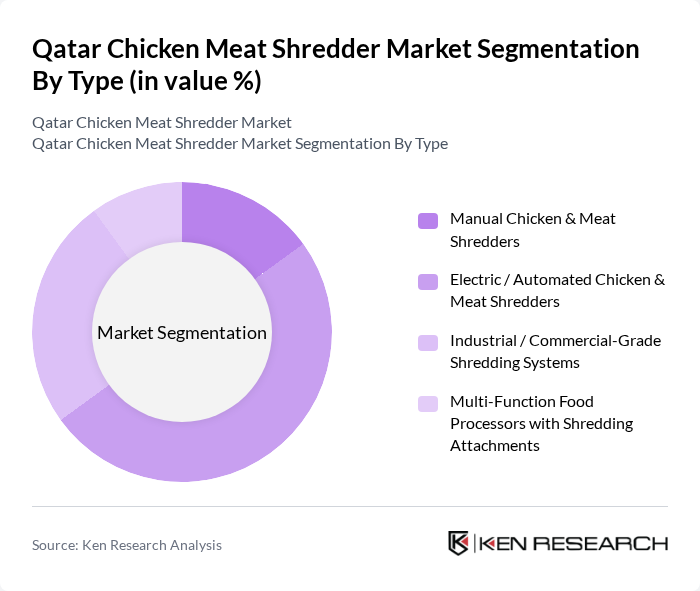

By Type:The market is segmented into various types of shredders, including Manual Chicken & Meat Shredders, Electric / Automated Chicken & Meat Shredders, Industrial / Commercial-Grade Shredding Systems, and Multi-Function Food Processors with Shredding Attachments. Among these, Electric / Automated Chicken & Meat Shredders dominate the market due to their efficiency and ability to handle large volumes of meat, catering to the needs of both commercial and residential users. The trend towards automation in food processing is driving the adoption of these systems, as they offer improved speed and consistency in shredding.

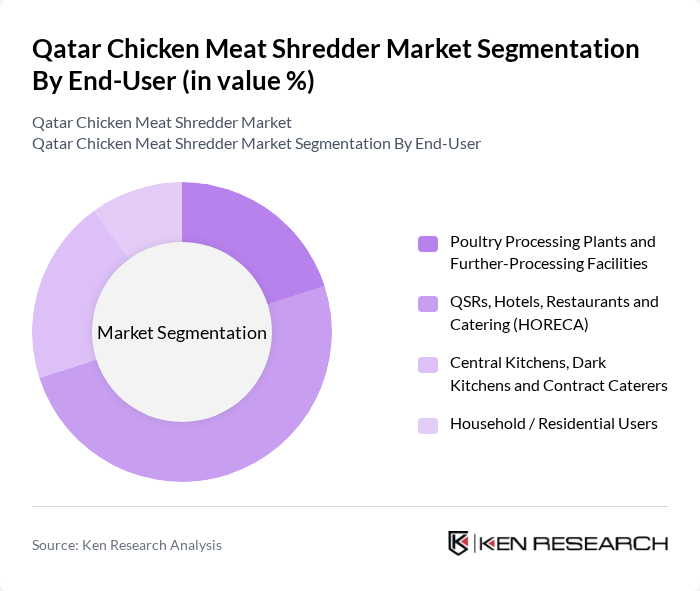

By End-User:The end-user segmentation includes Poultry Processing Plants and Further-Processing Facilities, QSRs, Hotels, Restaurants and Catering (HORECA), Central Kitchens, Dark Kitchens and Contract Caterers, and Household / Residential Users. The HORECA segment is the leading end-user, driven by the growing food service industry in Qatar, which demands high-quality shredded chicken for various culinary applications. The increasing number of restaurants and catering services is propelling the demand for efficient shredding solutions.

The Qatar Chicken Meat Shredder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hassad Food Company Q.P.S.C., Widam Food Company Q.P.S.C., Baladna Food Industries Q.P.S.C., National Food Company (Americana Qatar), Supreme Foods Processing Company (Qatar Operations), Al Watania Poultry (Regional Supplier to Qatar), BRF S.A. / Sadia (Qatar and GCC Operations), JBS S.A. (Export Supplier to Qatar), Sunbulah Group (Processed Poultry Products, GCC), A’Saffa Foods SAOG (Regional Poultry Supplier), LuLu Group International (Central Kitchens and Retail in Qatar), Qatar National Import and Export Company, Al Meera Consumer Goods Company Q.P.S.C., Mazzraty Food Company (National Group for Agricultural and Animal Production), Zowadet Baladna for Food Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chicken meat shredder market in Qatar appears promising, driven by evolving consumer preferences and technological advancements. As the demand for processed chicken products continues to rise, manufacturers are likely to invest in automation and innovative processing techniques. Additionally, the increasing focus on sustainability and organic products will shape market dynamics, encouraging companies to adapt their offerings. Overall, the market is poised for growth, with opportunities for collaboration and product development emerging in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Chicken & Meat Shredders Electric / Automated Chicken & Meat Shredders Industrial / Commercial-Grade Shredding Systems Multi?Function Food Processors with Shredding Attachments |

| By End-User | Poultry Processing Plants and Further-Processing Facilities QSRs, Hotels, Restaurants and Catering (HORECA) Central Kitchens, Dark Kitchens and Contract Caterers Household / Residential Users |

| By Application | Shredded Chicken for Ready Meals, Sandwiches and Wraps Shredded Chicken for Salads, Pizza Toppings and Side Dishes Shredded Chicken for Frozen and Chilled Processed Products Shredded Chicken for Foodservice Bulk Preparation |

| By Distribution Channel | Specialized Food Processing Equipment Distributors Direct Sales by OEMs and System Integrators Online B2B Marketplaces and E-commerce Platforms General Trade / Retail and Hypermarkets |

| By Region | Doha Al Rayyan Al Wakrah Other Municipalities (Al Khor, Umm Salal, Al Daayen, Al Shamal) |

| By Price Range | Entry-Level / Budget Equipment Mid-Range Professional Equipment High-Capacity / Premium Industrial Systems Custom-Engineered and Turnkey Lines |

| By Brand | Local and Regional System Integrators International OEM Brands Private Label and Distributor-Branded Equipment Unbranded / Generic Imports |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Farm Operations | 60 | Poultry Farm Owners, Production Managers |

| Meat Processing Facilities | 50 | Plant Managers, Quality Control Supervisors |

| Retail Market Insights | 80 | Retail Managers, Category Buyers |

| Consumer Preferences | 120 | Household Consumers, Food Enthusiasts |

| Distribution Channels | 70 | Logistics Coordinators, Supply Chain Analysts |

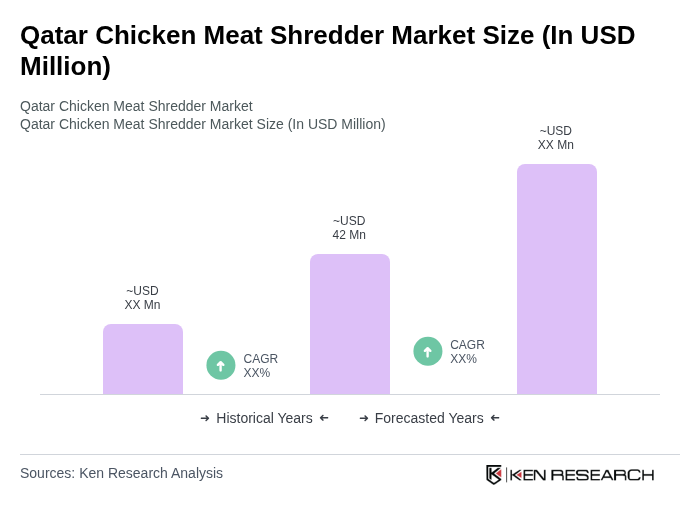

The Qatar Chicken Meat Shredder Market is valued at approximately USD 42 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for processed chicken products and advancements in food processing technology.