Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7348

Pages:96

Published On:December 2025

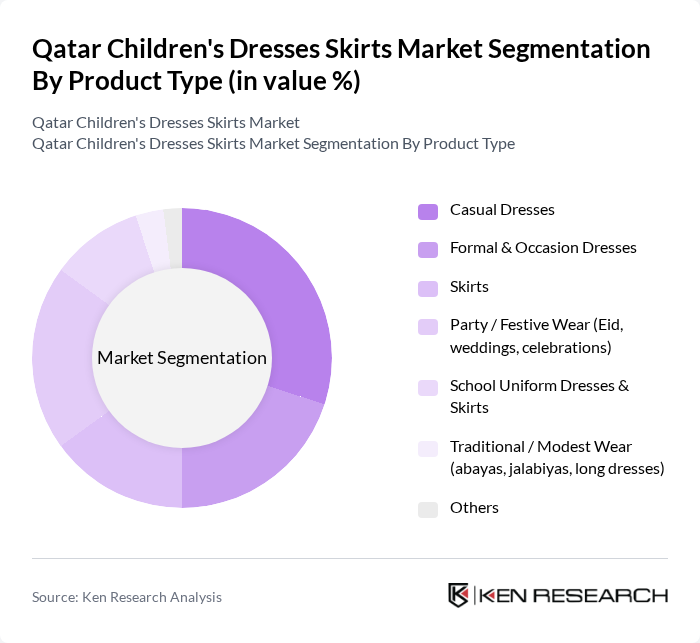

By Product Type:The product type segmentation includes various categories such as Casual Dresses, Formal & Occasion Dresses, Skirts, Party/Festive Wear, School Uniform Dresses & Skirts, Traditional/Modest Wear, and Others. Among these, Casual Dresses and Party/Festive Wear are particularly popular due to their versatility and alignment with cultural celebrations. The demand for School Uniform Dresses & Skirts is also significant, driven by the educational sector's requirements.

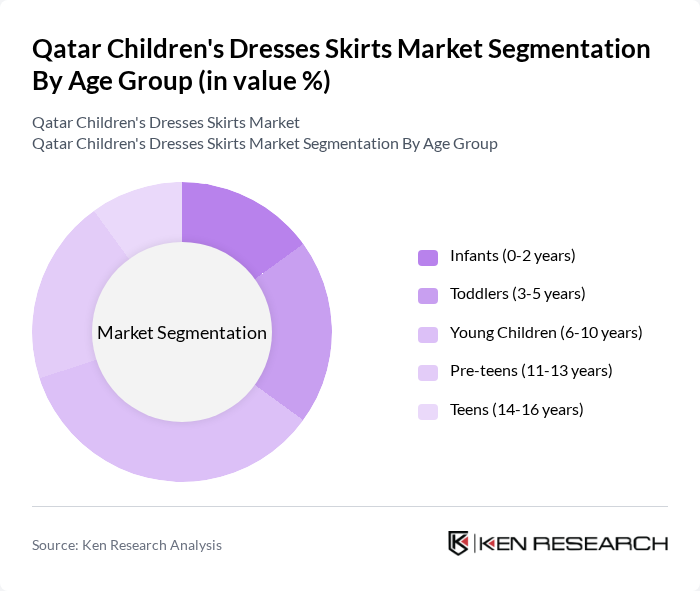

By Age Group:The age group segmentation includes Infants, Toddlers, Young Children, Pre-teens, and Teens. The Young Children segment is the most significant, driven by the larger population in this age range and the increasing trend of parents purchasing fashionable clothing for their kids. The Pre-teens and Teens segments are also growing as children become more aware of fashion trends.

The Qatar Children's Dresses Skirts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mothercare Qatar, Babyshop (Landmark Group), ZARA Kids (Inditex) – Qatar, H&M Kids – Qatar, OVS Kids – Qatar, Monsoon Children – Qatar, Matalan – Kidswear Qatar, Max Fashion – Kidswear (Landmark Group), Centrepoint – Kidswear (Splash, Babyshop & others), Khaadi Kids / Khaadi Qatar, Namshi / Noon – Kids Dresses & Skirts (online), Debenhams – Kidswear Qatar, Sakr & Co. School Uniforms Qatar, Zahrat Al Khaleej Tailoring & Kidswear, Carters OshKosh – Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar children's dresses market appears promising, driven by evolving consumer preferences and technological advancements. As families increasingly prioritize fashion and quality, brands that adapt to these trends will thrive. The integration of technology in retail, such as augmented reality for virtual try-ons, is expected to enhance the shopping experience. Additionally, sustainability will play a crucial role, with brands focusing on eco-friendly materials and practices to attract environmentally conscious consumers, ensuring long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Casual Dresses Formal & Occasion Dresses Skirts Party / Festive Wear (Eid, weddings, celebrations) School Uniform Dresses & Skirts Traditional / Modest Wear (abayas, jalabiyas, long dresses) Others |

| By Age Group | Infants (0-2 years) Toddlers (3-5 years) Young Children (6-10 years) Pre-teens (11-13 years) Teens (14-16 years) |

| By Fabric Type | Cotton Polyester & Synthetics Silk & Satin Linen Blends (cotton-poly, stretch blends, etc.) Organic & Sustainable Fabrics |

| By Distribution Channel | Online Retail (marketplaces, brand e-shops) Department Stores & Shopping Malls Specialty Kidswear Stores & Boutiques Supermarkets/Hypermarkets Brand-owned Stores Others |

| By Price Range | Budget Mid-range Premium Luxury / Designer Private Label / Value Packs |

| By Occasion | Everyday / Casual Wear Special Occasions (birthdays, parties) Religious & Festive Events (Eid, Ramadan, National Day) School & Institutional Wear Others |

| By Region | Doha Al Rayyan Al Wakrah Al Khor & Al Thakhira Al Daayen & Umm Salal Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 150 | Store Managers, Buyers, and Merchandisers |

| Consumer Behavior Analysis | 120 | Parents of children aged 0-12 years |

| Fashion Trends Evaluation | 100 | Fashion Designers, Trend Analysts |

| Online Shopping Preferences | 120 | eCommerce Managers, Digital Marketing Specialists |

| Product Feedback Sessions | 80 | Children aged 5-12 years, Parents |

The Qatar Children's Dresses Skirts Market is valued at approximately USD 130 million, reflecting a significant growth driven by increasing disposable incomes, a growing population of children, and a rising trend in fashion-consciousness among parents.