Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8173

Pages:90

Published On:November 2025

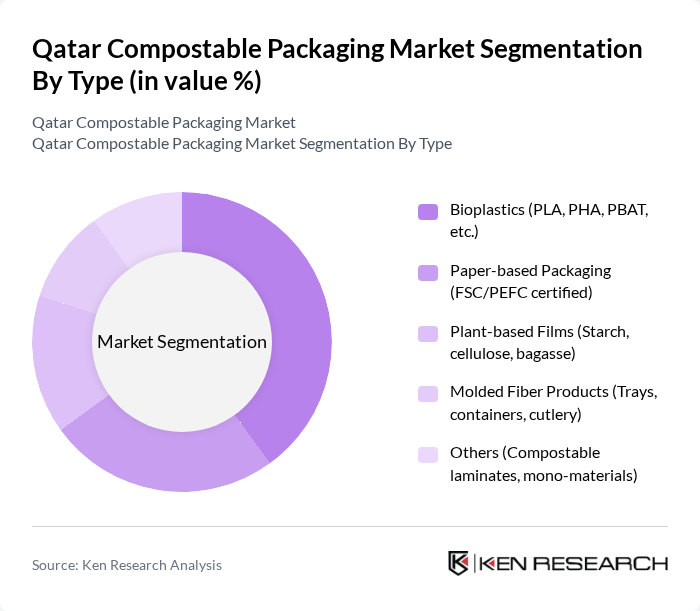

By Type:The compostable packaging market can be segmented into bioplastics, paper-based packaging, plant-based films, molded fiber products, and others. Among these, bioplastics—especially PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates)—are leading the market due to their versatility, compostability, and suitability for food-contact applications. The increasing demand for sustainable packaging solutions in the food service and retail sectors continues to drive the growth of bioplastics, which offer a viable alternative to traditional plastics.

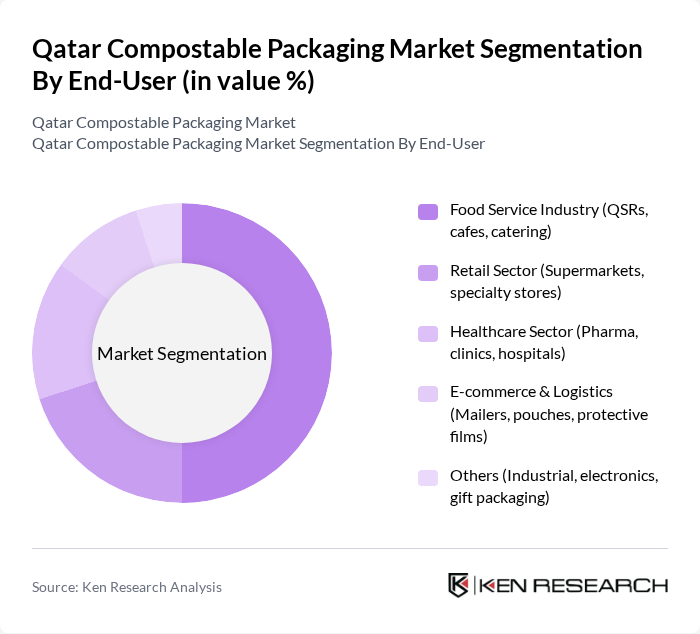

By End-User:The end-user segmentation includes the food service industry, retail sector, healthcare sector, e-commerce & logistics, and others. The food service industry is the dominant segment, driven by the increasing number of quick-service restaurants (QSRs) and cafes adopting compostable packaging to meet consumer demand for sustainable practices. This trend is further supported by government regulations and sustainability targets encouraging eco-friendly packaging solutions.

The Qatar Compostable Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Biopak, Eco-Products, Vegware, BioBag International, Green Pack (Qatar), Novamont, TIPA Corp, NatureWorks, BASF, Stora Enso, Smurfit Kappa, Mondi Group, Sealed Air, Huhtamaki, Amcor, Qatar Pack, Al Bayader International, Hotpack Global, DGrade, Ecopack Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the compostable packaging market in Qatar appears promising, driven by ongoing government support and increasing consumer demand for sustainable products. As environmental regulations tighten, businesses are likely to invest more in innovative compostable solutions. Additionally, the rise of e-commerce is expected to further fuel demand for eco-friendly packaging options. With a growing emphasis on sustainability, the market is poised for significant expansion, creating opportunities for new entrants and established players alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Bioplastics (PLA, PHA, PBAT, etc.) Paper-based Packaging (FSC/PEFC certified) Plant-based Films (Starch, cellulose, bagasse) Molded Fiber Products (Trays, containers, cutlery) Others (Compostable laminates, mono-materials) |

| By End-User | Food Service Industry (QSRs, cafes, catering) Retail Sector (Supermarkets, specialty stores) Healthcare Sector (Pharma, clinics, hospitals) E-commerce & Logistics (Mailers, pouches, protective films) Others (Industrial, electronics, gift packaging) |

| By Material | PLA (Polylactic Acid) PHA (Polyhydroxyalkanoates) Starch-based Materials Cellulose-based Materials Bagasse & Other Plant Fibers |

| By Application | Food Packaging (Trays, cups, wraps) Beverage Packaging (Bottles, cups, lids) Personal Care Products (Cosmetics, hygiene) Industrial Packaging (Components, spare parts) Others (Gift, promotional, event packaging) |

| By Distribution Channel | Online Retail (B2B platforms, e-commerce) Supermarkets/Hypermarkets Specialty Stores (Eco-friendly, organic) Direct Sales (Manufacturers, distributors) Others (NGOs, government tenders) |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor & Others |

| By Policy Support | Subsidies for Compostable Packaging Tax Incentives for Manufacturers Grants for Research and Development Regulatory Mandates & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 100 | Packaging Managers, Product Development Leads |

| Retail Sector Insights | 60 | Store Managers, Supply Chain Coordinators |

| Cosmetics & Personal Care Packaging | 50 | Brand Managers, Sustainability Officers |

| Consumer Attitudes towards Compostable Packaging | 90 | General Consumers, Eco-conscious Shoppers |

| Government & Regulatory Perspectives | 40 | Policy Makers, Environmental Consultants |

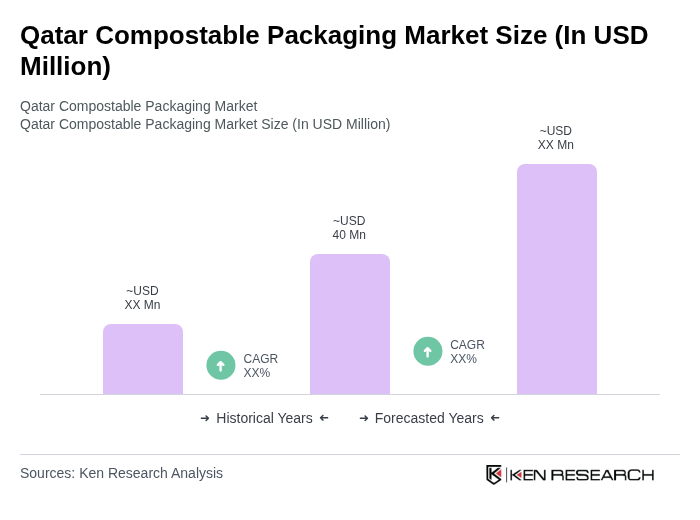

The Qatar Compostable Packaging Market is valued at approximately USD 40 million, reflecting a significant growth trend driven by increasing environmental awareness and consumer demand for sustainable packaging solutions across various sectors, including food service and retail.