Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4877

Pages:85

Published On:December 2025

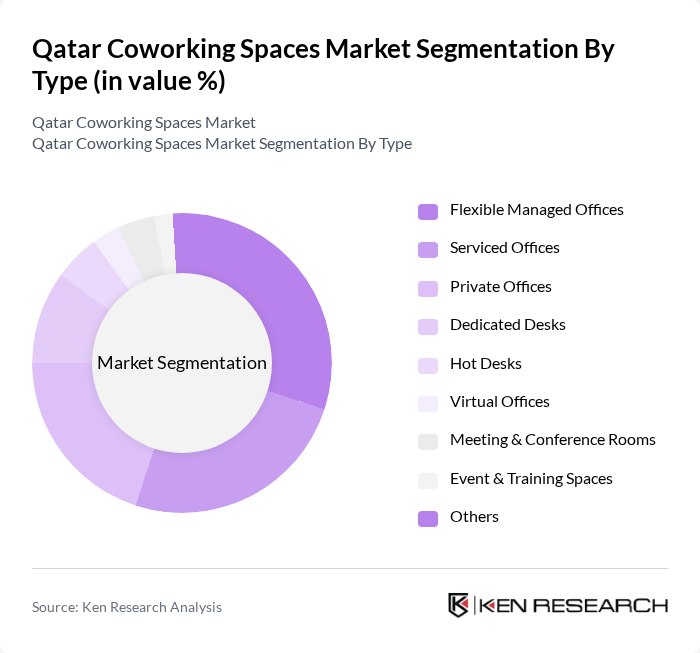

By Type:The coworking spaces market can be segmented into various types, including Flexible Managed Offices, Serviced Offices, Private Offices, Dedicated Desks, Hot Desks, Virtual Offices, Meeting & Conference Rooms, Event & Training Spaces, and Others. Flexible Managed Offices are gaining traction due to their adaptability, bundled services, and ability to scale space up or down in line with business needs, which aligns with regional demand for shorter lease terms and plug?and?play offices. Serviced Offices also hold a significant share, appealing to companies seeking fully equipped workspaces, reception and IT services, and prestigious business addresses without long-term commitments. The demand for Private Offices is rising as businesses prioritize privacy, data security, and dedicated spaces for their teams within larger shared facilities, particularly among SMEs and international firms entering the Qatari market.

By End-User:The end-user segmentation of the coworking spaces market includes Freelancers and Remote Workers, Startups, Small and Medium Enterprises (SMEs), Large Enterprises and Multinationals, Government-Backed Innovation & Incubation Programs, Non-Profit and Community Organizations, and Others. Freelancers and Remote Workers are the largest segment, supported by the global shift toward hybrid and remote work and the preference for flexible, on-demand work environments. Startups also represent a significant portion of the market, as they often seek cost-effective solutions, shared amenities, and networking opportunities to establish and scale their operations, which is consistent with Qatar’s focus on SME and startup development. SMEs are increasingly utilizing coworking spaces to foster collaboration, manage real estate costs more efficiently, and access prime business districts without committing to traditional long-term leases.

The Qatar Coworking Spaces Market is characterized by a dynamic mix of regional and international players. Leading participants such as Regus (International Workplace Group), Servcorp, Workinton Qatar, Regus Spaces, QBIC – Qatar Business Incubation Center, Workinton Alfardan Centre, Servcorp – Tornado Tower, West Bay, Regus – Doha West Bay, Regus – Lusail Marina, Regus – The Pearl-Qatar, Servcorp – Qatar Financial Centre, Maktab Qatar, Global Business Centre Doha, Alliance Business Centers Network – Qatar, and other emerging local coworking operators contribute to innovation, geographic expansion, and service delivery in this space.

The future of coworking spaces in Qatar appears promising, driven by the increasing adoption of hybrid work models and a growing emphasis on community engagement. As businesses continue to embrace flexible work arrangements, the demand for coworking spaces that foster collaboration and innovation is expected to rise. Additionally, the integration of advanced technology in these environments will enhance user experience, making coworking spaces more appealing to a diverse range of professionals and businesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Managed Offices Serviced Offices Private Offices Dedicated Desks Hot Desks Virtual Offices Meeting & Conference Rooms Event & Training Spaces Others |

| By End-User | Freelancers and Remote Workers Startups Small and Medium Enterprises (SMEs) Large Enterprises and Multinationals Government-Backed Innovation & Incubation Programs Non-Profit and Community Organizations Others |

| By Location | Doha Central Business District (West Bay, Al Dafna) Lusail The Pearl and Waterfront Developments Secondary Urban Areas (e.g., Al Sadd, Al Waab) Other Cities and Suburban Areas Others |

| By Service Offering | Workspace Access (Desks, Offices, Meeting Rooms) Business Support Services (Reception, Mail Handling, PRO/Company Setup) Technology & Connectivity (High-Speed Internet, IT Support) Community & Networking Programs Ancillary Services (Parking, F&B, Printing, Event Hosting) Others |

| By Duration of Use | Hourly and Daily Passes Weekly Passes Monthly Memberships Long-Term Contracts (6–24 Months) Others |

| By Industry Focus | Technology & Startups Creative & Media Professional Services (Legal, Consulting, Finance) Education, Training & EdTech Public Sector & NGOs Others |

| By Policy Support | Government Grants & Subsidies (e.g., QDB, QF programs) Tax and Fee Incentives for Tenants Rent Support and Incubation Schemes Free Zone & Special Economic Zone Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freelancer Usage Patterns | 120 | Freelancers, Remote Workers |

| Startup Incubator Feedback | 80 | Startup Founders, Program Managers |

| Corporate Clients of Coworking Spaces | 70 | HR Managers, Office Space Planners |

| Event Hosting in Coworking Spaces | 60 | Event Coordinators, Marketing Managers |

| Real Estate Insights on Coworking | 50 | Real Estate Analysts, Property Managers |

The Qatar Coworking Spaces Market is valued at approximately USD 90 million, reflecting a significant growth trend driven by the increasing demand for flexible workspace solutions among startups, freelancers, and remote workers in the region.