Region:Middle East

Author(s):Shubham

Product Code:KRAA8484

Pages:80

Published On:November 2025

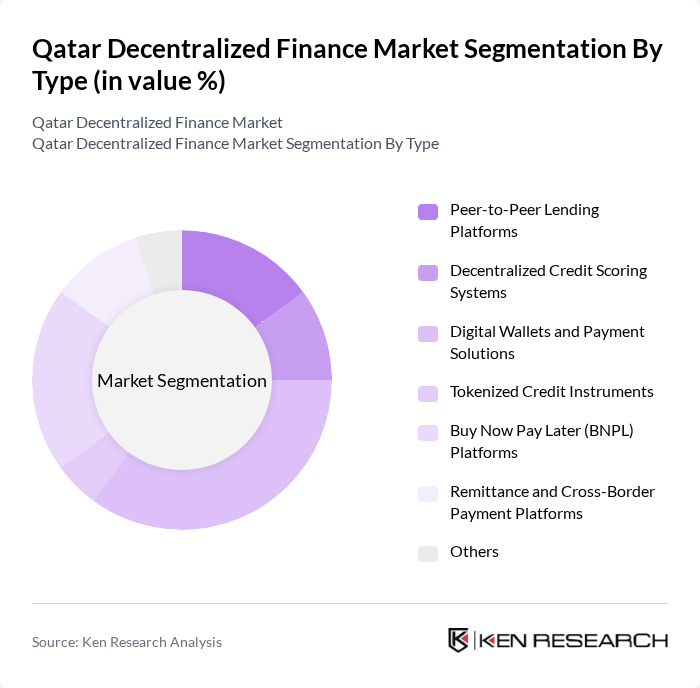

By Type:The market is segmented into various types, including Peer-to-Peer Lending Platforms, Decentralized Credit Scoring Systems, Digital Wallets and Payment Solutions, Tokenized Credit Instruments, Buy Now Pay Later (BNPL) Platforms, Remittance and Cross-Border Payment Platforms, and Others. Among these, Digital Wallets and Payment Solutions are leading due to the increasing preference for cashless transactions, the dominance of contactless payments, and the convenience they offer to consumers. The rapid expansion of embedded finance and open banking initiatives further accelerates the adoption of digital wallets and payment solutions .

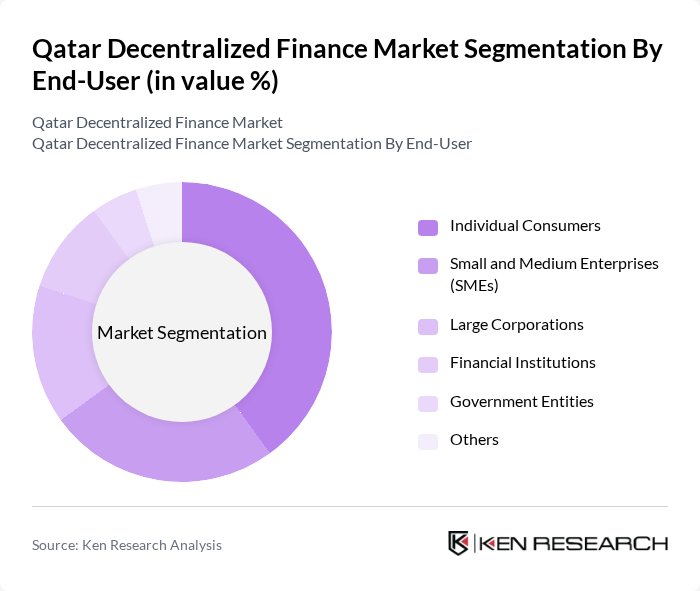

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, Government Entities, and Others. Individual Consumers are the dominant segment, driven by the increasing adoption of decentralized finance solutions for personal loans, investment opportunities, and the growing trend of financial independence among younger demographics. The widespread use of smartphones and high internet penetration further support this trend .

The Qatar Decentralized Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank (QNB), Qatar Islamic Bank (QIB), Masraf Al Rayan, Commercial Bank of Qatar, Doha Bank, Barwa Bank, Qatar Development Bank (QDB), Ooredoo, Vodafone Qatar, SkipCash, CWallet, Karty, Qatar FinTech Hub (QFTH), CoinMENA, and Binance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar decentralized finance market appears promising, driven by technological advancements and increasing consumer interest. As blockchain technology matures, more financial institutions are likely to adopt DeFi solutions, enhancing operational efficiencies. Additionally, the government's commitment to regulatory clarity will foster a safer environment for innovation. With a projected increase in digital asset transactions, the market is poised for significant growth, particularly as consumer education initiatives gain traction and awareness of DeFi benefits expands.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Lending Platforms Decentralized Credit Scoring Systems Digital Wallets and Payment Solutions Tokenized Credit Instruments Buy Now Pay Later (BNPL) Platforms Remittance and Cross-Border Payment Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Government Entities Others |

| By Application | Personal Loans Business Loans Credit Scoring Payment Processing Supply Chain Financing Others |

| By Technology | Smart Contracts Blockchain Protocols Layer-2 Scaling Solutions Oracles and Middleware Custody Solutions Interoperability Solutions Others |

| By Investment Source | Venture Capital Private Equity Crowdfunding Government Grants Corporate Investment Others |

| By User Demographics | Age Groups Income Levels Geographic Distribution Others |

| By Regulatory Compliance | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail DeFi Adoption | 100 | Retail Investors, Financial Advisors |

| Institutional DeFi Engagement | 70 | Institutional Investors, Asset Managers |

| Blockchain Development Insights | 45 | Blockchain Developers, Tech Entrepreneurs |

| Regulatory Perspectives on DeFi | 40 | Regulatory Officials, Compliance Officers |

| Consumer Behavior in DeFi | 80 | End Users, Crypto Enthusiasts |

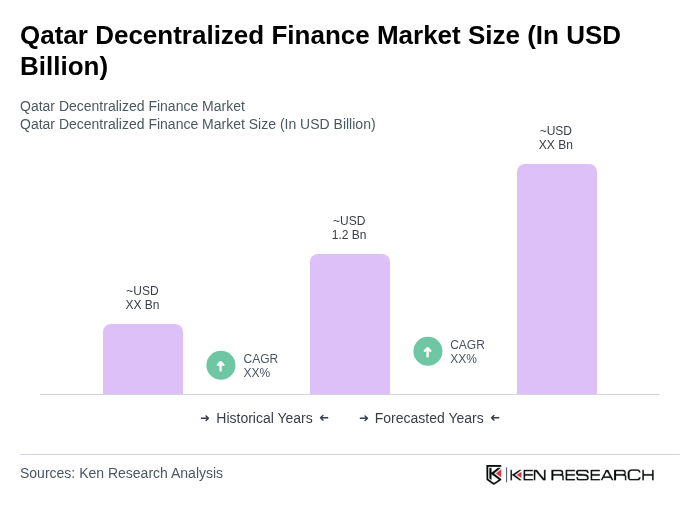

The Qatar Decentralized Finance Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of blockchain technology, digital payment solutions, and a rise in digital asset investments.