Region:Middle East

Author(s):Dev

Product Code:KRAD5196

Pages:85

Published On:December 2025

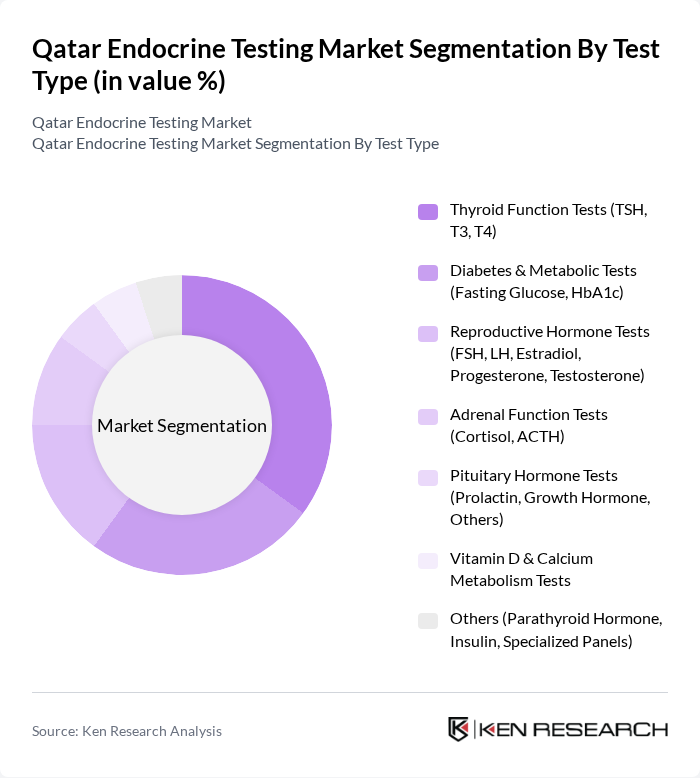

By Test Type:The market is segmented into various test types, including Thyroid Function Tests, Diabetes & Metabolic Tests, Reproductive Hormone Tests, Adrenal Function Tests, Pituitary Hormone Tests, Vitamin D & Calcium Metabolism Tests, and Others. Among these, Thyroid Function Tests are particularly dominant due to the high prevalence of thyroid disorders in the region. The increasing awareness of thyroid health and the availability of advanced testing technologies have further fueled the demand for these tests.

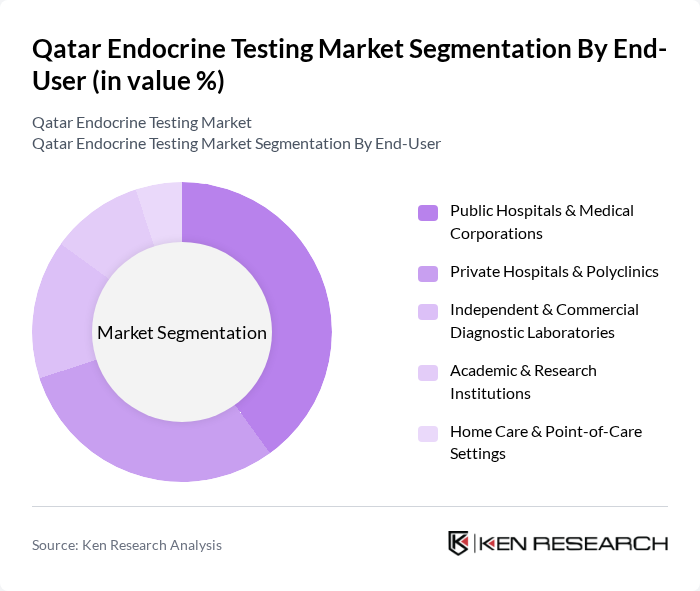

By End-User:The market is segmented by end-users, including Public Hospitals & Medical Corporations, Private Hospitals & Polyclinics, Independent & Commercial Diagnostic Laboratories, Academic & Research Institutions, and Home Care & Point-of-Care Settings. Public Hospitals & Medical Corporations dominate the market due to their extensive reach and ability to provide comprehensive testing services. The increasing patient load and government support for public healthcare facilities further enhance their market position. Commercial laboratories emphasize specialized endocrine testing capabilities and outsourcing efficiency.

The Qatar Endocrine Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamad Medical Corporation (HMC), Sidra Medicine, Al Ahli Hospital, Al Emadi Hospital, Aster DM Healthcare – Qatar (Aster Medical Centre & Hospital Doha), Naseem Healthcare (Naseem Medical Centre), Doha Clinic Hospital, Turkish Hospital – Doha, Queen Hospital, Al Hayat Medical Center, Allo Laboratoire Medical Qatar (ALLO LAB), Biolab Medical Laboratory – Qatar, Qatar Biobank, Ministry of Public Health – Qatar (MoPH), Qatar University – Health & Medical Sciences Units contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar endocrine testing market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, while the expansion of telemedicine services will improve access to testing. As the government continues to support healthcare initiatives, the market is likely to witness significant growth, fostering better health outcomes for the population and encouraging further innovation in testing methodologies.

| Segment | Sub-Segments |

|---|---|

| By Test Type | Thyroid Function Tests (TSH, T3, T4) Diabetes & Metabolic Tests (Fasting Glucose, HbA1c) Reproductive Hormone Tests (FSH, LH, Estradiol, Progesterone, Testosterone) Adrenal Function Tests (Cortisol, ACTH) Pituitary Hormone Tests (Prolactin, Growth Hormone, Others) Vitamin D & Calcium Metabolism Tests Others (Parathyroid Hormone, Insulin, Specialized Panels) |

| By End-User | Public Hospitals & Medical Corporations Private Hospitals & Polyclinics Independent & Commercial Diagnostic Laboratories Academic & Research Institutions Home Care & Point-of-Care Settings |

| By Patient Group | Pediatric Adult Geriatric |

| By Technology | Immunoassay (CLIA, ELISA, RIA) Clinical Chemistry/Automated Analyzers Mass Spectrometry & Chromatography-Based Assays Point-of-Care Testing Devices Others |

| By Sample Type | Blood/Serum/Plasma Urine Saliva Others |

| By Distribution Channel | Direct Sales to Hospitals & Labs Tender & Institutional Procurement Retail & Hospital Pharmacies Online & E-Procurement Platforms |

| By Geography (Within Qatar) | Doha Al Rayyan Al Wakrah Umm Salal Al Khor & Al Thakhira Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinology Clinics | 100 | Endocrinologists, Clinic Managers |

| Diagnostic Laboratories | 80 | Laboratory Technicians, Quality Control Managers |

| Patient Experience Surveys | 120 | Patients undergoing endocrine testing |

| Healthcare Policy Makers | 50 | Health Administrators, Policy Analysts |

| Insurance Providers | 60 | Claims Analysts, Underwriters |

The Qatar Endocrine Testing Market is valued at approximately USD 55 million, reflecting a significant growth driven by the increasing prevalence of endocrine disorders and advancements in diagnostic technologies.