Region:Middle East

Author(s):Rebecca

Product Code:KRAD6148

Pages:81

Published On:December 2025

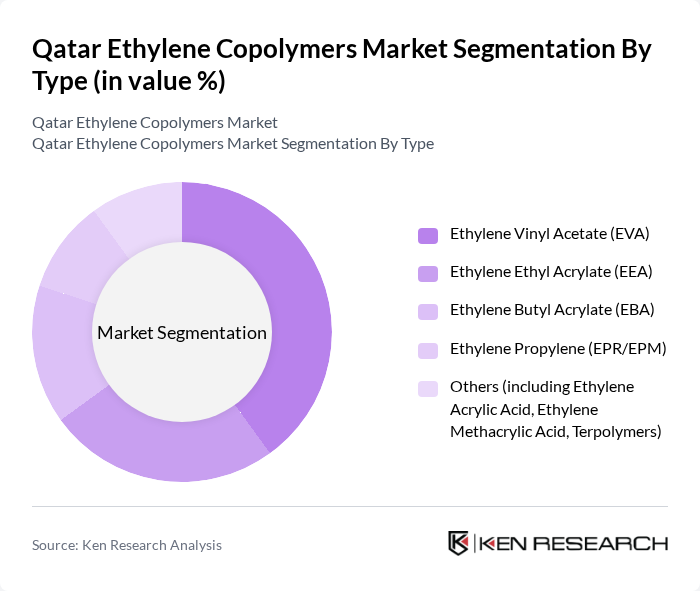

By Type:The market is segmented into various types of ethylene copolymers, including Ethylene Vinyl Acetate (EVA), Ethylene Ethyl Acrylate (EEA), Ethylene Butyl Acrylate (EBA), Ethylene Propylene (EPR/EPM), and others such as Ethylene Acrylic Acid, Ethylene Methacrylic Acid, and Terpolymers. Among these, Ethylene Vinyl Acetate (EVA) is the leading subsegment due to its extensive use in packaging and consumer goods, driven by its excellent flexibility and adhesion properties.

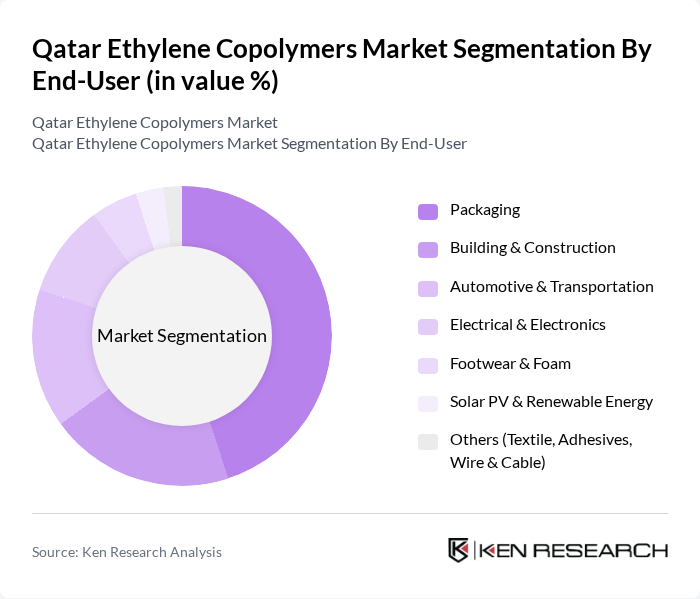

By End-User:The end-user segmentation includes Packaging, Building & Construction, Automotive & Transportation, Electrical & Electronics, Footwear & Foam, Solar PV & Renewable Energy, and others such as Textile, Adhesives, and Wire & Cable. The Packaging segment is the dominant subsegment, driven by the increasing demand for lightweight and durable materials in consumer goods and food packaging applications.

The Qatar Ethylene Copolymers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Petrochemical Company (QAPCO) Q.P.J.S.C., Qatar Chemical Company Ltd. (Q-Chem I & Q-Chem II), Mesaieed Petrochemical Holding Company Q.P.S.C. (MPHC), QatarEnergy (Petrochemicals & Downstream), Industries Qatar Q.P.S.C. (IQ), Qatar Plastic Products Company W.L.L., Doha Plastic Company W.L.L., Al Suwaidi Plastic Factory, Al Jazeera Factory for Plastic Products, Qatar National Plastic Factory, Qatar Modern Plastic Company, Qatar Petrochemical and Conversion Industries Cluster (Downstream Converters), SABIC (via imports into Qatar), Borealis AG (via Borouge and regional supply), Dow Inc. (regional and imported ethylene copolymers) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar ethylene copolymers market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As manufacturers increasingly adopt digitalization in production processes, efficiency and customization will improve, catering to diverse consumer needs. Furthermore, the growing emphasis on renewable energy applications will likely create new avenues for copolymer usage, aligning with global sustainability trends. This evolution will position the market favorably for future growth, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene Vinyl Acetate (EVA) Ethylene Ethyl Acrylate (EEA) Ethylene Butyl Acrylate (EBA) Ethylene Propylene (EPR/EPM) Others (including Ethylene Acrylic Acid, Ethylene Methacrylic Acid, Terpolymers) |

| By End-User | Packaging Building & Construction Automotive & Transportation Electrical & Electronics Footwear & Foam Solar PV & Renewable Energy Others (Textile, Adhesives, Wire & Cable) |

| By Application | Hot-melt Adhesives & Sealants Films & Sheets (including PV encapsulant films) Wire & Cable Compounds Asphalt & Bitumen Modification Extrusion & Injection Molding Coatings & Laminations Others |

| By Distribution Channel | Direct Sales to Converters and Industrial End Users Authorized Regional Distributors Trading Companies & Importers Online / E-tender Platforms Others |

| By Geography | Doha & Industrial Areas (Mesaieed, Ras Laffan) Al Rayyan & Dukhan Al Khor & Al Wakrah Northern Municipalities (Umm Salal, Al Shamal, Others) |

| By Product Form | Pellets / Granules Powder Emulsions & Dispersions Others (Compounds, Masterbatches) |

| By End-User Industry | Packaging & Consumer Goods Construction & Infrastructure Automotive & Transportation Electrical, Electronics & Telecom Energy & Utilities (Oil & Gas, Solar PV) Healthcare & Medical Agriculture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 100 | Product Managers, Procurement Specialists |

| Automotive Applications | 80 | Design Engineers, Supply Chain Managers |

| Construction Sector Usage | 70 | Project Managers, Materials Engineers |

| Consumer Goods Sector | 90 | Brand Managers, R&D Directors |

| Research & Development Insights | 60 | R&D Managers, Innovation Leads |

The Qatar Ethylene Copolymers Market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for versatile materials across various sectors, including packaging, automotive, and construction.