Region:Middle East

Author(s):Geetanshi

Product Code:KRAE1766

Pages:97

Published On:December 2025

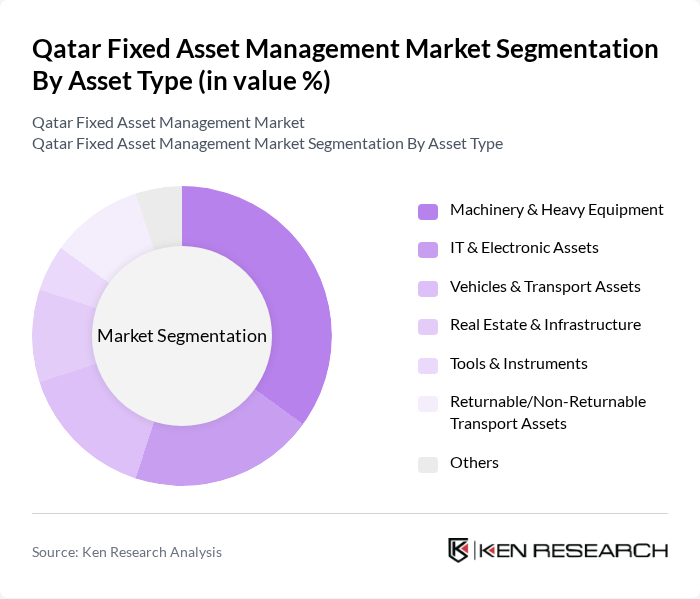

By Asset Type:The asset type segmentation includes various categories such as Machinery & Heavy Equipment, IT & Electronic Assets, Vehicles & Transport Assets, Real Estate & Infrastructure, Tools & Instruments, Returnable/Non-Returnable Transport Assets, and Others. Among these, Machinery & Heavy Equipment and IT & Electronic Assets are the leading sub-segments due to the booming construction and infrastructure projects in Qatar, which require significant investment in heavy machinery, alongside digital transformation trends for efficient operations.

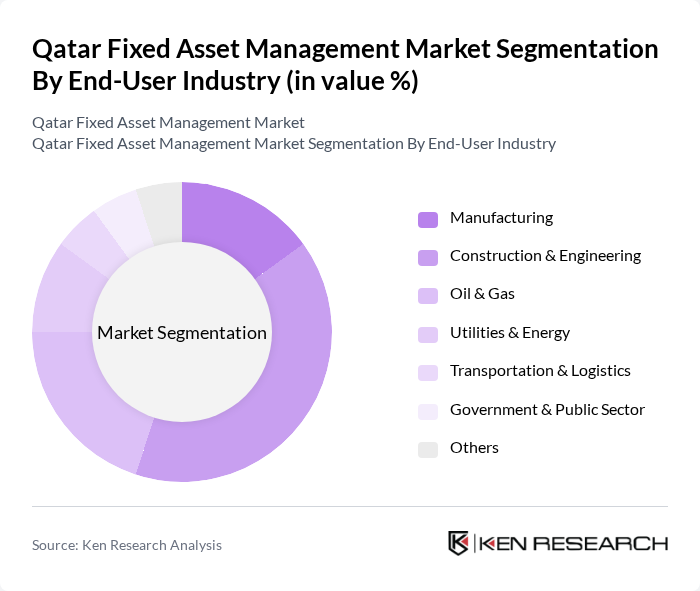

By End-User Industry:The end-user industry segmentation encompasses Manufacturing, Construction & Engineering, Oil & Gas, Utilities & Energy, Transportation & Logistics, Government & Public Sector, and Others. Manufacturing is the dominant sub-segment, driven by Qatar's industrial diversification and export-oriented growth strategies, while Construction & Engineering and Oil & Gas also show strong demand supported by mega-projects, energy sector expansion, and the increasing focus on sustainability and smart infrastructure.

The Qatar Fixed Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation (IBM Maximo), Siemens AG, Honeywell International Inc., Schneider Electric SE, Infor, Inc., AssetWorks LLC, Trimble Inc., ABB Ltd., Bentley Systems, Incorporated, AMCS Group, Rockwell Automation, Inc., Radiant RFID, Zebra Technologies Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar fixed asset management market appears promising, driven by ongoing infrastructure investments and technological advancements. As the government continues to prioritize digital transformation, organizations are likely to adopt more sophisticated asset management solutions. Additionally, the increasing focus on sustainability and efficiency will further propel the market. In future, the integration of IoT and AI technologies is expected to redefine asset management practices, enhancing operational efficiency and decision-making capabilities across sectors.

| Segment | Sub-Segments |

|---|---|

| By Asset Type | Machinery & Heavy Equipment IT & Electronic Assets Vehicles & Transport Assets Real Estate & Infrastructure Tools & Instruments Returnable/Non-Returnable Transport Assets Others |

| By End-User Industry | Manufacturing Construction & Engineering Oil & Gas Utilities & Energy Transportation & Logistics Government & Public Sector Others |

| By Asset Lifecycle Stage | Acquisition & Procurement Operation & Usage Maintenance & Support Disposal & Replacement Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Geographic Distribution | Urban Industrial Areas Rural Industrial Areas Industrial Zones Free Zones Others |

| By Service Type | Consulting & Advisory Implementation & Integration Maintenance & Support Services Training & Skill Development Others |

| By Financing Model | Direct Purchase Leasing & Rental Loan Financing Government Grants & Subsidies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Asset Management | 120 | Project Managers, Asset Managers |

| Manufacturing Equipment Management | 100 | Operations Managers, Maintenance Supervisors |

| IT Asset Management | 90 | IT Managers, Procurement Officers |

| Real Estate Asset Valuation | 80 | Real Estate Analysts, Financial Controllers |

| Public Sector Asset Oversight | 70 | Government Officials, Policy Advisors |

The Qatar Fixed Asset Management Market is valued at approximately USD 1.3 billion, driven by the increasing need for efficient asset tracking and management solutions across various sectors, including construction, oil and gas, and utilities.