Region:Middle East

Author(s):Dev

Product Code:KRAA9604

Pages:95

Published On:November 2025

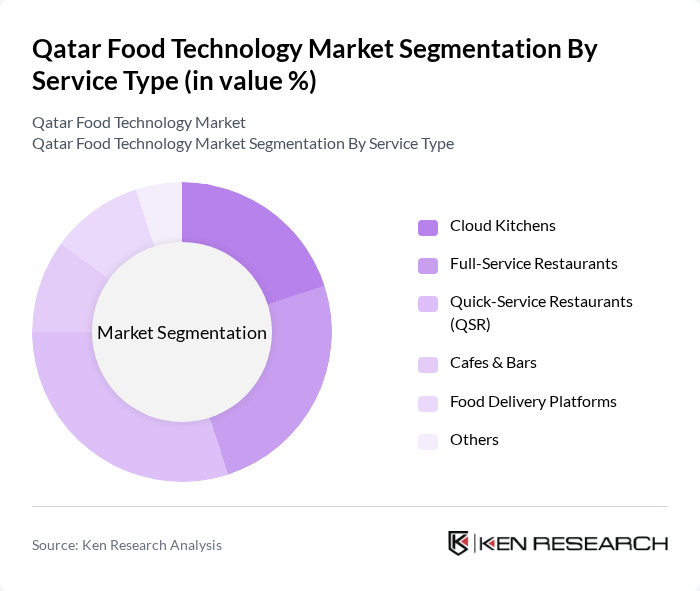

By Service Type:The service type segmentation includes Cloud Kitchens, Full-Service Restaurants, Quick-Service Restaurants (QSR), Cafes & Bars, Food Delivery Platforms, and Others. Quick-Service Restaurants (QSR) have emerged as the dominant segment, accounting for the largest share of foodservice outlets due to increasing consumer preference for fast and convenient meal options. Urbanization, busy lifestyles, and the expansion of international QSR chains have driven demand for affordable, quick-service dining. Cloud Kitchens are also experiencing rapid growth, propelled by the popularity of online food delivery and the operational efficiency of delivery-only models .

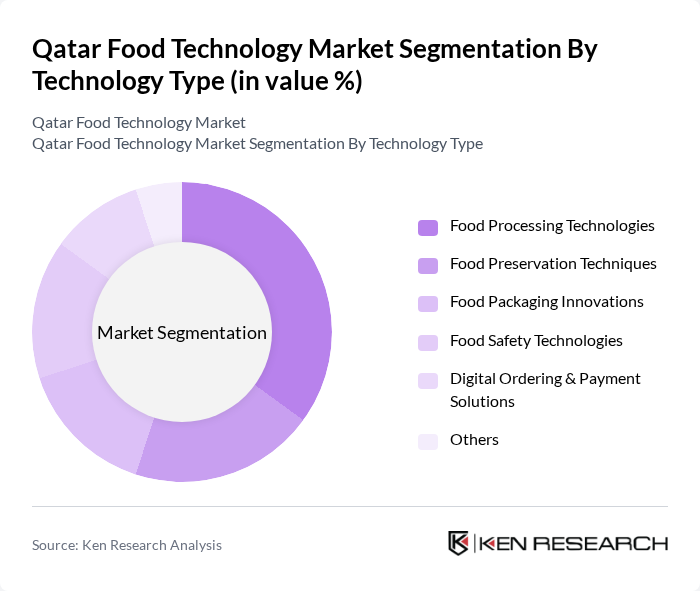

By Technology Type:The technology type segmentation encompasses Food Processing Technologies, Food Preservation Techniques, Food Packaging Innovations, Food Safety Technologies, Digital Ordering & Payment Solutions, and Others. Food Processing Technologies lead this segment, driven by automation, smart supply chain management, and advanced manufacturing practices that improve efficiency and product quality. The adoption of digital ordering and payment solutions is accelerating, with mobile apps and e-commerce platforms transforming consumer access and engagement. Food safety and packaging innovations are also gaining traction, reflecting the market’s focus on compliance, sustainability, and shelf-life extension .

The Qatar Food Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Meera Consumer Goods Company, Baladna Food Industries, Qatar Meat and Livestock Company (Mawashi), Qatar Flour Mills Company, Al Watania Poultry, Gulf Food Industries, Teatime, Americana Restaurants International PLC, Al Mana Restaurants & Food Company, Almuftah Group, M.H. Alshaya Co. WLL, Talabat, Deliveroo Editions, Qatar International Food Company, Al Islami Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar food technology market appears promising, driven by increasing investments in sustainable practices and technological advancements. With the government’s commitment to enhancing food security and local production, the market is expected to witness significant growth. Additionally, the integration of smart technologies and a focus on health-conscious products will likely shape consumer preferences, leading to innovative solutions that cater to evolving dietary needs and sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Cloud Kitchens Full-Service Restaurants Quick-Service Restaurants (QSR) Cafes & Bars Food Delivery Platforms Others |

| By Technology Type | Food Processing Technologies Food Preservation Techniques Food Packaging Innovations Food Safety Technologies Digital Ordering & Payment Solutions Others |

| By End-User | Food Manufacturers Retailers Food Service Providers Consumers Others |

| By Product Category | Processed Foods Organic Foods Functional Foods Convenience Foods Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Direct Sales Others |

| By Consumer Demographics | Age Groups Income Levels Lifestyle Preferences Others |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Technology | 60 | Production Managers, R&D Directors |

| Food Packaging Innovations | 50 | Packaging Engineers, Product Managers |

| Food Safety Technologies | 40 | Quality Assurance Managers, Compliance Officers |

| Consumer Preferences in Food Tech | 55 | Market Researchers, Consumer Insights Analysts |

| Food Technology Startups | 45 | Founders, Business Development Managers |

The Qatar Food Technology Market is valued at approximately USD 1.4 billion, reflecting the integration of foodservice, food technology, and digital delivery segments within the broader food and beverage sector, which exceeds USD 14 billion.