Region:Middle East

Author(s):Rebecca

Product Code:KRAD5044

Pages:90

Published On:December 2025

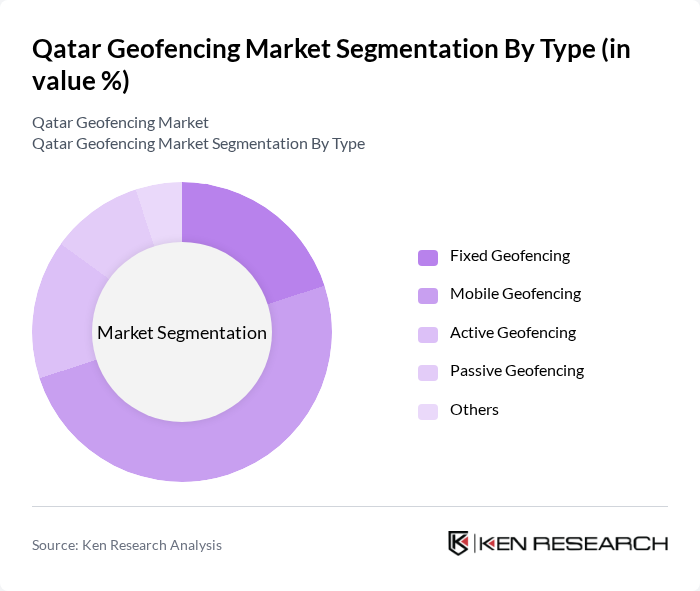

By Type:The geofencing market can be segmented into Fixed Geofencing, Mobile Geofencing, Active Geofencing, Passive Geofencing, and Others, in line with global market taxonomies for geofencing solutions. Among these, Mobile Geofencing is currently the leading sub-segment due to the widespread use of smartphones and mobile applications and the central role of mobile devices in delivering location-based notifications and offers. Businesses are increasingly utilizing mobile geofencing to engage customers in real time, offering personalized promotions, in-app messages, and proximity-based advertising that enhance customer experiences in sectors such as retail, quick-service restaurants, events, and transport hubs. The demand for mobile solutions is driven by consumer behavior that favors location-based services, as well as the integration of AI and analytics into mobile geofencing platforms, making it a critical component of omnichannel and hyperlocal marketing strategies.

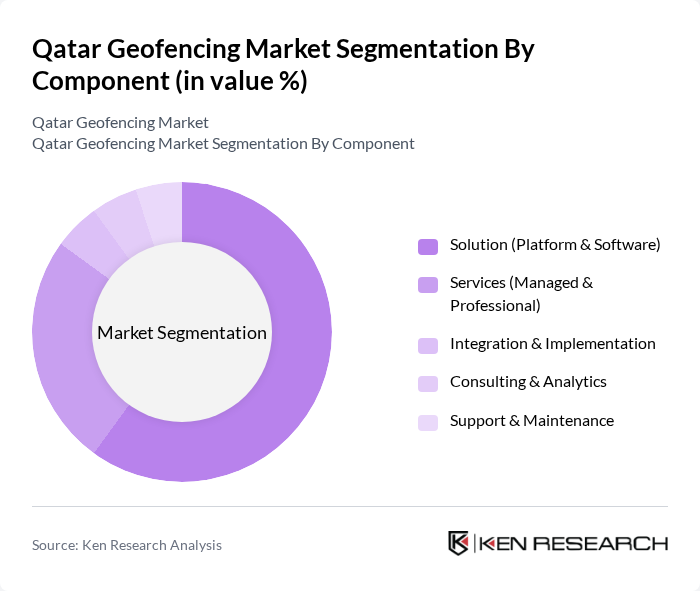

By Component:The market can also be segmented into Solution (Platform & Software), Services (Managed & Professional), Integration & Implementation, Consulting & Analytics, and Support & Maintenance, consistent with the way global geofencing and geomarketing markets are structured. The Solution segment is the most significant contributor to the market, driven by the increasing demand for comprehensive geofencing platforms that integrate campaign management, analytics, audience segmentation, real-time data processing, and APIs for mobile apps and IoT devices. Businesses are seeking robust solutions that offer advanced targeting, dashboard-based insights, and user-friendly interfaces, while also supporting compliance with data privacy rules, making this segment essential for effective and scalable geofencing implementation across enterprises and public-sector projects.

The Qatar Geofencing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo Qatar Q.P.S.C., Vodafone Qatar P.Q.S.C., Qatar Mobility Innovations Center (QMIC), MEmob+ (Data-driven Geomarketing Platform), Eskimi, Bluedot Innovation, Radar Labs, Inc., Mapbox, HERE Technologies, LocationSmart, Simpli.fi, InMarket Media LLC, Gimbal, Inc., GeoMoby, Local and Regional System Integrators (e.g., Mannai Corporation, MEEZA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geofencing market in Qatar appears promising, driven by technological advancements and increasing consumer expectations for personalized experiences. As businesses continue to adopt innovative marketing strategies, the integration of artificial intelligence and real-time data analytics will enhance the effectiveness of geofencing solutions. Additionally, the expansion of smart city initiatives will create new opportunities for geofencing applications, fostering a more connected and efficient urban environment that benefits both consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Geofencing Mobile Geofencing Active Geofencing Passive Geofencing Others |

| By Component | Solution (Platform & Software) Services (Managed & Professional) Integration & Implementation Consulting & Analytics Support & Maintenance |

| By Industry Vertical | Retail and E-commerce Transportation and Logistics Healthcare and Life Sciences Media and Entertainment Government and Public Sector Banking, Financial Services and Insurance (BFSI) Others |

| By Technology | GPS / GNSS RFID / NFC Bluetooth Low Energy (Beacons) Wi?Fi and WLAN Cellular Network-based Others |

| By Application | Proximity Marketing & Advertising Fleet and Asset Management Workforce Management & Field Service Security, Access Control and Compliance Monitoring Location-based Customer Engagement & Loyalty Smart City and Public Safety Others |

| By Deployment Mode | Cloud-Based On-Premises Hybrid Edge / On-Device |

| By Policy Support | Government Digital Transformation and Smart City Initiatives Subsidies and Grants for ICT & IoT Adoption Data Protection and Cybersecurity Regulations Tax Incentives and Free Zone Benefits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Geofencing Applications | 110 | Marketing Managers, Store Managers |

| Real Estate Geofencing Solutions | 90 | Real Estate Agents, Property Managers |

| Tourism and Hospitality Geofencing | 70 | Hotel Managers, Tourism Operators |

| Advertising Agencies Utilizing Geofencing | 85 | Creative Directors, Media Planners |

| Technology Providers in Geofencing | 60 | Product Managers, Software Developers |

The Qatar Geofencing Market is valued at approximately USD 160 million, reflecting significant growth driven by the increasing adoption of location-based services, mobile devices, and personalized advertising strategies across various sectors such as retail and transportation.