Region:Middle East

Author(s):Rebecca

Product Code:KRAC3936

Pages:97

Published On:October 2025

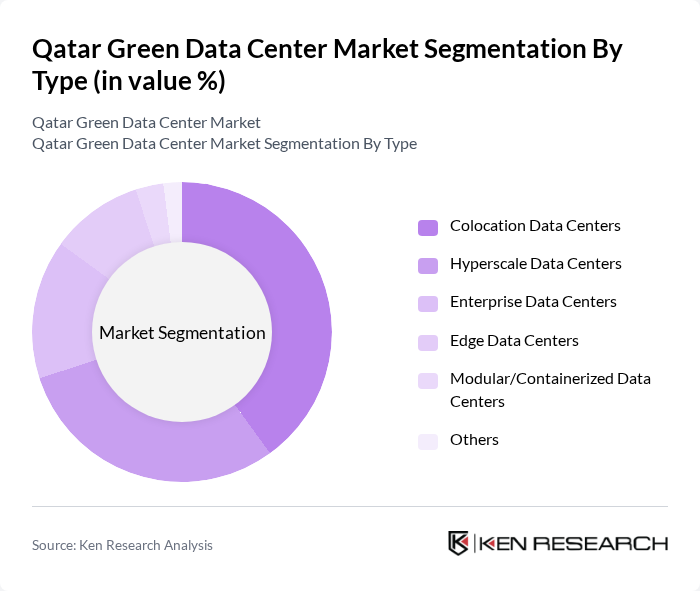

By Type:The market is segmented into various types of data centers, including Colocation Data Centers, Hyperscale Data Centers, Enterprise Data Centers, Edge Data Centers, Modular/Containerized Data Centers, and Others. Among these, Colocation Data Centers are currently leading the market due to their flexibility and cost-effectiveness, allowing businesses to share resources while maintaining control over their data. The demand for Hyperscale Data Centers is also increasing, driven by the growth of cloud service providers and the need for scalable solutions.

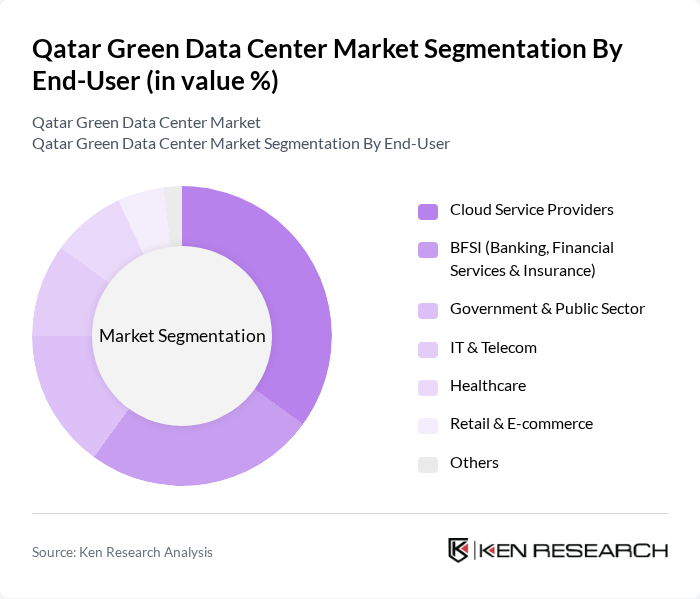

By End-User:The end-user segmentation includes Cloud Service Providers, BFSI (Banking, Financial Services & Insurance), Government & Public Sector, IT & Telecom, Healthcare, Retail & E-commerce, and Others. Cloud Service Providers are the dominant segment, driven by the increasing adoption of cloud solutions and the need for scalable infrastructure. The BFSI sector is also a significant contributor, as financial institutions require robust data management and security solutions.

The Qatar Green Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo Q.P.S.C., Vodafone Qatar P.Q.S.C., MEEZA Q.P.S.C., Gulf Data Hub, Gulf Bridge International, Qatar National Broadband Network (Qnbn), Qatar Data Center, Qatar Free Zones Authority, Microsoft Corporation (Qatar Cloud Region), Oracle Corporation (Qatar Cloud Region), Google Cloud (Qatar Cloud Region), Qatar Science and Technology Park, Qatar Investment Authority, Qatar Financial Centre Authority, Doha Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Green Data Center market appears promising, driven by increasing government support and a growing emphasis on sustainability. As the demand for data services continues to rise, the integration of advanced technologies such as AI and IoT will enhance operational efficiency. Furthermore, the shift towards renewable energy sources will likely accelerate, positioning Qatar as a leader in sustainable data center solutions in the Middle East, fostering innovation and attracting global investments.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Data Centers Hyperscale Data Centers Enterprise Data Centers Edge Data Centers Modular/Containerized Data Centers Others |

| By End-User | Cloud Service Providers BFSI (Banking, Financial Services & Insurance) Government & Public Sector IT & Telecom Healthcare Retail & E-commerce Others |

| By Application | Data Storage & Management Cloud Computing Disaster Recovery & Business Continuity High-Performance Computing IoT & Edge Applications |

| By Power Source | Grid Electricity Solar Power Wind Power Hybrid (Renewable + Grid) |

| By Cooling Technique | Air-Based Cooling Liquid Cooling Free Cooling Waste Heat Recovery |

| By Certification | LEED Uptime Institute Tier Certification ISO 14001 Others |

| By Ownership | Public Private Joint Venture |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Center Operations | 100 | IT Managers, Data Center Administrators |

| Cloud Service Providers | 60 | Business Development Managers, Technical Leads |

| Energy Efficiency Consultants | 40 | Environmental Engineers, Sustainability Officers |

| Telecommunications Infrastructure | 50 | Network Engineers, Operations Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The Qatar Green Data Center Market is valued at approximately USD 160 million, reflecting a significant growth driven by the demand for sustainable data storage solutions, cloud computing, and government initiatives focused on environmental sustainability.