Region:Middle East

Author(s):Rebecca

Product Code:KRAD4313

Pages:98

Published On:December 2025

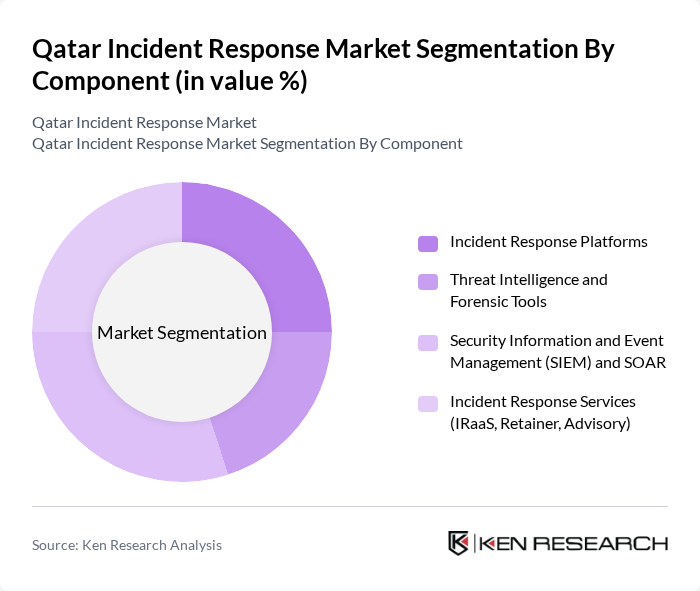

By Component:The components of the market include Incident Response Platforms, Threat Intelligence and Forensic Tools, Security Information and Event Management (SIEM) and SOAR, and Incident Response Services (IRaaS, Retainer, Advisory). The leading subsegment is Incident Response Services, driven by the increasing need for organizations to have expert assistance during cyber incidents, including managed detection and response, remote response, and specialist support for complex ransomware, data theft, and cloud compromise cases.

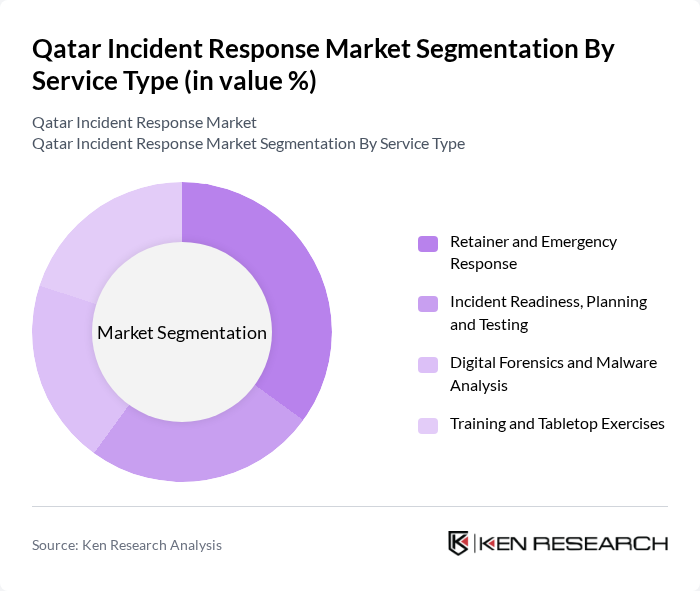

By Service Type:The service types include Retainer and Emergency Response, Incident Readiness, Planning and Testing, Digital Forensics and Malware Analysis, and Training and Tabletop Exercises. The Retainer and Emergency Response subsegment is currently leading, in line with global trends where organizations engage providers on standby to reduce time-to-engage, ensure access to expert responders, and meet cyber insurance, regulatory, and board-level expectations for rapid incident handling.

The Qatar Incident Response Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Computer Emergency Response Team (Q-CERT), which operates as the national CERT function under the relevant government authority in Doha, and telecom operators like Ooredoo Qatar Q.P.S.C. and Vodafone Qatar P.Q.S.C., which provide managed security and SOC-based incident monitoring and response, play central roles in the ecosystem. Large domestic organizations such as Qatar National Bank (Q.P.S.C.) and QatarEnergy maintain internal CSIRTs and often work with global service providers for specialized response, particularly around OT/ICS environments in oil and gas, financial fraud, and high-impact cyber incidents.

Regional integrators and IT service providers such as Gulf Business Machines Qatar (GBM Qatar W.L.L.), Malomatia Q.S.C., and Mannai Corporation QPSC support design, integration, and operation of SIEM, SOAR, SOC, and wider security architectures that underpin incident response capabilities for enterprises and government entities. In parallel, global vendors and consultancies including Cisco Systems, IBM Security Services (e.g., X-Force), Deloitte, PwC, KPMG, Accenture Security, and Palo Alto Networks (Unit 42) serve Qatari clients through regional hubs, offering incident response retainers, emergency response, threat hunting, and digital forensics as part of broader managed detection and response and advisory portfolios.

These organizations collectively contribute to innovation, geographic expansion, and service delivery in this space, with a particular focus on sectors such as banking, oil and gas, government, and critical infrastructure that face elevated regulatory and threat pressures. Their offerings increasingly emphasize automation and orchestration, cloud and SaaS security incident response, OT/ICS incident handling, and integration of threat intelligence to reduce detection and response times.

The future of the Qatar incident response market appears promising, driven by increasing investments in cybersecurity and a growing emphasis on proactive threat management. As organizations recognize the importance of integrating incident response with business continuity planning, the demand for innovative solutions is expected to rise. Additionally, collaboration with international cybersecurity firms will enhance local capabilities, fostering a more resilient cybersecurity ecosystem that can effectively address emerging threats and challenges in the digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Incident Response Platforms Threat Intelligence and Forensic Tools Security Information and Event Management (SIEM) and SOAR Incident Response Services (IRaaS, Retainer, Advisory) |

| By Service Type | Retainer and Emergency Response Incident Readiness, Planning and Testing Digital Forensics and Malware Analysis Training and Tabletop Exercises |

| By Security Type | Network and Endpoint Incident Response Cloud and Application Incident Response OT / ICS and Critical Infrastructure Incident Response Email, Identity and Data Breach Response |

| By Deployment Mode | On-Premises SOC Cloud / SaaS-based Incident Response Hybrid SOC and Co-managed Models |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-User Vertical | Government and Defense BFSI (Banks, Insurance and Fintech) Energy, Oil & Gas and Utilities Telecom, IT and Managed Service Providers Healthcare and Public Services Transport, Smart Cities and Other Enterprises |

| By Geography (Within Qatar) | Doha and Lusail Al Rayyan and Dukhan Ras Laffan Industrial City and Energy Corridors Other Municipalities |

| By Engagement Model | In-house CSIRT / SOC Managed Security Service Providers (MSSPs) Hybrid and Co-sourcing Arrangements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Emergency Services | 60 | Emergency Response Coordinators, Policy Makers |

| Private Security Firms | 50 | Operations Managers, Security Analysts |

| Community-Based Organizations | 40 | Community Leaders, Disaster Response Volunteers |

| Healthcare Emergency Response | 50 | Healthcare Administrators, Emergency Room Managers |

| Academic Institutions Researching Incident Response | 40 | Researchers, Professors in Emergency Management |

The Qatar Incident Response Market is valued at approximately USD 150 million, driven by increasing cyber threats and the need for robust incident response strategies across sectors such as energy, finance, and government.