Region:Middle East

Author(s):Rebecca

Product Code:KRAD6209

Pages:98

Published On:December 2025

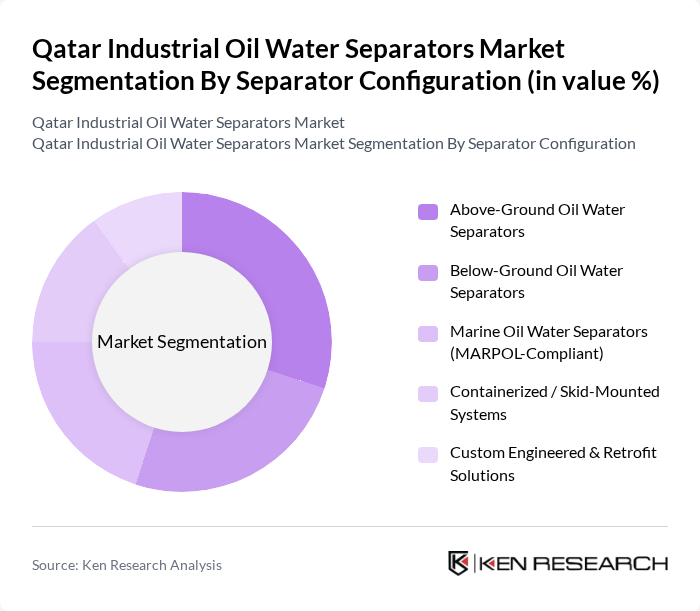

By Separator Configuration:This segmentation includes various types of oil water separators based on their design and installation. The subsegments are: Above-Ground Oil Water Separators, Below-Ground Oil Water Separators, Marine Oil Water Separators (MARPOL-Compliant), Containerized / Skid-Mounted Systems, and Custom Engineered & Retrofit Solutions. The market is primarily driven by the need for efficient and compliant separation technologies in various industrial applications, with growing emphasis on compact, energy?efficient systems that are easy to integrate into existing plants and meet tighter discharge limits.

The Above-Ground Oil Water Separators segment is currently leading the market due to their ease of installation and maintenance, making them a preferred choice for many industrial applications, especially in retrofit projects and facilities with space constraints. These systems are particularly favored in the oil and gas sector, workshops, and service areas where rapid deployment, flexibility in capacity expansion, and operational efficiency are critical. The growing awareness of environmental compliance, rising penalties for non?compliant discharges, and the need for effective wastewater management further bolster the demand for above-ground solutions, positioning them as the dominant subsegment in the market.

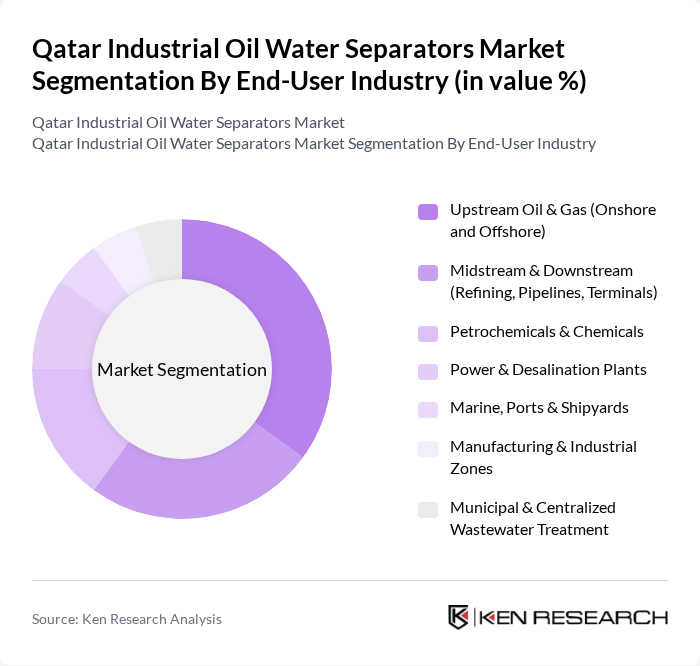

By End-User Industry:This segmentation categorizes the market based on the industries that utilize oil water separators. The subsegments include Upstream Oil & Gas (Onshore and Offshore), Midstream & Downstream (Refining, Pipelines, Terminals), Petrochemicals & Chemicals, Power & Desalination Plants, Marine, Ports & Shipyards, Manufacturing & Industrial Zones, and Municipal & Centralized Wastewater Treatment. The demand from these sectors is driven by regulatory requirements on oil and grease discharge, corporate sustainability targets, and the push to reduce fresh?water intake through greater reuse of treated wastewater.

The Upstream Oil & Gas segment is the largest end-user of oil water separators, driven by the high volume of produced water and oily slops generated during drilling, production, and well?testing operations. The stringent regulations regarding wastewater treatment in this sector, together with industry standards that limit oil in water discharge from offshore and onshore fields, necessitate the use of advanced separation technologies, including API separators, coalescing plate units, and compact modular treatment packages. Additionally, the ongoing expansion and brownfield optimization of oil and gas activities in Qatar, particularly associated with gas processing and related infrastructure, further enhances the demand for effective oil water separation solutions, solidifying its position as the leading subsegment in the market.

The Qatar Industrial Oil Water Separators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Water Technologies & Solutions Qatar, SUEZ – Water Technologies & Solutions (SUEZ Qatar), Alfa Laval Middle East Ltd. (Qatar Operations), Wartsila Qatar WLL (Marine Oil Water Separators), Prominent Fluid Controls Middle East (Qatar), Enviro-Tech Systems LLC (Gulf & Qatar Projects), Hydro International Ltd. (Regional Projects in Qatar), Ecolog International Qatar, Pentair Middle East (Qatar), Ecolab Gulf FZE (Qatar Branch), Qatar Engineering & Construction Company (Qcon), Petrofac Qatar (Water Treatment & Produced Water Separation), Schlumberger Limited (SLB Qatar – Produced Water & Separation Systems), Halliburton Qatar (Produced Water & Separation Solutions), Siemens Energy Qatar (Industrial Water & Wastewater Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Industrial Oil Water Separators market appears promising, driven by increasing environmental awareness and regulatory pressures. As industries expand, the demand for efficient water treatment solutions will likely rise, particularly in the oil and gas sector. Furthermore, the integration of smart technologies and sustainable practices will shape the market landscape, encouraging innovation and investment. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the evolving regulatory environment.

| Segment | Sub-Segments |

|---|---|

| By Separator Configuration | Above-Ground Oil Water Separators Below-Ground Oil Water Separators Marine Oil Water Separators (MARPOL-Compliant) Containerized / Skid-Mounted Systems Custom Engineered & Retrofit Solutions |

| By End-User Industry | Upstream Oil & Gas (Onshore and Offshore) Midstream & Downstream (Refining, Pipelines, Terminals) Petrochemicals & Chemicals Power & Desalination Plants Marine, Ports & Shipyards Manufacturing & Industrial Zones Municipal & Centralized Wastewater Treatment |

| By Critical Application | Produced Water Treatment Oily Sludge & Slop Water Treatment Tank Farms, Refueling & Maintenance Depots Workshop, Garage & Wash-Bay Effluents Bilge & Ballast Water Treatment Stormwater & Surface Runoff from Industrial Sites |

| By Separation Technology | Gravity & API Separators Coalescing Plate (CPI/TPI) Separators Dissolved Air Flotation (DAF) Systems Membrane-Based Oil Removal Systems Electrocoagulation & Advanced Hybrid Systems |

| By Installation Environment | Onshore Facilities Offshore Platforms & FPSOs Port & Maritime Infrastructure Industrial Estates & Free Zones |

| By Procurement Model | CAPEX Purchase (New Installations) Rental / Temporary Treatment Systems Retrofit & Upgrade Projects Operations & Maintenance (O&M) Contracts Build-Own-Operate (BOO) / PPP Structures |

| By Compliance & Performance Class | MARPOL MEPC 60–100 ppm Systems MARPOL MEPC & Local <15 ppm Discharge Systems Qatari Environmental Regulations-Compliant Systems High-Recovery / Water Reuse-Oriented Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Industry Operators | 100 | Environmental Managers, Operations Directors |

| Manufacturing Sector Wastewater Management | 80 | Facility Managers, Compliance Officers |

| Construction Industry Water Treatment | 70 | Project Managers, Site Engineers |

| Municipal Wastewater Treatment Facilities | 60 | Plant Operators, Environmental Engineers |

| Research Institutions on Water Treatment Technologies | 50 | Research Scientists, Academic Professors |

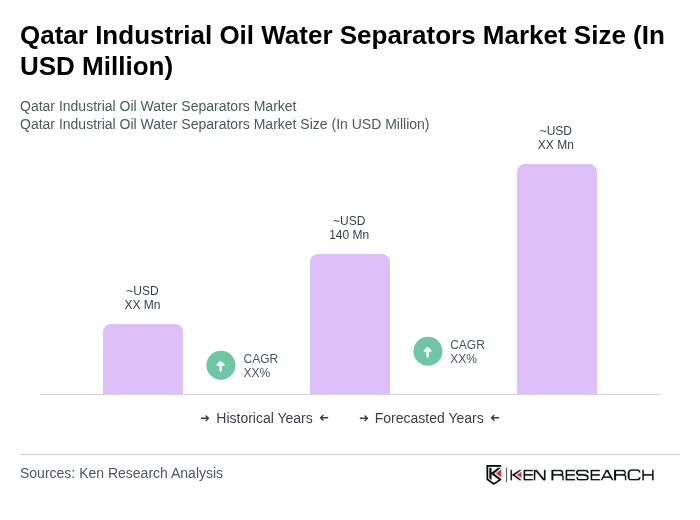

The Qatar Industrial Oil Water Separators Market is valued at approximately USD 140 million, reflecting the growing demand for effective wastewater treatment solutions, particularly in the oil and gas sector, as well as compliance with stringent environmental regulations.