Region:Middle East

Author(s):Shubham

Product Code:KRAA1118

Pages:91

Published On:August 2025

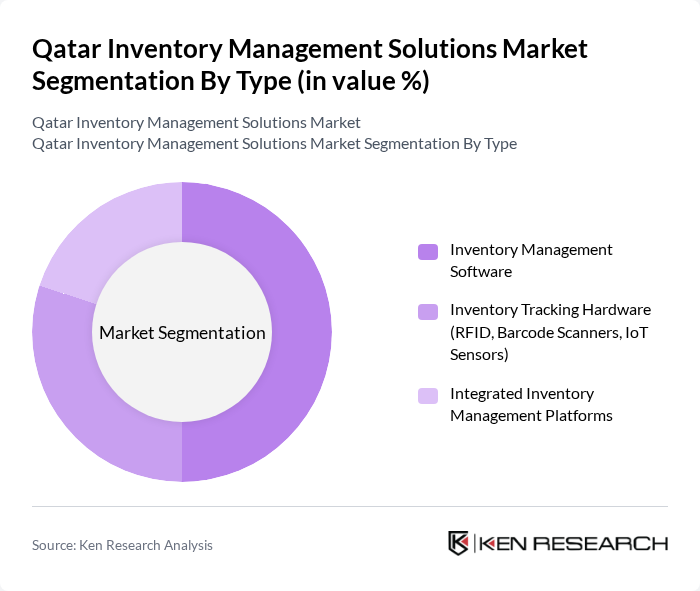

By Type:

The market is segmented into three main types: Inventory Management Software, Inventory Tracking Hardware (RFID, Barcode Scanners, IoT Sensors), and Integrated Inventory Management Platforms. Inventory Management Software is the leading sub-segment, driven by the need for automation, real-time data analytics, and integration with other business systems. The rise of e-commerce, demand for seamless supply chain visibility, and increased focus on reducing manual errors have further propelled the adoption of software solutions, making them essential for operational efficiency .

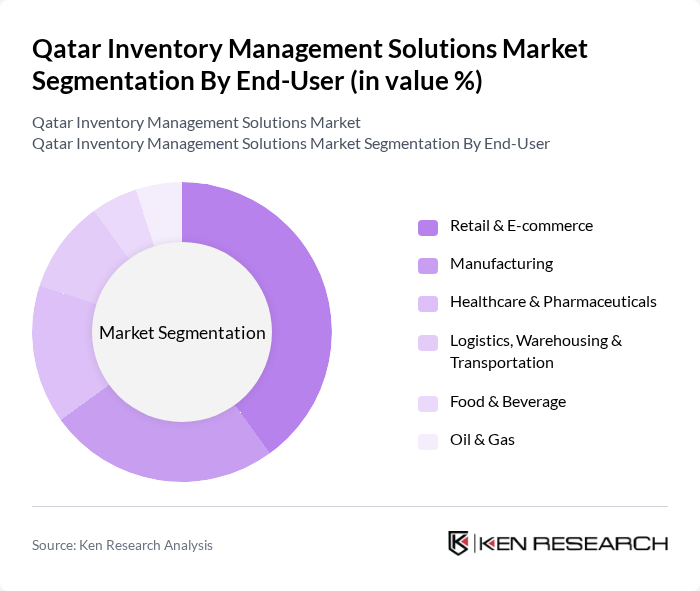

By End-User:

The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics, Warehousing & Transportation, Food & Beverage, and Oil & Gas. Retail & E-commerce is the dominant segment, as rapid growth in online shopping and omnichannel retailing has necessitated advanced inventory management solutions to handle increased product variety, faster fulfillment, and higher customer expectations. Manufacturing and logistics sectors are also significant adopters, driven by the need for real-time inventory visibility and process automation .

The Qatar Inventory Management Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Dynamics (Microsoft Corporation), Infor, Zoho Corporation (Zoho Inventory), NetSuite (Oracle NetSuite), Epicor Software Corporation, SkuVault, Ooredoo Q.P.S.C. (Ooredoo Business Solutions), Mannai Corporation QPSC (Mannai ICT), Tech Mahindra (Middle East), Wasp Barcode Technologies, Unleashed Software, BoxHero Inc., and Brightpearl (Sage Group plc) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory management solutions market in Qatar appears promising, driven by technological advancements and increasing digitalization across various sectors. As businesses continue to embrace automation and data analytics, the demand for sophisticated inventory management systems is expected to rise. Additionally, the ongoing government initiatives aimed at enhancing digital infrastructure will further facilitate the adoption of innovative solutions, positioning Qatar as a regional leader in inventory management practices in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Inventory Tracking Hardware (RFID, Barcode Scanners, IoT Sensors) Integrated Inventory Management Platforms |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics, Warehousing & Transportation Food & Beverage Oil & Gas |

| By Application | Warehouse & Storage Management Order & Fulfillment Management Demand Forecasting & Replenishment Asset Tracking |

| By Sales Channel | Direct Sales Online Sales Value-Added Resellers & Distributors |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Supply Chain Solutions | 80 | Operations Managers, Production Supervisors |

| Healthcare Inventory Systems | 60 | Pharmacy Managers, Logistics Coordinators |

| Technology Providers in Inventory Management | 40 | Product Managers, Business Development Executives |

| Logistics and Warehousing Services | 70 | Warehouse Managers, Logistics Directors |

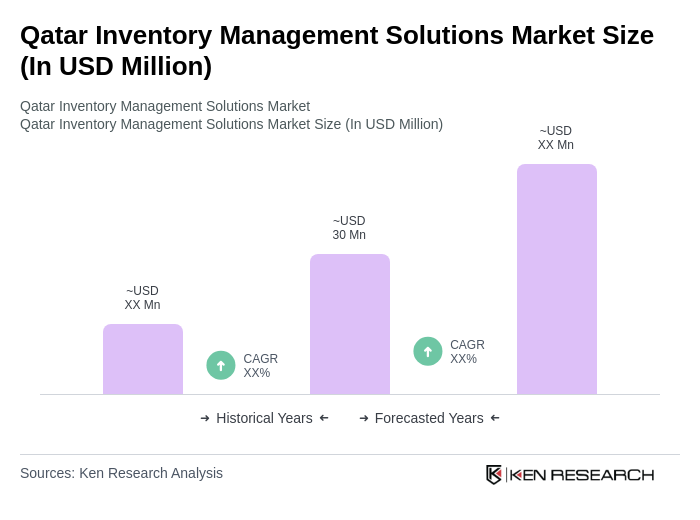

The Qatar Inventory Management Solutions Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient supply chain management and the adoption of automation and IoT technologies.