Region:Middle East

Author(s):Geetanshi

Product Code:KRAB9309

Pages:87

Published On:October 2025

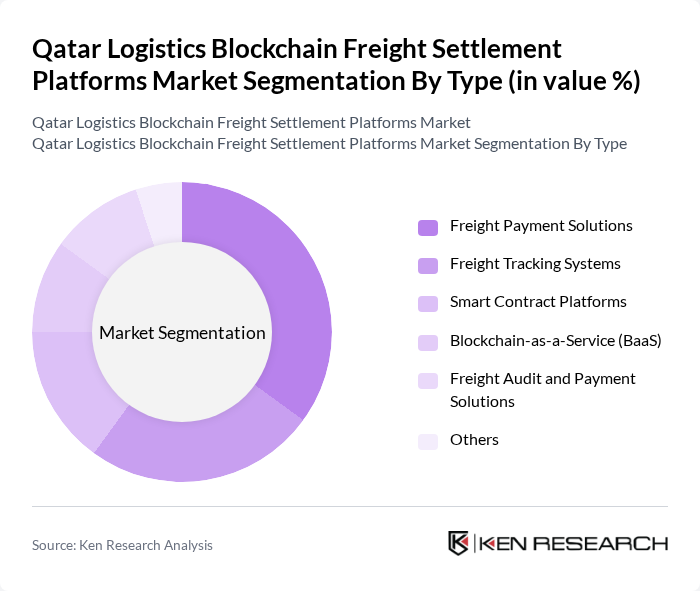

By Type:The market is segmented into various types, including Freight Payment Solutions, Freight Tracking Systems, Smart Contract Platforms, Blockchain-as-a-Service (BaaS), Freight Audit and Payment Solutions, and Others. Among these, Freight Payment Solutions are leading the market due to their ability to streamline payment processes and enhance transaction security. The increasing need for efficient payment mechanisms in logistics is driving the adoption of these solutions, making them a preferred choice for businesses.

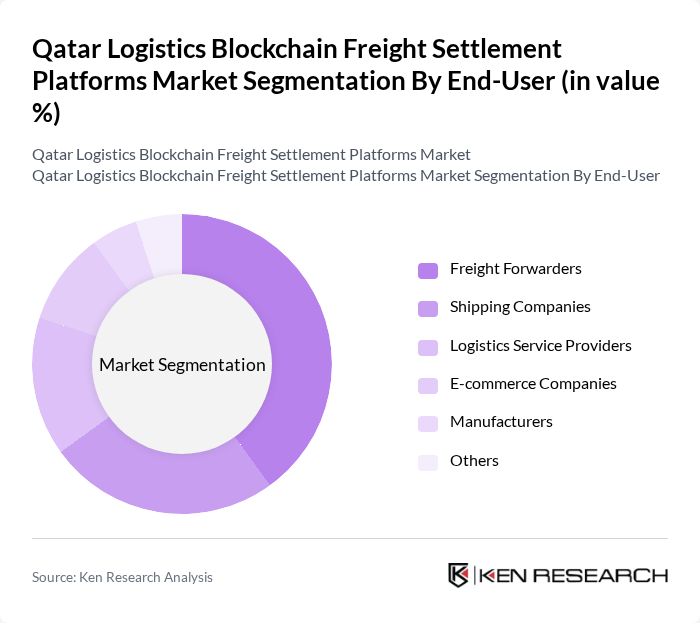

By End-User:The end-user segmentation includes Freight Forwarders, Shipping Companies, Logistics Service Providers, E-commerce Companies, Manufacturers, and Others. Freight Forwarders dominate this segment as they increasingly adopt blockchain solutions to enhance operational efficiency and reduce costs. The growing trend of digital transformation in logistics is pushing these companies to seek innovative solutions that can streamline their processes and improve service delivery.

The Qatar Logistics Blockchain Freight Settlement Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Oracle Corporation, SAP SE, Maersk, Accenture, Microsoft Corporation, CargoX, VeChain, Chain.io, TCS (Tata Consultancy Services), Wipro Limited, Blockchain App Factory, ShipChain, OpenPort, DLT Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's logistics blockchain freight settlement platforms is poised for significant transformation, driven by technological advancements and evolving market demands. As companies increasingly prioritize transparency and security, the integration of blockchain with IoT technologies is expected to enhance operational efficiency. Furthermore, partnerships with financial institutions will facilitate smoother transactions, fostering innovation. The focus on sustainability will also shape the market, as logistics firms seek eco-friendly solutions that align with global environmental goals, ensuring a competitive edge in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Payment Solutions Freight Tracking Systems Smart Contract Platforms Blockchain-as-a-Service (BaaS) Freight Audit and Payment Solutions Others |

| By End-User | Freight Forwarders Shipping Companies Logistics Service Providers E-commerce Companies Manufacturers Others |

| By Application | Cross-Border Trade Domestic Freight Supply Chain Management Inventory Management Others |

| By Payment Method | Cryptocurrency Payments Traditional Currency Payments Hybrid Payment Solutions Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Middle East North Africa Asia-Pacific Europe Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Companies | 100 | Operations Managers, IT Directors |

| Shipping and Logistics Providers | 80 | Supply Chain Managers, Blockchain Specialists |

| Regulatory Bodies and Government Agencies | 50 | Policy Makers, Compliance Officers |

| Technology Providers for Blockchain Solutions | 70 | Product Managers, Business Development Executives |

| Industry Associations and Trade Groups | 60 | Executive Directors, Research Analysts |

The Qatar Logistics Blockchain Freight Settlement Platforms Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for transparency and efficiency in freight transactions, alongside the rising adoption of blockchain technology.