Region:Middle East

Author(s):Rebecca

Product Code:KRAD4271

Pages:80

Published On:December 2025

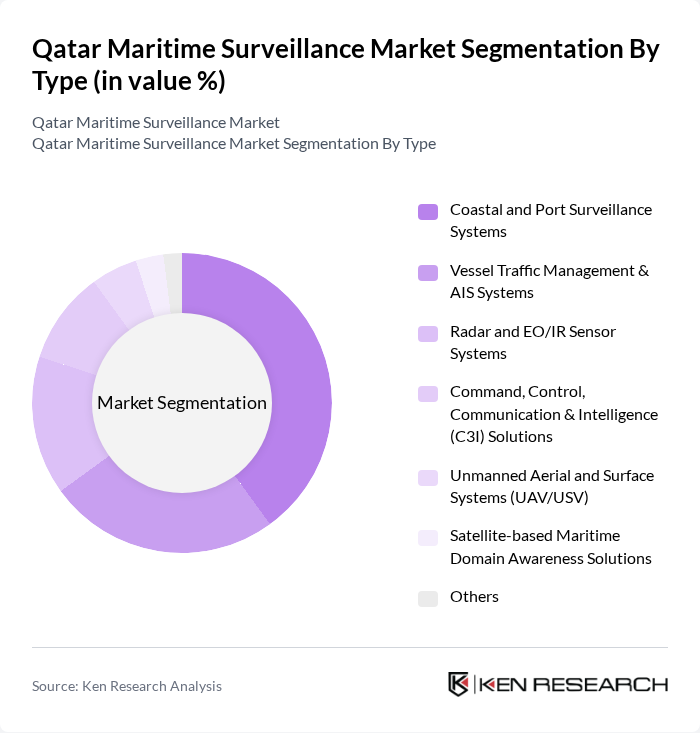

By Type:The market is segmented into various types of surveillance systems, each catering to specific operational needs. The dominant sub-segment is the Coastal and Port Surveillance Systems, which are essential for monitoring maritime traffic and ensuring the security of critical infrastructure. This segment is driven by the increasing need for real-time data and situational awareness in busy ports and coastal areas. Other notable segments include Vessel Traffic Management & AIS Systems and Radar and EO/IR Sensor Systems, which are gaining traction due to advancements in technology and the growing emphasis on maritime safety.

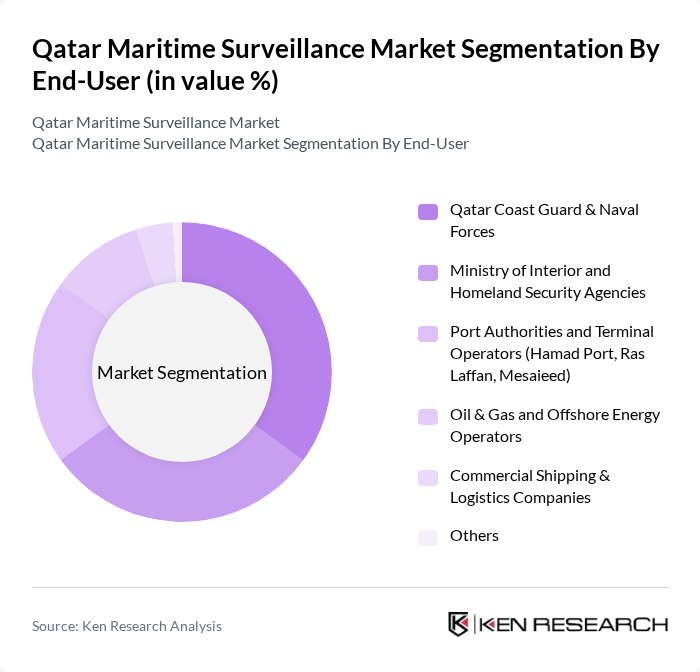

By End-User:The end-user segmentation includes various stakeholders involved in maritime operations. The Qatar Coast Guard & Naval Forces represent the largest segment, driven by the need for enhanced security and surveillance capabilities in national waters. Other significant end-users include the Ministry of Interior and Homeland Security Agencies, which require advanced systems for law enforcement and border protection. The Oil & Gas and Offshore Energy Operators are also key players, as they rely on surveillance technologies to protect critical assets and ensure operational safety.

The Qatar maritime surveillance market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, Leonardo S.p.A., Northrop Grumman Corporation, Saab AB, Elbit Systems Ltd., Raytheon Technologies Corporation, BAE Systems plc, Airbus Defence and Space, Kongsberg Gruppen ASA, L3Harris Technologies, Inc., General Dynamics Corporation, Indra Sistemas, S.A., QinetiQ Group plc, Qatar Armed Forces / Qatar Emiri Naval Forces (Key End-user and Program Driver), Mwani Qatar (Qatar Ports Management Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar maritime surveillance market appears promising, driven by ongoing technological innovations and increasing government support. As the demand for integrated security solutions rises, stakeholders are likely to invest in advanced systems that leverage AI and data analytics. Furthermore, collaborations with international maritime organizations will enhance capabilities, ensuring compliance with global standards while addressing local security needs. This evolving landscape will foster a more secure maritime environment, essential for sustaining trade growth and national security.

| Segment | Sub-Segments |

|---|---|

| By Type | Coastal and Port Surveillance Systems Vessel Traffic Management & AIS Systems Radar and EO/IR Sensor Systems Command, Control, Communication & Intelligence (C3I) Solutions Unmanned Aerial and Surface Systems (UAV/USV) Satellite-based Maritime Domain Awareness Solutions Others |

| By End-User | Qatar Coast Guard & Naval Forces Ministry of Interior and Homeland Security Agencies Port Authorities and Terminal Operators (Hamad Port, Ras Laffan, Mesaieed) Oil & Gas and Offshore Energy Operators Commercial Shipping & Logistics Companies Others |

| By Application | Coastal Border Surveillance and EEZ Protection Port and Critical Infrastructure Security Offshore Asset and Pipeline Protection Search and Rescue and Emergency Response Illegal Fishing, Smuggling, and Anti-Piracy Monitoring Environmental and Pollution Monitoring |

| By Technology | Radar and AIS-based Surveillance Electro-Optical/Infrared (EO/IR) Surveillance Acoustic and Sonar-based Surveillance Integrated Sensor Fusion and Analytics Platforms Cloud, AI, and Data-driven Surveillance Solutions |

| By Investment Source | Central Government and Defense Budget Allocations State-owned Enterprises and Port Authority Investments Private Sector and Operator CAPEX International Defense and Technology Partnerships Others |

| By Policy Support | National Maritime Security and Safety Programs Vision 2030 and Port Modernization Initiatives Bilateral and Multilateral Maritime Security Agreements Others |

| By Region | Doha and Hamad Port Zone Ras Laffan Industrial City and North Field Offshore Mesaieed Industrial Area and Adjacent Waters Dukhan and Western Coastline Other Coastal and Island Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Port Authority Surveillance Needs | 90 | Port Managers, Security Directors |

| Commercial Shipping Companies | 80 | Fleet Managers, Operations Directors |

| Maritime Technology Providers | 70 | Product Managers, Technical Directors |

| Government Regulatory Bodies | 60 | Policy Makers, Maritime Safety Officials |

| Research Institutions Focused on Maritime Security | 50 | Research Analysts, Academic Experts |

The Qatar maritime surveillance market is valued at approximately USD 1.2 billion, driven by increased maritime trade, regional security concerns, and the need for advanced surveillance technologies to monitor coastal and offshore activities.