Region:Middle East

Author(s):Dev

Product Code:KRAC9880

Pages:97

Published On:November 2025

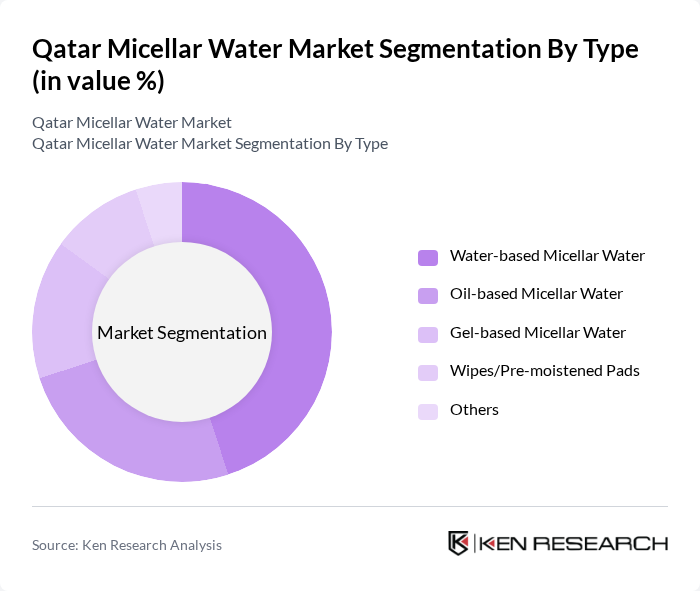

By Type:The market is segmented into various types of micellar water, including water-based, oil-based, gel-based, wipes/pre-moistened pads, and others. Water-based micellar water is currently the leading sub-segment due to its lightweight formulation and effectiveness in removing makeup and impurities without the need for rinsing. This aligns with consumer preferences for convenience, gentle cleansing, and suitability for sensitive skin, which are increasingly prioritized in the region .

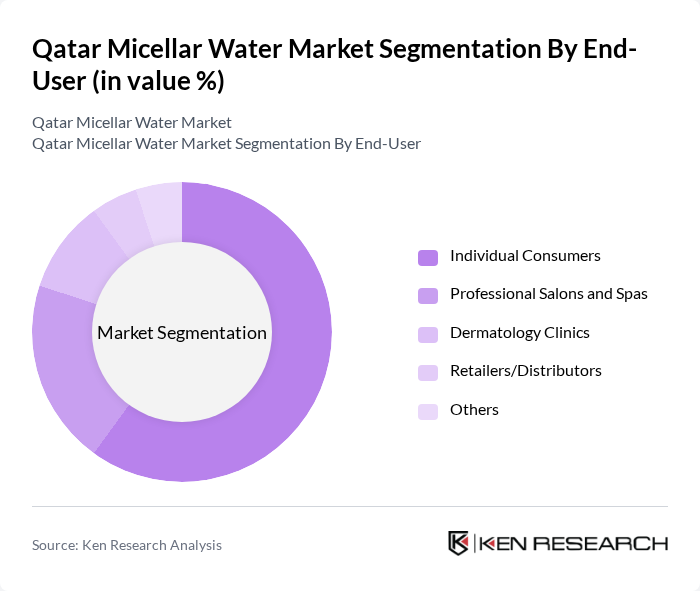

By End-User:The end-user segmentation includes individual consumers, professional salons and spas, dermatology clinics, retailers/distributors, and others. Individual consumers dominate the market, driven by the increasing trend of self-care, the growing popularity of skincare routines, and heightened awareness of the benefits of gentle, multifunctional skincare. The convenience and versatility of micellar water have made it a staple in daily routines, particularly among younger, urban consumers .

The Qatar Micellar Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Middle East (Garnier, L'Oréal Paris), Beiersdorf Middle East (Nivea), Bioderma (NAOS Middle East), Johnson & Johnson Middle East (Neutrogena), Unilever Gulf (Simple), La Roche-Posay (L'Oréal Group), Vichy (L'Oréal Group), The Face Shop (LG Household & Health Care), Clinique (Estée Lauder Middle East), CeraVe (L'Oréal Group), Eau Thermale Avène (Pierre Fabre Middle East), Kiehl's (L'Oréal Group), Pixi Beauty (Pixi Inc.), Tatcha (Unilever Prestige), Himalaya Wellness (Himalaya Global Holdings) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar micellar water market appears promising, driven by evolving consumer preferences and innovative product offerings. As the trend towards multifunctional skincare products continues, brands are likely to develop micellar waters that combine cleansing with additional benefits, such as hydration and anti-aging properties. Furthermore, the increasing influence of social media on purchasing decisions will likely propel brand visibility and consumer engagement, fostering a dynamic market environment that encourages growth and diversification.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based Micellar Water Oil-based Micellar Water Gel-based Micellar Water Wipes/Pre-moistened Pads Others |

| By End-User | Individual Consumers Professional Salons and Spas Dermatology Clinics Retailers/Distributors Others |

| By Packaging Type | Bottles Sachets Pumps Travel-size/Minis Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Pharmacies/Drugstores Specialty Beauty Stores Others |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Sensitive Skin Formulations Others |

| By Price Range | Premium Mid-range Budget Others |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers First-time Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Micellar Water | 60 | Store Managers, Beauty Advisors |

| Consumer Preferences in Skincare | 120 | Skincare Enthusiasts, General Consumers |

| Online Purchase Behavior | 50 | E-commerce Shoppers, Digital Marketing Managers |

| Brand Perception Studies | 40 | Brand Managers, Marketing Executives |

| Market Trends and Insights | 40 | Industry Analysts, Market Researchers |

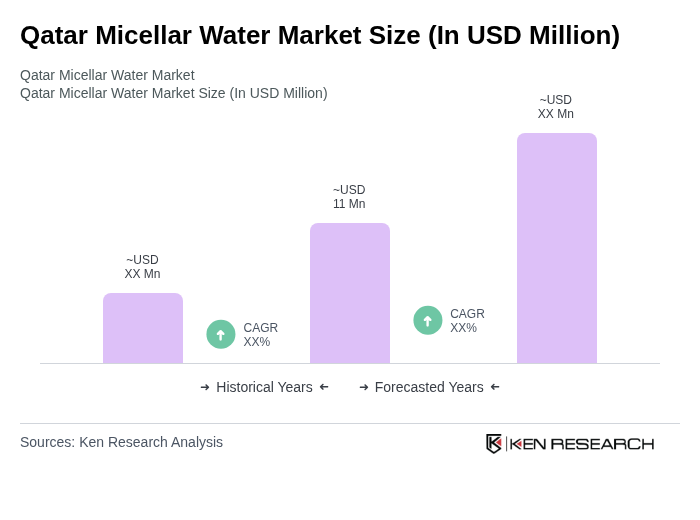

The Qatar Micellar Water Market is valued at approximately USD 11 million, reflecting a growing trend in consumer awareness and demand for multifunctional skincare products that simplify routines and address specific skin concerns.