Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7172

Pages:86

Published On:December 2025

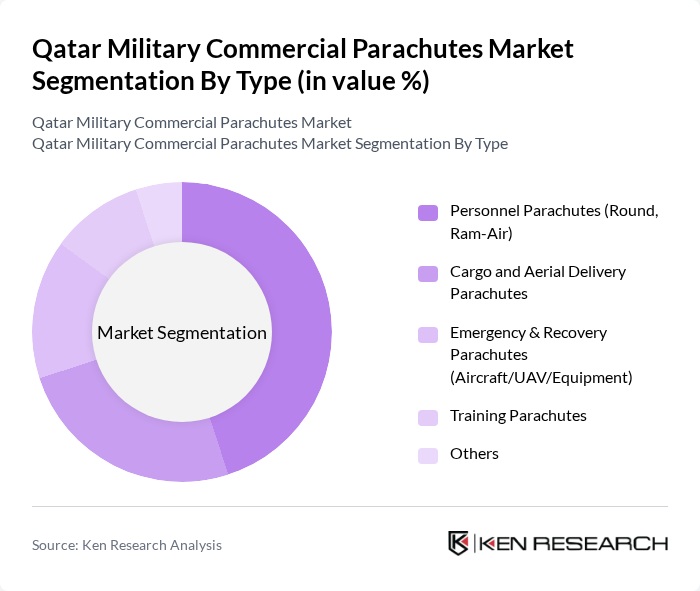

By Type:The market is segmented into various types of parachutes, including Personnel Parachutes (Round, Ram-Air), Cargo and Aerial Delivery Parachutes, Emergency & Recovery Parachutes (Aircraft/UAV/Equipment), Training Parachutes, and Others. This structure is aligned with standard global military parachute categorizations, where personnel deployment dominates overall demand. Among these, Personnel Parachutes are the most dominant due to their critical role in military operations and training exercises, consistent with the global trend where personnel applications account for the largest share of military parachute usage. The demand for advanced parachute systems that enhance safety, steerability, and load-carrying performance—such as ram?air canopies, improved harness systems, and low?altitude insertion solutions—is driving innovation in this segment.

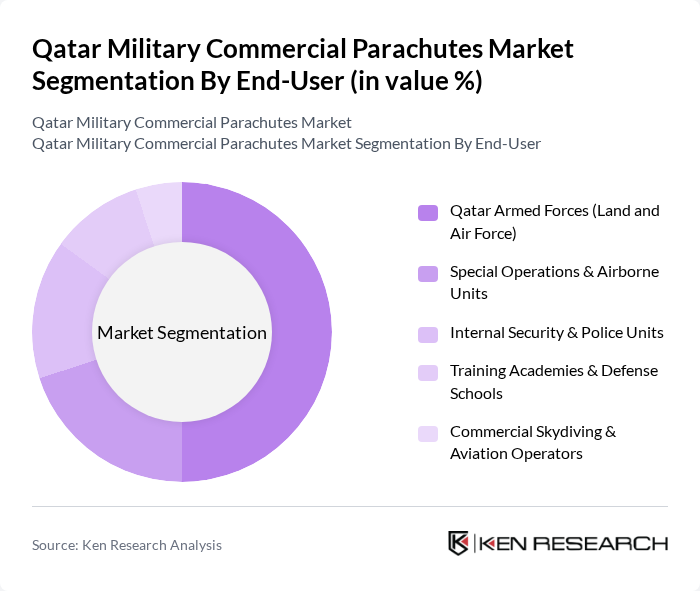

By End-User:The end-user segmentation includes the Qatar Armed Forces (Land and Air Force), Special Operations & Airborne Units, Internal Security & Police Units, Training Academies & Defense Schools, and Commercial Skydiving & Aviation Operators. This structure is consistent with global military parachute end?user patterns, where army and air force users form the core demand base, supplemented by special operations and internal security forces. The Qatar Armed Forces represent the largest segment, driven by ongoing military modernization programs in land and air domains, expansion of air transport fleets, and increased training requirements for paratroopers and aircrew. The focus on enhancing operational capabilities, rapid deployment, and joint exercises with partner nations is propelling growth in this segment, while specialized and internal security units increasingly use parachute and fast?rope insertion capabilities for counter?terrorism and border security roles.

The Qatar Military Commercial Parachutes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airborne Systems Ltd., Safran Aerosystems (formerly Zodiac Aerosafety Systems), Butler Parachute Systems Inc., Mills Manufacturing Corporation, SPEKON Systemtechnik GmbH, Fujikura Parachute Co., Ltd., BAE Systems plc, Complete Parachute Solutions Inc., Parachute Industries of Southern Africa (PISA), FXC Corporation / Guardian Parachute, Aerodyne Research, LLC, Performance Designs, Inc., United Parachute Technologies, LLC, Aerial Delivery Solutions LLC, Safran Electronics & Defense Middle East contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader global competitive landscape for military parachutes and airborne delivery systems.

The future of the Qatar military commercial parachutes market appears promising, driven by increasing defense budgets and a focus on advanced aerial operations. As the Qatari military continues to modernize its capabilities, the demand for innovative parachute systems is expected to rise. Furthermore, strategic partnerships with global defense contractors may enhance local manufacturing capabilities, fostering a competitive environment. Overall, the market is poised for growth, with technological advancements playing a crucial role in shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Personnel Parachutes (Round, Ram-Air) Cargo and Aerial Delivery Parachutes Emergency & Recovery Parachutes (Aircraft/UAV/Equipment) Training Parachutes Others |

| By End-User | Qatar Armed Forces (Land and Air Force) Special Operations & Airborne Units Internal Security & Police Units Training Academies & Defense Schools Commercial Skydiving & Aviation Operators |

| By Application | Military Personnel Airdrop Cargo & Humanitarian/Logistics Aerial Delivery Search & Rescue / MEDEVAC Support Aircraft / UAV Recovery & Deceleration Recreational and Training Jumps |

| By Material | Low-Porosity Nylon High-Tenacity Polyester Aramid Fibers (Kevlar, Nomex) Others (Hybrid & Advanced Technical Fabrics) |

| By Deployment Method | Static Line Deployment HALO/HAHO Freefall Deployment Automatic Activation / Reserve Systems |

| By Payload Capacity | Personnel Systems (< 150 kg) Medium Cargo Systems (150–1,000 kg) Heavy Cargo Systems (> 1,000 kg) Specialized Mission Payloads |

| By Procurement Channel | Direct OEM Procurement Regional Distributors & Integrators Government-to-Government / Offset Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Officers | 45 | Senior Procurement Managers, Defense Budget Analysts |

| Commercial Parachute Manufacturers | 50 | Product Development Managers, Sales Directors |

| Military Training Personnel | 40 | Training Coordinators, Operations Officers |

| Defense Industry Experts | 30 | Consultants, Analysts specializing in military equipment |

| Logistics and Supply Chain Managers | 35 | Logistics Officers, Supply Chain Directors |

The Qatar Military Commercial Parachutes Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This valuation is influenced by increasing defense budgets and modernization efforts within the Qatari military.