Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6003

Pages:100

Published On:December 2025

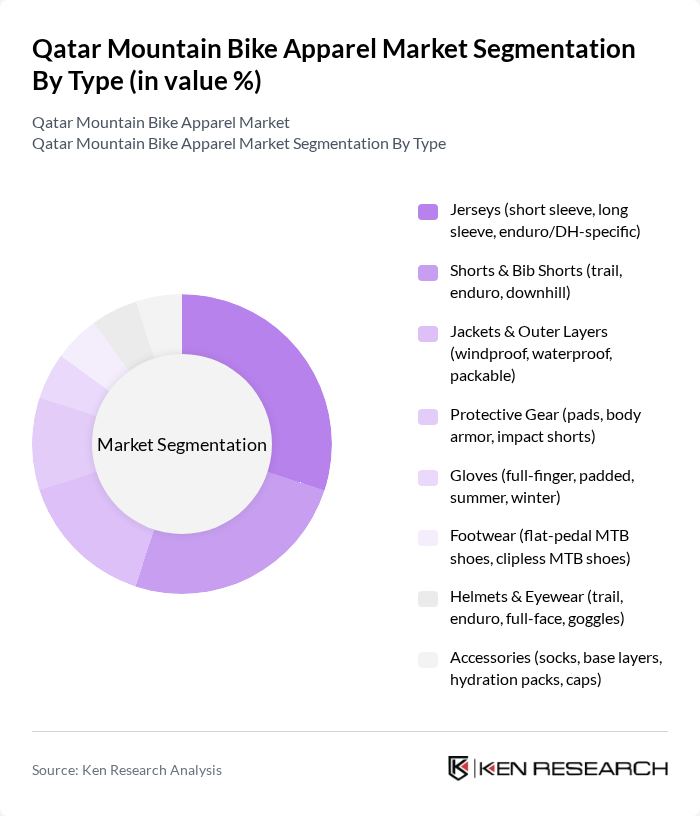

By Type:The market is segmented into various types of apparel, including jerseys, shorts, jackets, protective gear, gloves, footwear, helmets, eyewear, and accessories. This structure is consistent with global mountain bike apparel categorisation, where top wear (jerseys and jackets) accounts for the largest revenue share, followed by bottoms and accessories. Among these, jerseys and shorts are the most popular due to their essential role in providing comfort, moisture management, and aerodynamics during rides, especially in hot climates like Qatar. The demand for protective gear, including pads and body armour, is also rising as safety becomes a priority for riders and more technical off?road riding and bike?park style activities gain traction. The trend towards sustainable materials, such as recycled polyester and bluesign?approved or Oeko?Tex?certified fabrics, is influencing the development of new products, with consumers increasingly seeking eco?friendly, durable, and multifunctional options that can be used across different outdoor sports.

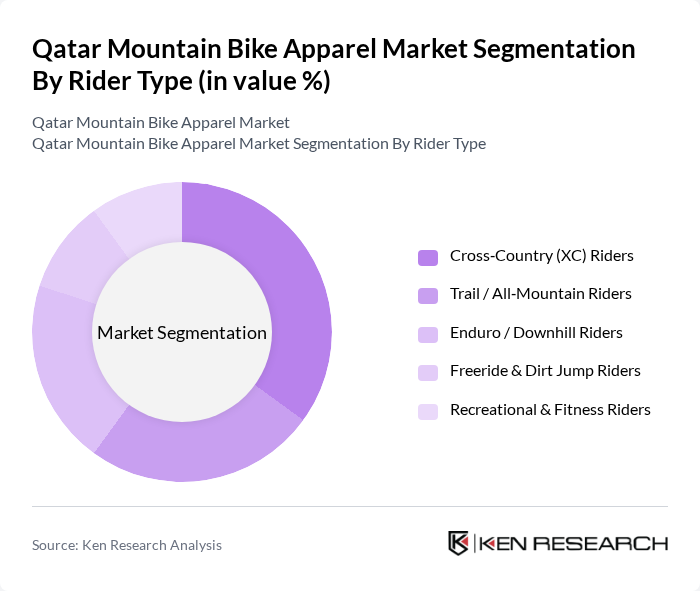

By Rider Type:The market is segmented by rider type, including cross-country, trail/all-mountain, enduro/downhill, freeride/dirt jump, and recreational/fitness riders. This segmentation broadly reflects participation structures seen in global mountain biking markets, where cross?country and trail/all?mountain riding account for the largest share of apparel demand. Cross-country riders represent a major segment in Qatar due to the increasing popularity of endurance and marathon?style events, organised club rides, and the need for lightweight, breathable, performance-oriented apparel suited to longer distances. Trail and enduro riders are also significant contributors, as they seek durable, impact?resistant, and relaxed?fit gear for varied desert and off?road terrains, often aligning with trends in enduro/downhill apparel seen globally. The recreational segment is growing as more individuals take up cycling for fitness, commuting on dedicated routes, and leisure, supported by national health initiatives and the expansion of bicycle retail and club ecosystems in Qatar.

The Qatar Mountain Bike Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fox Racing, Troy Lee Designs, Endura, Alpinestars, POC Sports, Dainese, Dakine, 100%, Shimano, Pearl Izumi, Specialized Bicycle Components, Trek Bicycle Corporation, Giant Manufacturing Co., Ltd., Decathlon S.A. (Rockrider), and Doha Cycling Center (retail & club-merchandise provider) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar mountain bike apparel market is poised for potential growth, driven by increasing participation in cycling and a shift towards healthier lifestyles. As the government continues to invest in sports and cycling infrastructure and promotes outdoor activities as part of national health and tourism strategies, the demand for specialized apparel is expected to rise. Additionally, the integration of technology in fabric development and the growing trend of sustainability will shape future product offerings, catering to the evolving preferences of consumers in Qatar's dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Jerseys (short sleeve, long sleeve, enduro/DH-specific) Shorts & Bib Shorts (trail, enduro, downhill) Jackets & Outer Layers (windproof, waterproof, packable) Protective Gear (pads, body armor, impact shorts) Gloves (full-finger, padded, summer, winter) Footwear (flat-pedal MTB shoes, clipless MTB shoes) Helmets & Eyewear (trail, enduro, full-face, goggles) Accessories (socks, base layers, hydration packs, caps) |

| By Rider Type | Cross?Country (XC) Riders Trail / All?Mountain Riders Enduro / Downhill Riders Freeride & Dirt Jump Riders Recreational & Fitness Riders |

| By Gender & Age Group | Men's Apparel Women's Apparel Youth & Kids' Apparel Unisex Apparel |

| By Material & Performance Feature | High?Performance Synthetics (moisture?wicking, quick?dry) Natural & Blended Fabrics (cotton blends, merino blends) Thermal & Insulated Fabrics (cold?weather use) UV?Resistant & Ventilated Fabrics (hot?climate specific) Sustainable & Recycled Materials |

| By Distribution Channel | Online Brand Stores & Marketplaces Specialty Bike Shops Sporting Goods Retail Chains General Apparel & Department Stores Hypermarkets & Supermarkets Event?Based & Club Sales (races, clubs, pop?ups) |

| By Price Range | Entry?Level / Budget Mid?Range Performance Premium / Professional Luxury & Custom Apparel |

| By Buyer Segment | Individual Consumers Cycling Clubs & Teams Corporate & Event Buyers (sponsors, organizers) Government & Institutional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mountain Bike Retailers | 60 | Store Owners, Sales Managers |

| Mountain Biking Enthusiasts | 150 | Amateur Cyclists, Club Members |

| Professional Cyclists | 50 | Team Coaches, Sponsored Athletes |

| Outdoor Sports Influencers | 40 | Bloggers, Social Media Influencers |

| Event Organizers | 40 | Event Coordinators, Sponsorship Managers |

The Qatar Mountain Bike Apparel Market is valued at approximately USD 40 million, reflecting the growing interest in cycling as both a recreational and competitive sport, alongside rising health consciousness among the population.