Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4886

Pages:87

Published On:December 2025

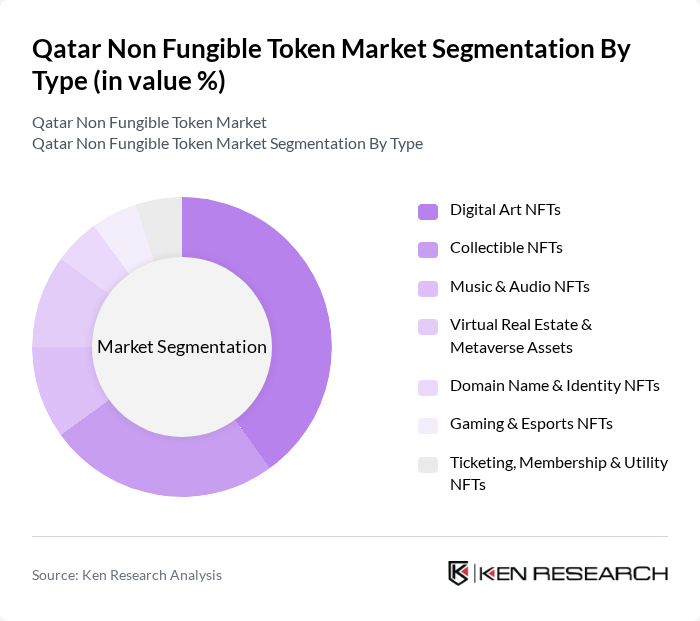

By Type:The market is segmented into various types of NFTs, including Digital Art NFTs, Collectible NFTs, Music & Audio NFTs, Virtual Real Estate & Metaverse Assets, Domain Name & Identity NFTs, Gaming & Esports NFTs, and Ticketing, Membership & Utility NFTs. Among these, Digital Art NFTs have emerged as the dominant segment, driven by the growing popularity of digital artists and the increasing acceptance of art in digital formats. Collectible NFTs also hold a significant share, appealing to both collectors and investors.

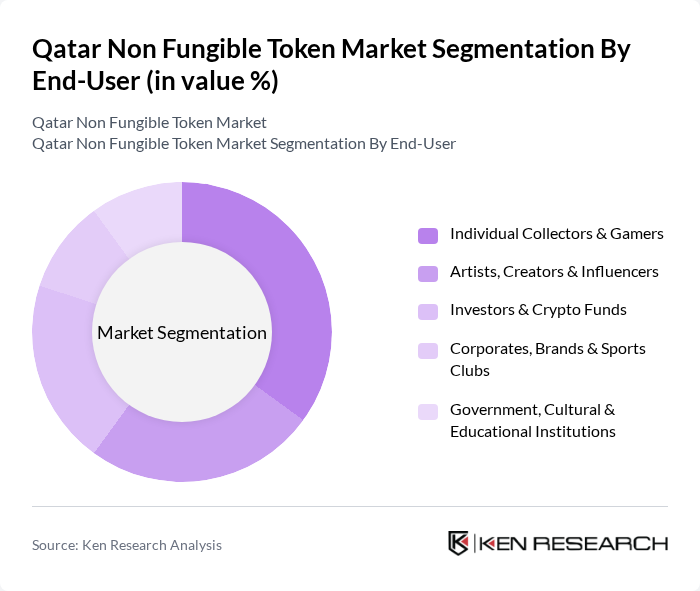

By End-User:The end-user segmentation includes Individual Collectors & Gamers, Artists, Creators & Influencers, Investors & Crypto Funds, Corporates, Brands & Sports Clubs, and Government, Cultural & Educational Institutions. Individual Collectors & Gamers represent the largest segment, driven by the growing interest in digital collectibles and gaming assets. Artists and creators are also increasingly engaging with NFTs to monetize their work, while investors are drawn to the potential for high returns.

The Qatar Non Fungible Token Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Digital Asset Lab (QDAL), Qatar Museums – NFT & Digital Art Initiatives, Qatar Football Association – Fan Token & NFT Programs, Ooredoo – Web3 & NFT Fan Engagement Projects, Katara Cultural Village – Digital Art & NFT Collaborations, Qatar Stars League (QSL) NFT Collectibles, Global NFT Marketplaces Active in Qatar (e.g., OpenSea, Binance NFT), MENA-Focused NFT Platforms Used by Qatar Creators, Local Web3 / Blockchain Studios Developing NFT Projects in Qatar, NFT Ticketing & Event Platforms Serving Qatar, Sports & Esports NFT Partnerships Linked to Qatar Events, Media & Entertainment Firms in Qatar Launching NFT Drops, Real Estate & Metaverse Initiatives for Qatar Properties, Fintech & Crypto Service Providers Enabling NFT Payments in Qatar, Art Galleries & Auction Houses in Qatar Offering NFT Sales contribute to innovation, geographic expansion, and service delivery in this space.

The future of the NFT market in Qatar appears promising, driven by technological advancements and increasing mainstream acceptance. As blockchain technology matures, transaction speeds and security are expected to improve, enhancing user experience. Additionally, collaborations between NFT platforms and traditional art institutions are likely to bridge the gap between digital and physical art, fostering greater legitimacy. With a growing base of digital art enthusiasts and investors, the market is poised for sustained growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Art NFTs Collectible NFTs Music & Audio NFTs Virtual Real Estate & Metaverse Assets Domain Name & Identity NFTs Gaming & Esports NFTs Ticketing, Membership & Utility NFTs |

| By End-User | Individual Collectors & Gamers Artists, Creators & Influencers Investors & Crypto Funds Corporates, Brands & Sports Clubs Government, Cultural & Educational Institutions |

| By Market Segment | Primary Issuance (Minting & Drops) Secondary Trading (Resale Market) OTC & Private Sales |

| By Platform | Local / Qatar-based NFT Platforms Regional (GCC / MENA) NFT Platforms Global NFT Marketplaces Used in Qatar |

| By Payment Method | Cryptocurrency (e.g., ETH, BTC, Stablecoins) Cards via Payment Gateway (Credit/Debit) Bank Transfers & Wallet Top-Ups Telco & Super-App Payments |

| By Geographic Distribution (Within Qatar) | Doha & Lusail Other Urban Centers International Buyers of Qatar-Origin NFTs |

| By User Demographics | Age Groups (18–24, 25–34, 35–44, 45+) Income Levels (Mass, Affluent, HNWI) Profession (Students, Creatives, Professionals, Entrepreneurs) Crypto Experience Level (New, Intermediate, Advanced) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| NFT Artists and Creators | 80 | Digital Artists, Musicians, Content Creators |

| Collectors and Investors | 70 | Art Collectors, Crypto Investors, NFT Enthusiasts |

| Blockchain Technology Firms | 50 | CTOs, Product Managers, Blockchain Developers |

| Marketplaces and Platforms | 60 | Platform Managers, Marketing Directors, Sales Executives |

| Regulatory Bodies and Advisors | 40 | Legal Advisors, Compliance Officers, Government Officials |

The Qatar Non Fungible Token market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of blockchain technology and increased participation in digital asset platforms across various sectors, including art and gaming.