Region:Middle East

Author(s):Dev

Product Code:KRAD3383

Pages:99

Published On:November 2025

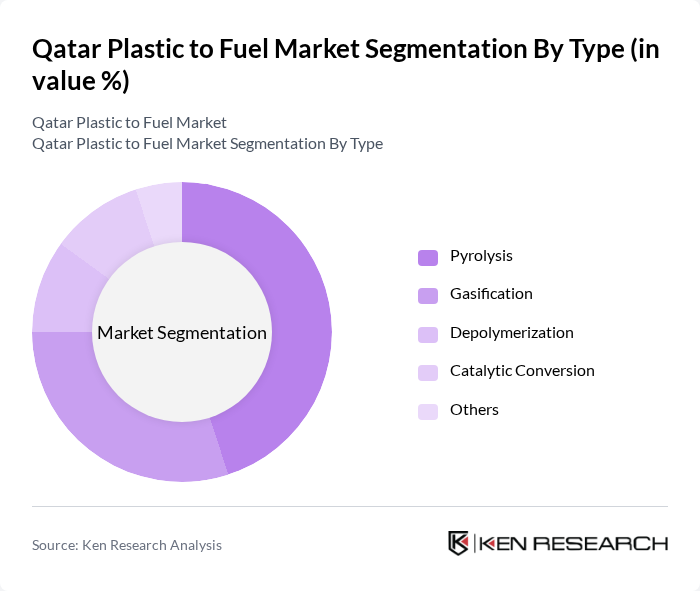

By Type:The market is segmented into Pyrolysis, Gasification, Depolymerization, Catalytic Conversion, and Others. Pyrolysis is the leading technology due to its efficiency in converting a broad spectrum of plastic waste into fuel, its scalability, and its ability to process mixed and non-recyclable plastics. Gasification is also gaining momentum, especially for its capacity to produce syngas, which can be further refined into various fuels. The adoption of these technologies is supported by the increasing focus on waste-to-energy solutions and the need for sustainable alternatives to traditional waste disposal .

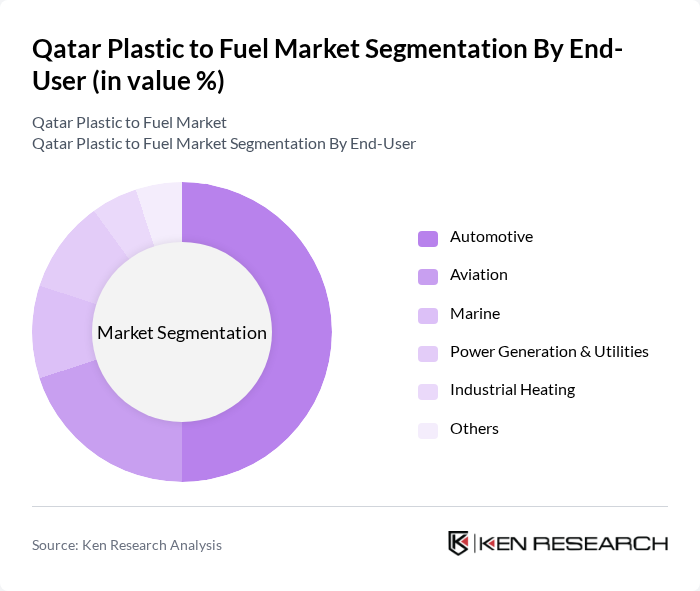

By End-User:The end-user segmentation includes Automotive, Aviation, Marine, Power Generation & Utilities, Industrial Heating, and Others. The Automotive sector is the dominant end-user, driven by the increasing demand for sustainable fuels in transportation and the sector’s alignment with national decarbonization goals. The aviation and marine sectors are also actively exploring alternative fuels to meet evolving regulatory requirements and reduce carbon emissions. The growing emphasis on renewable energy sources and stricter environmental standards is accelerating the adoption of plastic-to-fuel technologies across these industries .

The Qatar Plastic to Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Petrochemical Company (QAPCO), Qatar Chemical Company (Q-Chem), Gulf Petrochemical Industries Company (GPIC), Qatar Fuel Company (Woqod), Qatar Recycling Company, Seashore Recycling & Sustainability, Bee’ah Qatar, Qatar Environment and Energy Research Institute (QEERI), Qatar Green Building Council, Qatar Foundation, Qatar University, Qatar Development Bank, Qatari Investors Group (QIG), Power Waste Management & Transport Co. W.L.L., and Al Haya Enviro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the plastic-to-fuel market in Qatar appears promising, driven by increasing government support and a growing emphasis on sustainability. As the country continues to invest in innovative waste management technologies, the integration of plastic-to-fuel solutions is likely to gain momentum. Additionally, the collaboration between public and private sectors will enhance research and development efforts, fostering advancements in conversion technologies that can further optimize fuel production from plastic waste, ultimately contributing to a more sustainable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Pyrolysis Gasification Depolymerization Catalytic Conversion Others |

| By End-User | Automotive Aviation Marine Power Generation & Utilities Industrial Heating Others |

| By Feedstock | Polyethylene (PE) Polypropylene (PP) Polystyrene (PS) Polyethylene Terephthalate (PET) Mixed Plastics Others |

| By Conversion Technology | Thermal Conversion (Pyrolysis, Gasification) Catalytic Conversion Chemical Conversion Others |

| By Application | Fuel Production (Diesel, Crude Oil, Gasoline, Kerosene) Chemical Feedstock Energy Generation Others |

| By Investment Source | Private Investments Government Funding International Grants Public-Private Partnerships Others |

| By Policy Support | Subsidies for renewable energy projects Tax incentives for waste-to-fuel initiatives Regulatory support for technology adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastic Waste Management Companies | 60 | Operations Managers, Environmental Compliance Officers |

| Renewable Energy Policy Makers | 45 | Government Officials, Regulatory Affairs Specialists |

| Technology Providers in Waste-to-Fuel | 40 | Product Development Engineers, Sales Directors |

| Academic Researchers in Environmental Science | 40 | Professors, Research Analysts |

| End-users of Fuel Derived from Plastics | 50 | Energy Sector Executives, Procurement Managers |

The Qatar Plastic to Fuel Market is valued at approximately USD 12 million, reflecting a growing trend towards sustainable practices and the conversion of plastic waste into usable fuel, driven by environmental concerns and government initiatives.