Region:Middle East

Author(s):Dev

Product Code:KRAA8166

Pages:95

Published On:November 2025

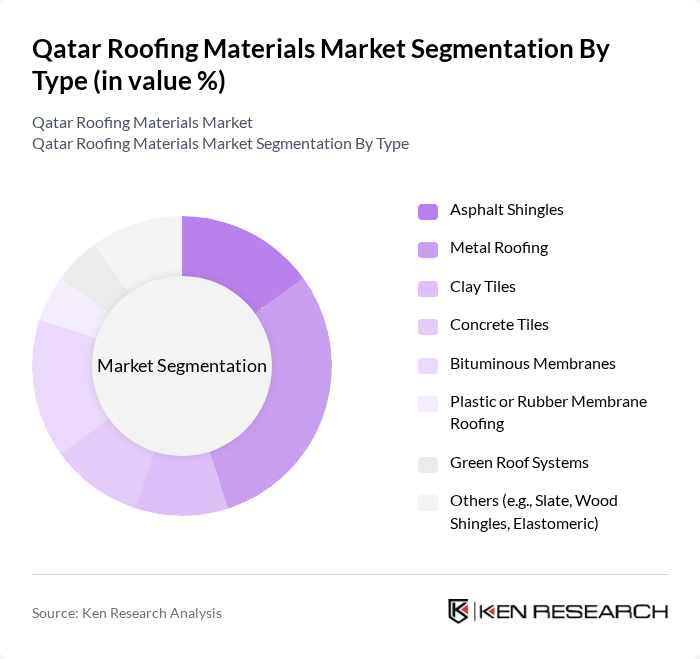

By Type:The roofing materials market can be segmented into various types, including Asphalt Shingles, Metal Roofing, Clay Tiles, Concrete Tiles, Bituminous Membranes, Plastic or Rubber Membrane Roofing, Green Roof Systems, and Others (e.g., Slate, Wood Shingles, Elastomeric). Among these, Bituminous Membranes and Asphalt Shingles collectively represent the largest share due to their cost-effectiveness and suitability for the region’s climate. However, Metal Roofing is increasingly favored for its durability, energy efficiency, and aesthetic appeal, reflecting a growing preference for sustainable building materials among consumers and builders .

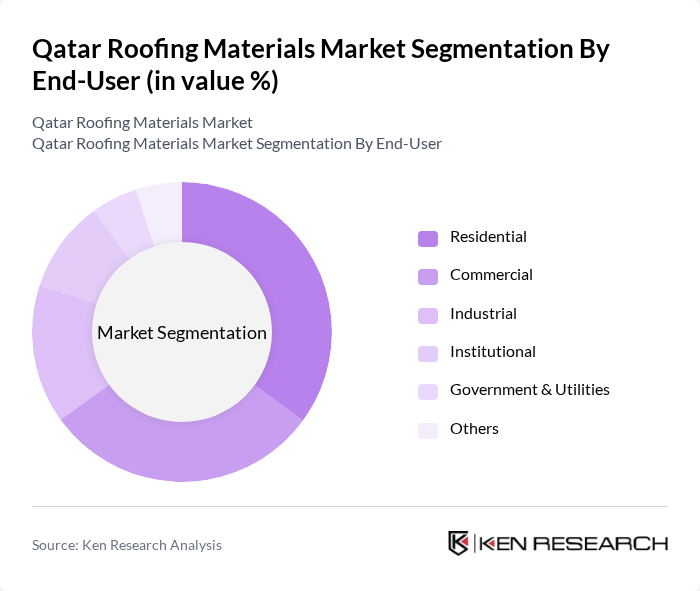

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Institutional, Government & Utilities, and Others. The Commercial segment currently leads the market, driven by the expansion of office spaces, retail, hospitality, and public infrastructure projects. Residential demand remains robust, supported by ongoing housing developments and renovation trends, while government investment in infrastructure continues to stimulate demand across all segments .

The Qatar Roofing Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Cement Company, Gulf Cement Company, Qatar Building Company, Qatari Investors Group, Qatar Industrial Manufacturing Company, Qatar German GRC (Glassfibre Reinforced Concrete) Co. W.L.L., Al Muftah Group, Al Sraiya Holding Group, Al Jaber Group, Al Futtaim Engineering, Qatar Technical International, Qatar Steel, Doha Cladding Solutions, Qatar Marble & Granite, Al Mana & Partners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar roofing materials market appears promising, driven by ongoing urbanization and a shift towards sustainable construction practices. As the government continues to invest in infrastructure, the demand for innovative roofing solutions is expected to rise. Additionally, advancements in technology, such as smart roofing systems, will likely enhance energy efficiency and sustainability, aligning with national goals. The market is poised for growth, with opportunities for companies that adapt to these evolving trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Asphalt Shingles Metal Roofing Clay Tiles Concrete Tiles Bituminous Membranes Plastic or Rubber Membrane Roofing Green Roof Systems Others (e.g., Slate, Wood Shingles, Elastomeric) |

| By End-User | Residential Commercial Industrial Institutional Government & Utilities Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor Others |

| By Application | Residential Roofing Commercial Roofing Industrial Roofing Agricultural Roofing Others |

| By Material Source | Locally Sourced Materials Imported Materials Recycled Materials Others |

| By Installation Type | New Construction Reroofing/Renovation Maintenance Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Roofing Projects | 100 | Homeowners, Contractors |

| Commercial Roofing Solutions | 80 | Facility Managers, Project Managers |

| Industrial Roofing Applications | 60 | Construction Engineers, Procurement Managers |

| Green Roofing Initiatives | 40 | Sustainability Consultants, Architects |

| Roofing Material Distribution | 50 | Distributors, Retail Managers |

The Qatar Roofing Materials Market is valued at approximately USD 420 million, driven by rapid urbanization, infrastructure development, and the demand for durable, energy-efficient roofing solutions.