Region:Middle East

Author(s):Rebecca

Product Code:KRAD1410

Pages:85

Published On:November 2025

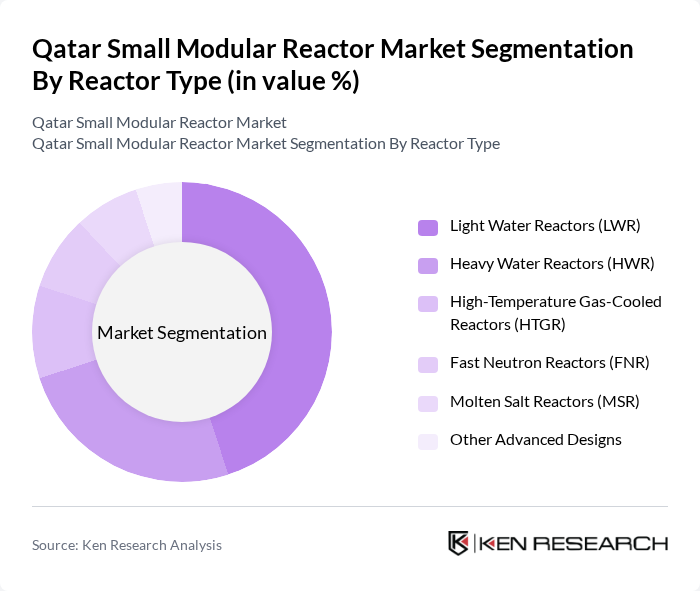

By Reactor Type:The reactor type segmentation encompasses a range of designs tailored to different operational requirements and safety standards. The leading sub-segment isLight Water Reactors (LWR), favored for their proven technology, operational reliability, and established safety record.Heavy Water Reactors (HWR)are also prominent, offering advantages in fuel flexibility and efficiency.High-Temperature Gas-Cooled Reactors (HTGR)andFast Neutron Reactors (FNR)are gaining traction due to their advanced thermal efficiency and potential for fuel recycling.Molten Salt Reactors (MSR)and other advanced designs are emerging as innovative alternatives, particularly for applications requiring enhanced safety and flexibility .

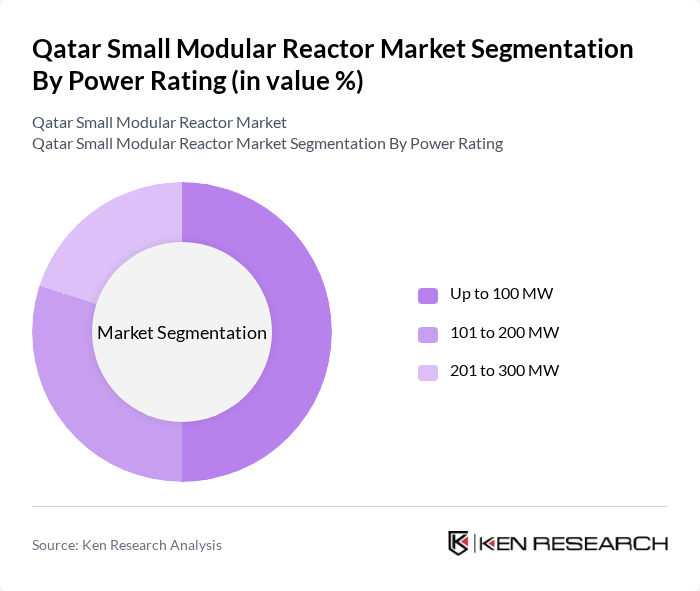

By Power Rating:The power rating segmentation classifies reactors according to their output capacity. TheUp to 100 MWsub-segment is currently the most prominent, reflecting demand for distributed energy solutions, microgrids, and remote applications. The101 to 200 MWsegment serves medium-sized industrial and municipal energy needs, while the201 to 300 MWcategory is emerging for larger installations requiring substantial baseload power. This segmentation aligns with global trends in SMR deployment, emphasizing flexibility, scalability, and integration with renewable energy systems .

The Qatar Small Modular Reactor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar General Electricity & Water Corporation (Kahramaa), Qatar Nuclear Regulatory Authority (QNRA), QatarEnergy, Qatar University, Doosan Enerbility, Westinghouse Electric Company LLC, Rosatom State Atomic Energy Corporation, GE Hitachi Nuclear Energy, Mitsubishi Heavy Industries, Ltd., BWX Technologies, Inc., NuScale Power, LLC, TerraPower, LLC, Holtec International, Framatome S.A.S., Siemens Energy AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Small Modular Reactor market appears promising, driven by increasing energy demands and government initiatives aimed at diversifying energy sources. As technological advancements continue to enhance reactor safety and efficiency, the adoption of SMRs is likely to accelerate. Additionally, the integration of digital technologies and renewable energy sources will play a crucial role in shaping the energy landscape, fostering a more resilient and sustainable energy system in Qatar in future.

| Segment | Sub-Segments |

|---|---|

| By Reactor Type | Light Water Reactors (LWR) Heavy Water Reactors (HWR) High-Temperature Gas-Cooled Reactors (HTGR) Fast Neutron Reactors (FNR) Molten Salt Reactors (MSR) Other Advanced Designs |

| By Power Rating | Up to 100 MW to 200 MW to 300 MW |

| By Deployment Model | Single Module Power Plant Multi-Module Power Plant |

| By Connectivity | Grid-Connected Off-Grid |

| By Application | Power Generation Desalination Process Heat Hydrogen Production Industrial Others |

| By End-User | Utilities Industrial Users Government Entities Research Institutions Others |

| By Fuel Type | Uranium-Based Fuels Thorium-Based Fuels Mixed Oxide (MOX) Fuels Others |

| By Financing Model | Public Financing Private Financing Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Energy Policy Makers | 45 | Energy Ministers, Regulatory Authority Officials |

| Nuclear Technology Providers | 40 | Business Development Managers, Technical Directors |

| Energy Sector Analysts | 30 | Market Analysts, Research Directors |

| Utility Company Executives | 50 | CEOs, Chief Engineers, Project Managers |

| Environmental and Safety Regulators | 35 | Environmental Officers, Safety Inspectors |

The Qatar Small Modular Reactor market is valued at approximately USD 1.0 billion, reflecting its share of the global market, which ranges between USD 6.0 billion and USD 8.9 billion. This valuation considers Qatar's energy demand and infrastructure investments.