Region:Middle East

Author(s):Rebecca

Product Code:KRAC3996

Pages:89

Published On:October 2025

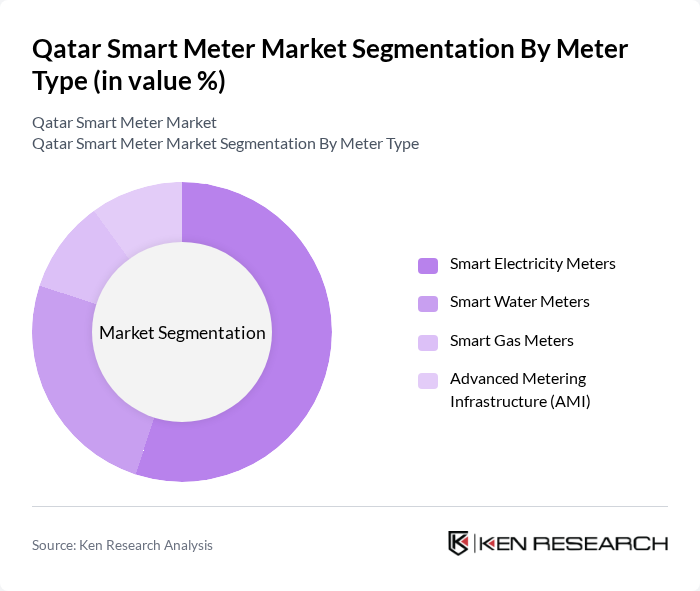

By Meter Type:The market is segmented into Smart Electricity Meters, Smart Water Meters, Smart Gas Meters, and Advanced Metering Infrastructure (AMI). Among these,Smart Electricity Metersare leading the market due to the increasing demand for energy efficiency and real-time monitoring. The adoption of smart electricity meters is driven by the need for utilities to manage energy consumption effectively and provide better services to consumers. Smart Water and Gas Meters are also gaining traction, but the electricity segment remains dominant due to its critical role in energy management .

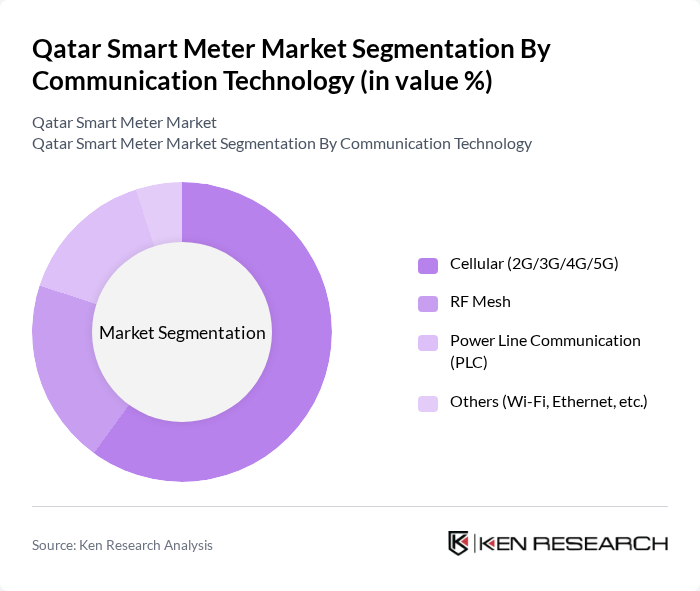

By Communication Technology:The market is categorized into Cellular (2G/3G/4G/5G), RF Mesh, Power Line Communication (PLC), and Others (Wi-Fi, Ethernet, etc.).Cellular communication technologyis the most widely adopted due to its reliability and extensive coverage, making it suitable for urban and rural deployments. RF Mesh technology is also gaining popularity for its ability to create a self-healing network, while PLC is used in specific applications where power lines are already in place. The Others category includes emerging technologies that are gradually being integrated into smart metering solutions .

The Qatar Smart Meter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, Itron, Inc., Landis+Gyr AG, Honeywell International Inc., Sensus (Xylem Inc.), Elster Group GmbH, Kamstrup A/S, Aclara Technologies LLC, Trilliant Networks, Inc., GE Digital, ABB Ltd., Oracle Corporation, Hexing Electrical Co., Ltd., Qatar General Electricity & Water Corporation (Kahramaa) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar smart meter market appears promising, driven by ongoing government support and technological advancements. The integration of smart meters is expected to enhance energy efficiency significantly, with projected savings of QAR 3 billion annually in future. Additionally, the rise of smart city initiatives will further propel the adoption of smart metering solutions, fostering a more sustainable urban environment. As consumer awareness grows, the demand for innovative energy management solutions will likely increase, shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Meter Type | Smart Electricity Meters Smart Water Meters Smart Gas Meters Advanced Metering Infrastructure (AMI) |

| By Communication Technology | Cellular (2G/3G/4G/5G) RF Mesh Power Line Communication (PLC) Others (Wi-Fi, Ethernet, etc.) |

| By Phase | Single Phase Three Phase |

| By End-User | Residential Commercial Industrial Utilities & Government |

| By Application | Electricity Metering Water Metering Gas Metering |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Meter Users | 100 | Homeowners, Renters |

| Commercial Energy Managers | 60 | Facility Managers, Energy Efficiency Coordinators |

| Utility Company Executives | 40 | CEOs, CTOs, Operations Directors |

| Smart Meter Technology Providers | 50 | Product Managers, Sales Directors |

| Regulatory Body Representatives | 40 | Policy Analysts, Regulatory Affairs Managers |

The Qatar Smart Meter Market is valued at approximately USD 550 million, driven by the increasing demand for efficient energy management, government initiatives promoting smart grid technologies, and the need for accurate billing systems.