Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3830

Pages:94

Published On:October 2025

By Type:The market is segmented into various types of APIs that cater to different functionalities and user needs. The subsegments include Messaging APIs, Voice APIs, IVR (Interactive Voice Response) APIs, Payment APIs, Location APIs, WebRTC APIs, REST APIs, SOAP APIs, GraphQL APIs, Webhooks, and Others. Each of these subsegments plays a crucial role in enhancing communication, facilitating transactions, and providing location-based services. Globally, Messaging APIs lead in market share due to high enterprise A2P traffic, while Location APIs are the fastest-growing segment, driven by IoT and mobile application demand.

By End-User:The end-user segmentation includes Telecom Operators, Enterprises, SMEs, Startups, Government Agencies, and Educational Institutions. Each of these segments utilizes telecom APIs to enhance their operational efficiency, improve customer engagement, and streamline communication processes. The proliferation of smartphones, tablets, wearables, and IoT devices has expanded the scope of telecom services, with APIs playing a crucial role in integrating these devices with telecom networks and enabling innovative applications across industries.

The Qatar Telecom API Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo Q.P.S.C., Vodafone Qatar P.Q.S.C., Qatar National Broadband Network (Qnbn), Gulf Bridge International (GBI), Starlink Qatar, Meeza QSTP LLC, MEEZA Digital, Es’hailSat (Qatar Satellite Company), Qatar Datamation Systems, Malomatia, Huawei Technologies Qatar, Ericsson Qatar, Nokia Solutions and Networks Qatar, Cisco Systems Qatar, Qatar Computer Services W.L.L. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Telecom API market appears promising, driven by ongoing digital transformation initiatives and the increasing integration of IoT technologies. As the government continues to invest in smart city projects, the demand for innovative API solutions will rise. Additionally, the adoption of cloud-based services and AI technologies will further enhance operational efficiencies. Companies that focus on user experience and develop open API ecosystems will likely lead the market, fostering collaboration and innovation across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Messaging APIs Voice APIs IVR (Interactive Voice Response) APIs Payment APIs Location APIs WebRTC APIs REST APIs SOAP APIs GraphQL APIs Webhooks Others |

| By End-User | Telecom Operators Enterprises SMEs Startups Government Agencies Educational Institutions |

| By Application | Mobile Applications Web Services E-commerce Platforms IoT Solutions OTT & Streaming Services Fintech Solutions |

| By Industry Vertical | Telecommunications Financial Services Healthcare Retail Transportation & Logistics Government & Public Sector |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Pay-as-you-go Subscription-Based Freemium |

| By Integration Level | Full Integration Partial Integration No Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom API Usage in Mobile Payments | 60 | Product Managers, Financial Services Executives |

| API Integration in IoT Solutions | 50 | IoT Developers, Technical Architects |

| Messaging API Adoption in Enterprises | 45 | IT Managers, Communication Directors |

| Location-Based Services API Insights | 40 | Marketing Managers, Data Analysts |

| API Security and Compliance Perspectives | 45 | Security Officers, Compliance Managers |

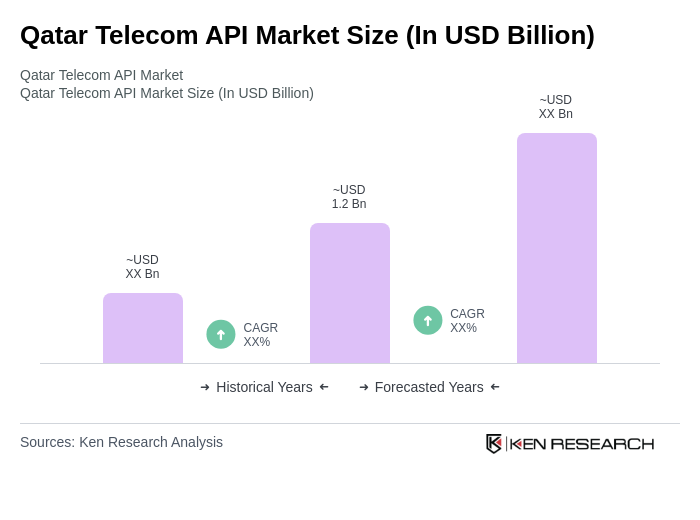

The Qatar Telecom API Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for digital communication solutions, mobile applications, and IoT technologies.