Region:Middle East

Author(s):Shubham

Product Code:KRAC2190

Pages:96

Published On:October 2025

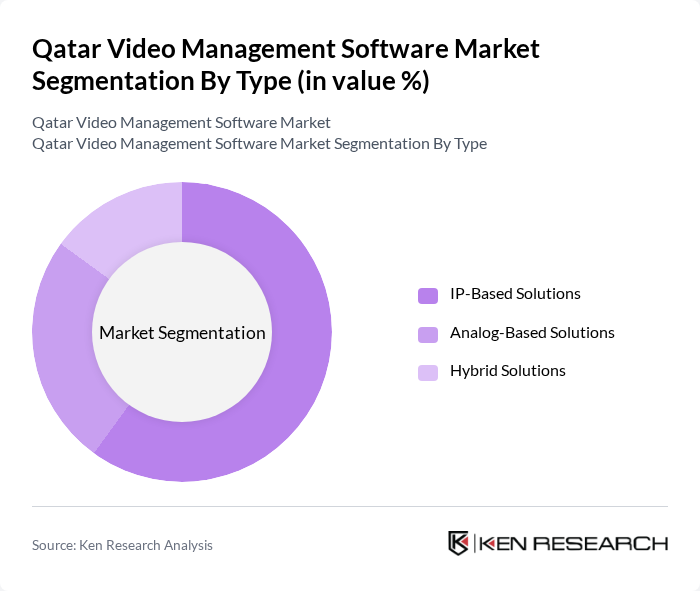

By Type:The market is segmented into three main types: IP-Based Solutions, Analog-Based Solutions, and Hybrid Solutions. Among these, IP-Based Solutions are leading the market due to their scalability, flexibility, and superior image quality. The increasing trend towards digital transformation in security systems is driving the adoption of IP-based technologies, as they offer advanced features such as remote access, integration with other security systems, and support for cloud-based storage and analytics. The shift to IP-based solutions is further supported by regulatory requirements for interoperability and centralized monitoring .

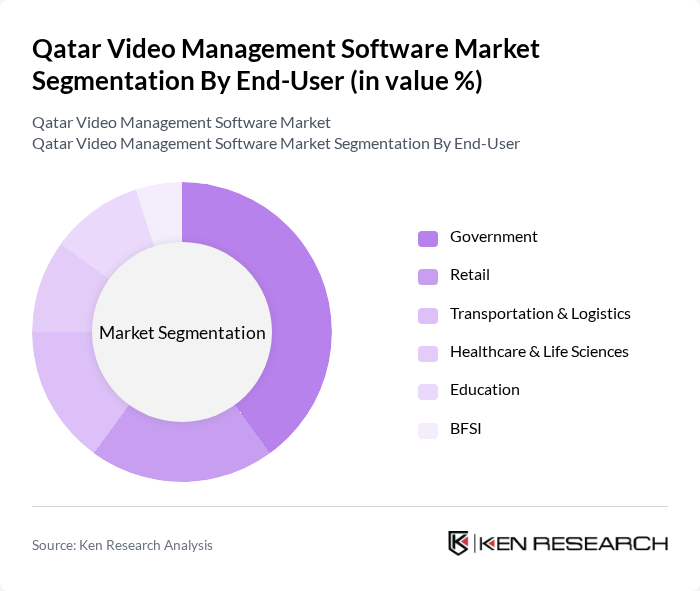

By End-User:The end-user segmentation includes Government, Retail, Transportation & Logistics, Healthcare & Life Sciences, Education, and Banking, Financial Services, and Insurance (BFSI). The Government sector is the leading end-user, driven by the need for enhanced security measures in public spaces and critical infrastructure. The increasing focus on public safety and the implementation of regulations mandating surveillance systems are key factors contributing to the dominance of this segment. Retail and transportation sectors are also experiencing strong growth due to heightened security requirements and the need for real-time monitoring and analytics .

The Qatar Video Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Genetec Inc., Milestone Systems A/S, Avigilon Corporation, Axis Communications AB, Honeywell International Inc., Bosch Security Systems, Dahua Technology Co., Ltd., Hikvision Digital Technology Co., Ltd., Panasonic Corporation, Johnson Controls International plc, FLIR Systems, Inc., Verint Systems Inc., Qognify Inc., BriefCam Ltd., VIVOTEK Inc., BCD Video, IndigoVision Group plc, Arcules Inc. contribute to innovation, geographic expansion, and service delivery in this space. These companies are recognized for their advanced video analytics, cloud-based solutions, and strong presence in public sector deployments .

The future of the Qatar video management software market appears promising, driven by technological advancements and increasing urbanization. As smart city initiatives gain momentum, the integration of IoT and AI technologies will enhance video analytics capabilities. Furthermore, the growing emphasis on user-friendly interfaces will likely attract more end-users. In future, the market is expected to witness a surge in demand for mobile surveillance solutions, reflecting the evolving needs of businesses and government entities in Qatar.

| Segment | Sub-Segments |

|---|---|

| By Type | IP-Based Solutions Analog-Based Solutions Hybrid Solutions |

| By End-User | Government Retail Transportation & Logistics Healthcare & Life Sciences Education Banking, Financial Services, and Insurance (BFSI) |

| By Application | Surveillance & Security Traffic Monitoring Incident & Case Management Video Analytics (Facial Recognition, People Counting, Perimeter Monitoring) |

| By Component | Software (VMS Platform, Analytics Module, Integration Tools) Hardware (Servers, Storage, Cameras, Networking Equipment) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| By Others | Custom Solutions Niche Applications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Video Management | 100 | Store Managers, IT Directors |

| Hospitality Industry Surveillance | 80 | Operations Managers, Security Managers |

| Government Security Solutions | 70 | Public Safety Officials, IT Administrators |

| Transportation Sector Monitoring | 60 | Logistics Managers, Safety Compliance Officers |

| Education Sector Video Solutions | 40 | Facility Managers, IT Coordinators |

The Qatar Video Management Software market is valued at approximately USD 140 million, driven by increasing demand for security solutions across various sectors, including government, healthcare, and retail, along with advancements in technologies like AI and cloud computing.