Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9345

Pages:100

Published On:November 2025

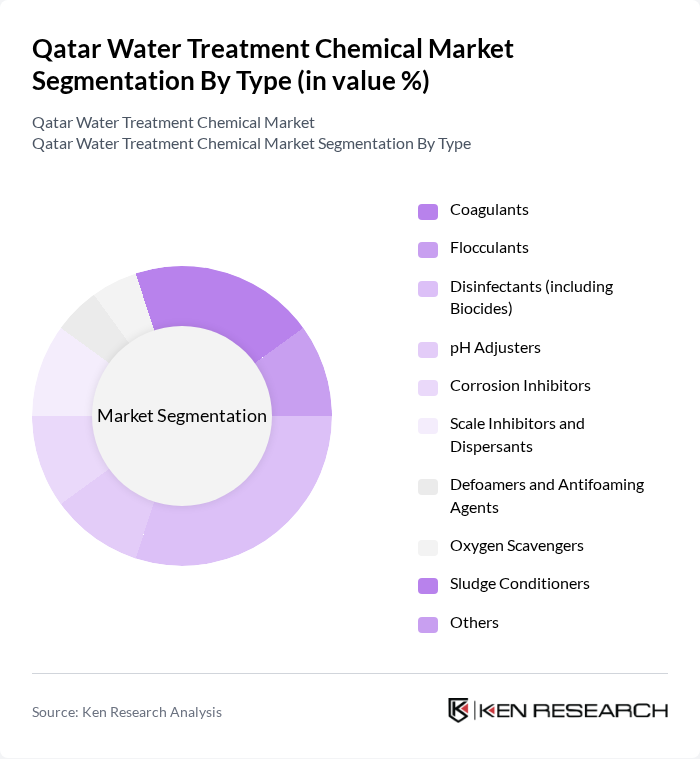

By Type:The market is segmented into various types of water treatment chemicals, including coagulants, flocculants, disinfectants, pH adjusters, corrosion inhibitors, scale inhibitors, defoamers, oxygen scavengers, sludge conditioners, and others. Among these, coagulants and flocculants are particularly significant due to their essential roles in the removal of suspended solids and impurities, especially in industrial applications. Disinfectants (including biocides) also maintain a strong presence, driven by the critical need for microbial control and compliance with public health standards in both municipal and industrial water treatment .

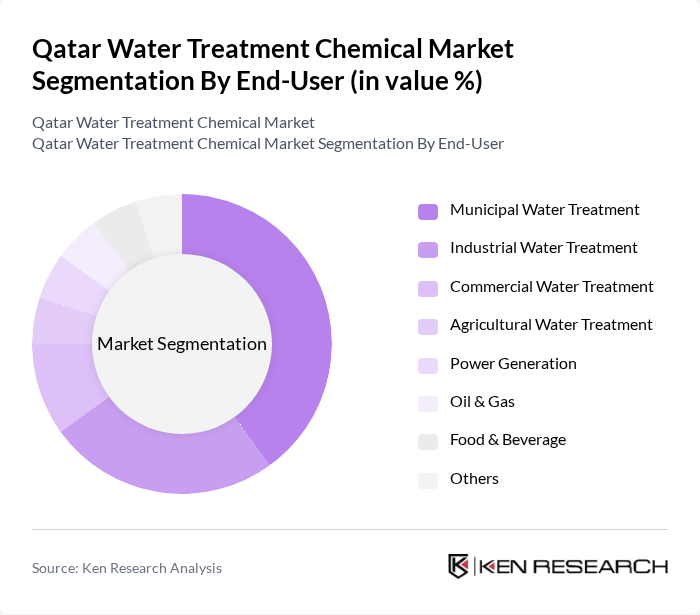

By End-User:The end-user segmentation includes municipal water treatment, industrial water treatment, commercial water treatment, agricultural water treatment, power generation, oil & gas, food & beverage, and others. Municipal water treatment remains the leading segment, reflecting the growing need for safe drinking water and the enforcement of stringent water quality regulations. The industrial sector, particularly power generation and oil & gas, is also a major consumer due to high water usage and compliance requirements for operational efficiency and environmental standards .

The Qatar Water Treatment Chemical Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Ecolab Inc., Kemira Oyj, SNF Group, Solvay S.A., Dow Chemical Company, Nouryon, Veolia Environnement S.A., SUEZ S.A., Kurita Water Industries Ltd., Metito Holdings Ltd., Nalco Water (an Ecolab Company), Clariant AG, Chemtrade Logistics Inc., Qatar Industrial Manufacturing Company (QIMC) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar water treatment chemical market is poised for significant evolution, driven by technological advancements and a growing emphasis on sustainability. As the government continues to invest in water conservation and treatment infrastructure, the demand for innovative and eco-friendly solutions will rise. Additionally, the integration of smart water management systems is expected to enhance operational efficiency. These trends indicate a shift towards more sustainable practices, positioning the market for robust growth in future, particularly as industrial and urban demands escalate.

| Segment | Sub-Segments |

|---|---|

| By Type | Coagulants Flocculants Disinfectants (including Biocides) pH Adjusters Corrosion Inhibitors Scale Inhibitors and Dispersants Defoamers and Antifoaming Agents Oxygen Scavengers Sludge Conditioners Others |

| By End-User | Municipal Water Treatment Industrial Water Treatment Commercial Water Treatment Agricultural Water Treatment Power Generation Oil & Gas Food & Beverage Others |

| By Application | Drinking Water Treatment Wastewater Treatment Process Water Treatment Cooling Water Treatment Boiler Water Treatment Desalination and RO Pre-treatment Sludge Handling and Conditioning Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Biochemical Agents Others |

| By Regulatory Compliance | Local Standards International Standards Environmental Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 100 | Water Treatment Plant Managers, Environmental Engineers |

| Industrial Water Treatment Applications | 90 | Procurement Managers, Operations Managers |

| Chemical Suppliers and Distributors | 60 | Sales Managers, Product Development Specialists |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Compliance Officers |

| Research Institutions and Academia | 50 | Research Scientists, Environmental Consultants |

The Qatar Water Treatment Chemical Market is valued at approximately USD 160 million, reflecting a five-year historical analysis. This growth is driven by urbanization, environmental regulations, and the demand for clean water in municipal and industrial sectors.