Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5942

Pages:85

Published On:December 2025

By Product Type:The product type segmentation includes various categories such as Sports / Performance Leggings, Athleisure Leggings, Fashion / Casual Leggings, Modest / Long-length Tights & Leggings, Shapewear & Compression Leggings, Maternity Leggings, and Others. Among these, Athleisure Leggings are currently dominating the market due to their versatility and comfort, appealing to a wide range of consumers who seek both style and functionality. The trend towards casual and comfortable clothing has significantly boosted the demand for this sub-segment, making it a preferred choice for everyday wear.

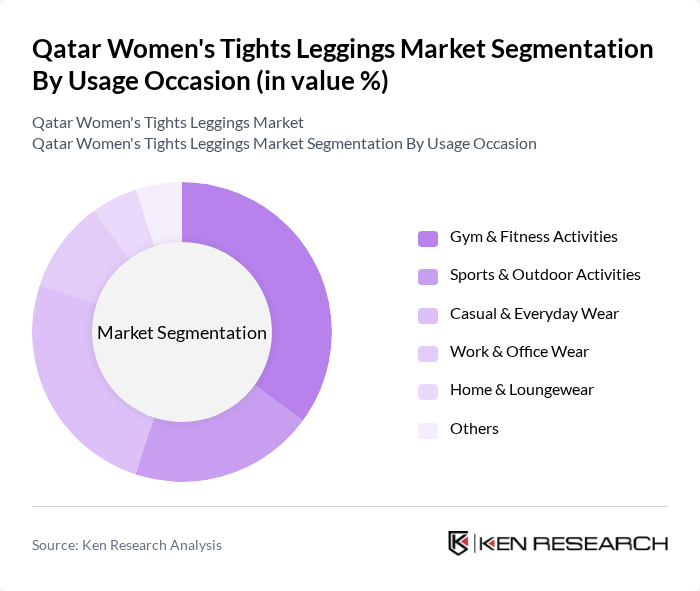

By Usage Occasion:The usage occasion segmentation encompasses Gym & Fitness Activities, Sports & Outdoor Activities, Casual & Everyday Wear, Work & Office Wear, Home & Loungewear, and Others. The Gym & Fitness Activities segment is leading the market, driven by the increasing number of women participating in fitness regimes and the growing popularity of fitness classes. This trend is further supported by the rise of health-conscious lifestyles, where leggings are not only functional but also fashionable, making them a staple in women's wardrobes.

The Qatar Women's Tights Leggings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, PUMA SE, Under Armour, Inc., Lululemon Athletica Inc., Oysho (Inditex Group), H&M Group (H & M Hennes & Mauritz AB), Marks and Spencer Group plc, Max Fashion (Landmark Group), Sun & Sand Sports (GMG Group), Sports Corner Co. W.L.L., Go Sport (Al Mana Group), Decathlon SE, Fabletics, Inc., Gymshark Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar women's tights leggings market appears promising, driven by the increasing integration of technology in fabric production and the growing trend of sustainability. As consumers become more environmentally conscious, brands that adopt eco-friendly practices are likely to gain a competitive edge. Additionally, the rise of social media influencers in fitness and fashion will continue to shape consumer preferences, creating opportunities for brands to engage with their target audience effectively and expand their market reach.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sports / Performance Leggings Athleisure Leggings Fashion / Casual Leggings Modest / Long-length Tights & Leggings Shapewear & Compression Leggings Maternity Leggings Others |

| By Usage Occasion | Gym & Fitness Activities Sports & Outdoor Activities Casual & Everyday Wear Work & Office Wear Home & Loungewear Others |

| By Distribution Channel | Online Retail & Marketplaces Brand-owned Stores & E-commerce Sports & Athleisure Specialty Stores Department Stores Supermarkets/Hypermarkets Others |

| By Fabric Type | Polyester & Polyester Blends Nylon & Polyamide Blends Cotton & Cotton-rich Blends Spandex / Elastane-rich Performance Fabrics Sustainable & Recycled Fabrics Others |

| By Price Range | Value / Budget Mass Mid-range Premium Luxury & Designer Others |

| By Age Group | Teens (13–19 Years) Young Adults (20–34 Years) Middle-aged Adults (35–54 Years) Seniors (55+ Years) Others |

| By Buyer Profile | Local Qatari Consumers Expatriate Residents Tourists & Short-term Visitors Corporate & Institutional Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Buyers, Merchandisers |

| Consumer Preferences Survey | 120 | Female Consumers aged 18-45 |

| Fitness Influencer Feedback | 30 | Fitness Trainers, Lifestyle Bloggers |

| Market Trend Analysis | 50 | Fashion Designers, Retail Analysts |

| Sales Data Verification | 75 | Retail Executives, Brand Managers |

The Qatar Women's Tights Leggings Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increased participation in fitness activities and the popularity of athleisure wear among women.