Region:Europe

Author(s):Geetanshi

Product Code:KRAA3262

Pages:90

Published On:September 2025

By Type:The furniture manufacturing market is segmented into residential furniture, office furniture, hospitality furniture, outdoor furniture, custom & contract furniture, modular furniture, luxury & designer furniture, mattresses & bedding, and others. Residential furniture remains the dominant segment, driven by a surge in home renovation activities, a dynamic real estate market, and consumer investment in high-quality, functional pieces for improved living spaces. The market also reflects a shift toward minimalistic and contemporary styles, with customized and modular solutions gaining traction among urban consumers .

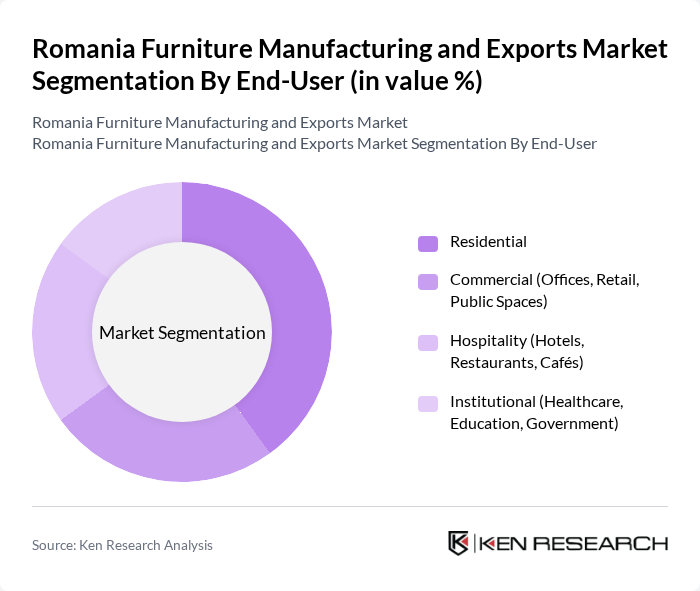

By End-User:The market is also segmented by end-user categories: residential, commercial (offices, retail, public spaces), hospitality (hotels, restaurants, cafés), and institutional (healthcare, education, government). The residential segment leads, supported by population growth, urbanization, and rising consumer prioritization of comfort and aesthetics. Commercial and hospitality segments are expanding due to increased investments in office spaces, hotels, and restaurants, while institutional demand is driven by modernization in healthcare and education infrastructure .

The Romania Furniture Manufacturing and Exports Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Romania, Mobexpert, Elvila, Lems, Casa Rusu, Simex, Sarmexin, Taparo, Aramis Invest, Magda Design, Antares Romania, Solenzara, Erisse, MobilaDalin, MobiLux contribute to innovation, geographic expansion, and service delivery in this space.

The future of Romania's furniture manufacturing and exports market appears promising, driven by increasing domestic consumption and expanding export opportunities. As consumer preferences shift towards sustainable and customizable products, manufacturers are likely to invest in eco-friendly materials and innovative designs. Additionally, the rise of e-commerce platforms is expected to enhance market accessibility, allowing local brands to reach broader audiences. Overall, the sector is poised for growth, adapting to changing market dynamics and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Hospitality Furniture Outdoor Furniture Custom & Contract Furniture Modular Furniture Luxury & Designer Furniture Mattresses & Bedding Others |

| By End-User | Residential Commercial (Offices, Retail, Public Spaces) Hospitality (Hotels, Restaurants, Cafés) Institutional (Healthcare, Education, Government) |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales (B2B/B2C) |

| By Material | Solid Wood Engineered Wood (MDF, Particleboard, Plywood) Metal Plastic & Synthetics Upholstered Bamboo & Alternative Materials |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Modern Traditional Contemporary Rustic Scandinavian Industrial |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Export-Oriented Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Manufacturers | 100 | Production Managers, Sales Directors |

| Commercial Furniture Exporters | 70 | Export Managers, Business Development Managers |

| Raw Material Suppliers | 50 | Supply Chain Managers, Procurement Officers |

| Retail Furniture Outlets | 80 | Store Managers, Marketing Directors |

| Industry Experts and Analysts | 40 | Market Analysts, Economic Advisors |

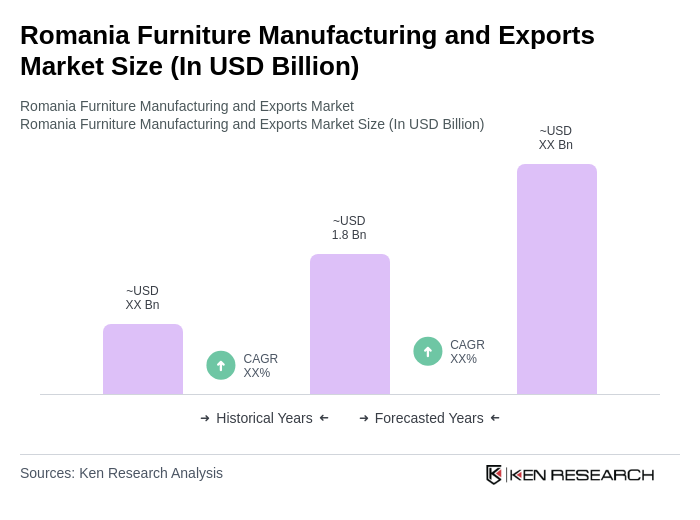

The Romania Furniture Manufacturing and Exports Market is valued at approximately USD 1.8 billion, reflecting a significant growth driven by rising consumer demand for modern furniture, increased disposable incomes, and a trend towards home improvement and interior design.