Region:Europe

Author(s):Dev

Product Code:KRAC0375

Pages:88

Published On:August 2025

By Type:The electric cars market can be segmented into four main types: Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Range-Extended Electric Vehicles (REEVs), and Hybrid Electric Vehicles (HEVs, non-plug-in). Among these, Battery Electric Vehicles (BEVs) are leading the market due to their zero-emission operation and the strong availability of imported Chinese BEV models that have recently dominated new EV sales in Russia; analysts and trade press note that BEVs account for the bulk of Russia’s EV registrations from brands such as Zeekr, BYD, and others . The growing consumer preference for fully electric vehicles, coupled with owner incentives (e.g., free parking and access to bus lanes in policies cited in national analyses), continues to reinforce BEV leadership .

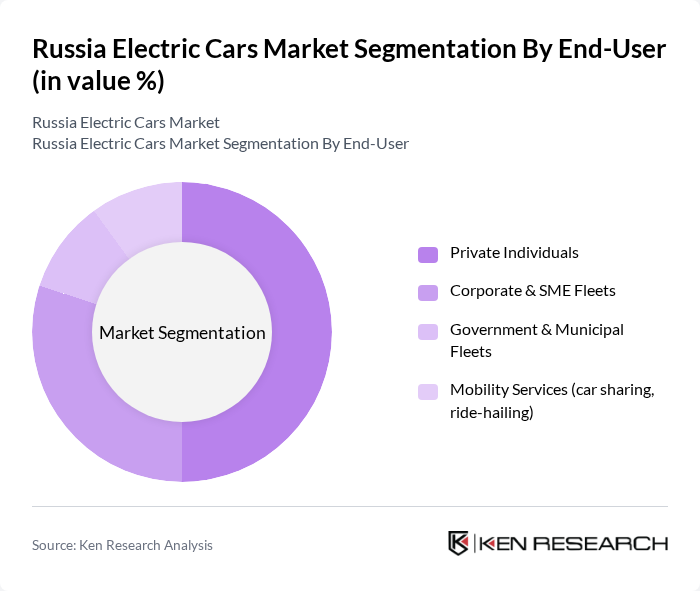

By End-User:The market can be categorized into four end-user segments: Private Individuals, Corporate & SME Fleets, Government & Municipal Fleets, and Mobility Services (car sharing, ride-hailing). Private Individuals represent the largest segment, driven by increasing consumer interest in sustainable transportation and the availability of various electric vehicle models. Corporate fleets are also expanding their electric vehicle adoption as companies aim to reduce their carbon footprint and operational costs, making them a significant contributor to market growth.

The Russia Electric Cars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Moskvich (JSC Moscow Automobile Plant Moskvich), KAMAZ PTC (incl. electric LCV projects), AvtoVAZ (LADA, EV concept programs), Evolute (Motorinvest), Haval (Great Wall Motor), BYD Auto, Geely Auto, Chery Automobile, Zeekr (Geely Holding), Tesla, Inc., Volkswagen Group (imported EVs legacy), Renault Group (legacy EV footprint), BMW Group, Mercedes?Benz Group AG, Xiaomi EV (SU7, parallel imports) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle market in Russia appears promising, driven by increasing environmental awareness and government support. In future, the number of electric vehicles on the road is expected to increase, supported by ongoing investments in charging infrastructure and local manufacturing initiatives. Additionally, the integration of renewable energy sources into the grid will enhance the sustainability of electric vehicles, making them more appealing to consumers. As technology continues to advance, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Range-Extended Electric Vehicles (REEVs) Hybrid Electric Vehicles (HEVs, non-plug-in) |

| By End-User | Private Individuals Corporate & SME Fleets Government & Municipal Fleets Mobility Services (car sharing, ride-hailing) |

| By Price Range | Entry/Budget (< US$25,000 equivalent) Mid-Range (US$25,000–US$45,000) Premium (> US$45,000) |

| By Distribution Mode | Authorized Dealerships Direct-to-Consumer (online/offline) Parallel/Independent Importers |

| By Charging Type | Home/Workplace AC (?22 kW) Public AC (?22 kW) DC Fast Charging (50–150 kW) High-Power DC (?150 kW) |

| By Vehicle Size | A/B-Segment (mini/compact) C/D-Segment (sedans/hatchbacks) SUVs & Crossovers Light Commercial Vehicles (LCV, M1/M2/N1) |

| By Application | Personal Mobility Commercial Operations (delivery, corporate) Public Sector & Utilities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Electric Vehicles | 120 | Car Owners, Potential EV Buyers |

| Industry Stakeholder Insights | 90 | Manufacturers, Suppliers, and Distributors |

| Government Policy Impact Assessment | 80 | Policy Makers, Regulatory Authorities |

| Charging Infrastructure Development | 70 | Infrastructure Developers, Utility Companies |

| Environmental Impact Perspectives | 60 | Environmental NGOs, Sustainability Experts |

The Russia Electric Cars Market is valued at approximately USD 1.6 billion, reflecting significant growth in new electric vehicle registrations, driven by policy incentives and an influx of Chinese EV brands.