Region:Europe

Author(s):Rebecca

Product Code:KRAB4182

Pages:96

Published On:October 2025

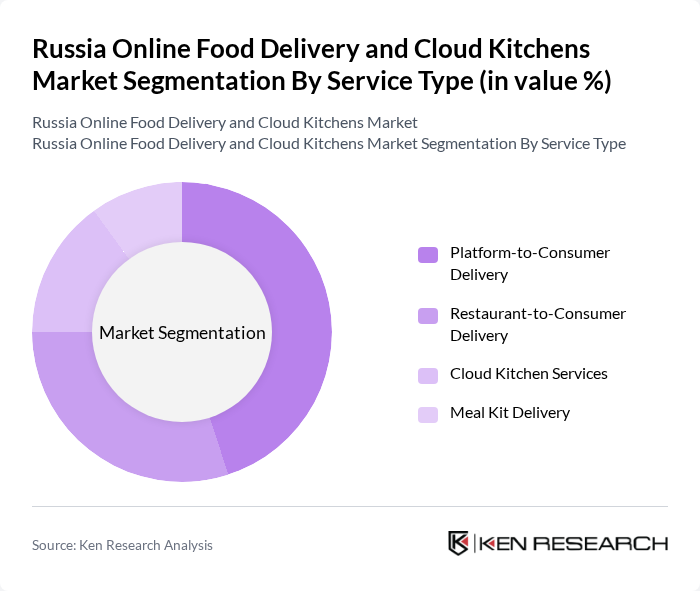

By Service Type:

The service type segmentation of the market includes Platform-to-Consumer Delivery, Restaurant-to-Consumer Delivery, Cloud Kitchen Services, and Meal Kit Delivery. Among these, Platform-to-Consumer Delivery is the leading subsegment, driven by the convenience it offers consumers who prefer ordering food through mobile applications. The increasing number of restaurants partnering with delivery platforms has also contributed to its dominance. Restaurant-to-Consumer Delivery follows closely, as traditional restaurants adapt to the growing demand for home delivery services. Cloud Kitchen Services are gaining traction due to lower operational costs and the ability to cater to multiple brands from a single location. Meal Kit Delivery, while popular, remains a niche segment compared to the others .

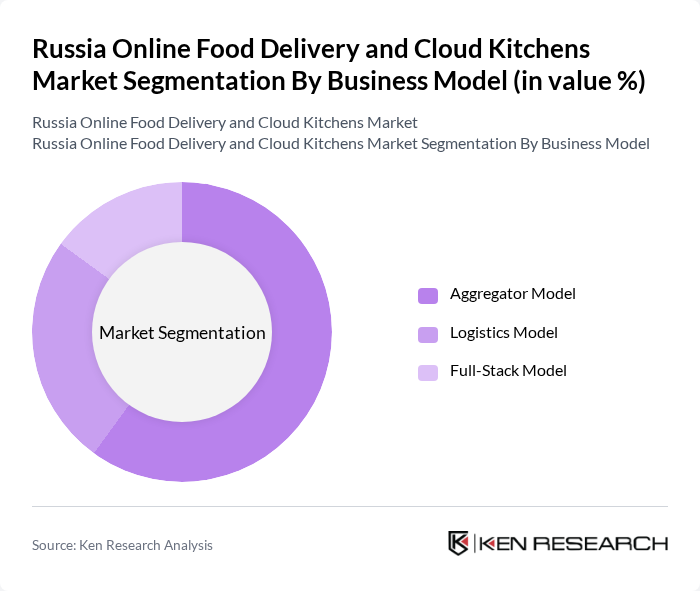

By Business Model:

The business model segmentation includes Aggregator Model, Logistics Model, and Full-Stack Model. The Aggregator Model is the most prominent, as it allows consumers to access a variety of restaurants through a single platform, enhancing convenience and choice. This model has been widely adopted by major players in the market, leading to its dominance. The Logistics Model, while essential for efficient delivery, is often integrated within aggregator platforms, making it less visible as a standalone model. The Full-Stack Model, which encompasses both food preparation and delivery, is emerging but still represents a smaller share of the market .

The Russia Online Food Delivery and Cloud Kitchens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yandex.Eda, Delivery Club, SberMarket, Ozon Eats, VkusVill, Dodo Pizza, Teremok, Samokat, Perekrestok, Magnit, X5 Retail Group, Lenta, Auchan Russia, Metro Cash & Carry, Globus contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online food delivery and cloud kitchens market in Russia appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for convenient meal solutions is expected to rise. Companies are likely to invest in AI and data analytics to enhance customer experiences and optimize delivery logistics. Furthermore, sustainability initiatives will play a crucial role in shaping consumer choices, as health-conscious and environmentally aware consumers increasingly seek responsible dining options.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Platform-to-Consumer Delivery Restaurant-to-Consumer Delivery Cloud Kitchen Services Meal Kit Delivery |

| By Business Model | Aggregator Model Logistics Model Full-Stack Model |

| By Order Value | Below 500 RUB 1000 RUB Above 1000 RUB |

| By Cuisine Type | Russian Cuisine Asian Cuisine European Cuisine Fast Food Pizza & Italian Others |

| By Payment Method | Digital Payments Cash on Delivery Card Payments |

| By City Tier | Tier 1 Cities (Moscow, St. Petersburg) Tier 2 Cities Tier 3 Cities |

| By Customer Demographics | Age 18-25 Age 26-35 Age 36-45 Above 45 |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Food Delivery | 120 | Regular Users, Occasional Users, Non-Users |

| Cloud Kitchen Operations Insights | 60 | Cloud Kitchen Owners, Operations Managers |

| Delivery Service Efficiency | 50 | Logistics Coordinators, Delivery Managers |

| Market Trends and Innovations | 40 | Industry Analysts, Food Technologists |

| Impact of COVID-19 on Food Delivery | 45 | Consumers, Restaurant Owners, Delivery Personnel |

The Russia Online Food Delivery and Cloud Kitchens Market is valued at approximately USD 8.7 billion, reflecting significant growth driven by digital platform adoption and changing consumer preferences for convenience and variety in meal options.