Region:Europe

Author(s):Shubham

Product Code:KRAA1804

Pages:81

Published On:August 2025

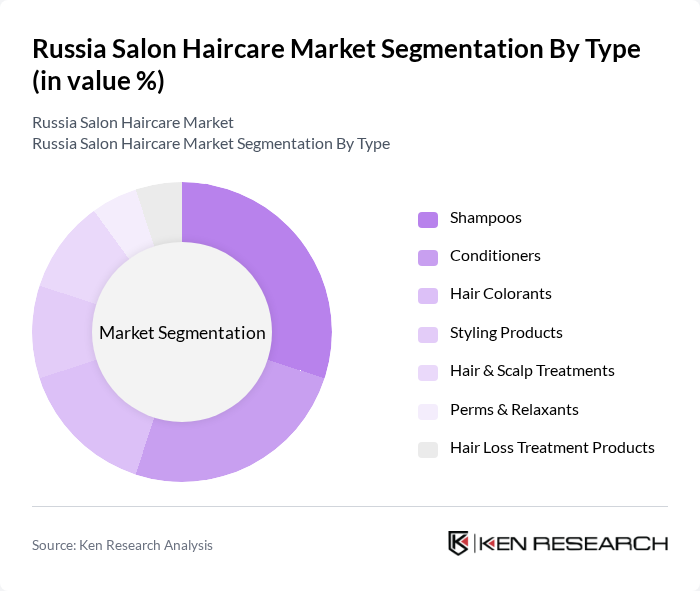

By Type:The market is segmented into various types of haircare products, including shampoos, conditioners, hair colorants, styling products, hair & scalp treatments, perms & relaxants, and hair loss treatment products. Each of these subsegments caters to specific consumer needs and preferences, with shampoos and conditioners being the most widely used products due to their essential role in daily hair care routines.

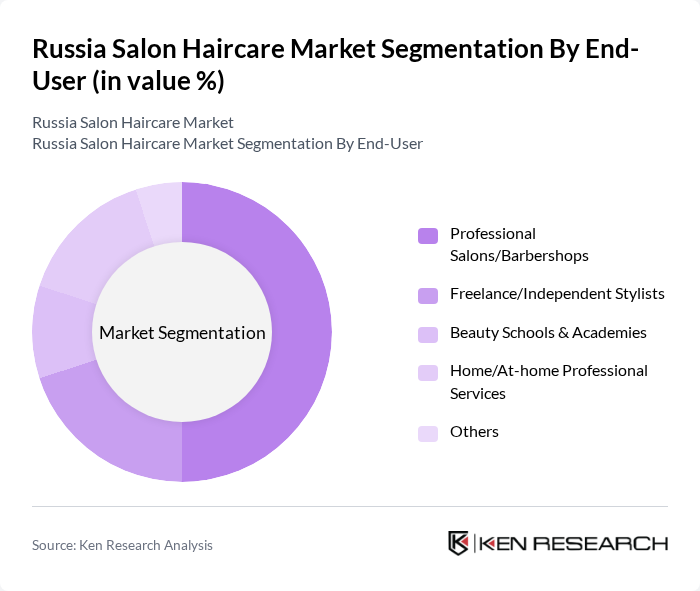

By End-User:The end-user segmentation includes professional salons/barbershops, freelance/independent stylists, beauty schools & academies, home/at-home professional services, and others. Professional salons and barbershops dominate the market, driven by the increasing number of consumers seeking professional hair services and treatments, which enhances the demand for high-quality salon products.

The Russia Salon Haircare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Estel Professional (??? «???????????», Russia), Kapous Professional (Russia), Ollin Professional (Russia), Londa Professional (Wella Company), Wella Professionals (Wella Company), Schwarzkopf Professional (Henkel), L'Oréal Professionnel (L'Oréal Groupe), Matrix (L'Oréal Groupe), Redken (L'Oréal Groupe), Kérastase (L'Oréal Groupe), Davines (Italy), Keune Haircosmetics (Netherlands), Paul Mitchell (John Paul Mitchell Systems), CHI / Farouk Systems, Natura Siberica Professional (Russia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia salon haircare market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek personalized and sustainable products, brands that adapt to these trends are likely to thrive. Additionally, the integration of digital platforms for marketing and sales will enhance brand visibility and accessibility. The focus on scalp health and wellness is expected to gain momentum, leading to innovative product developments that cater to these emerging consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Shampoos Conditioners Hair Colorants Styling Products Hair & Scalp Treatments Perms & Relaxants Hair Loss Treatment Products |

| By End-User | Professional Salons/Barbershops Freelance/Independent Stylists Beauty Schools & Academies Home/At-home Professional Services Others |

| By Distribution Channel | Professional Salon Distributors Specialty Beauty Stores Pharmacies/Drug Stores Supermarkets/Hypermarkets Online Retail/E-commerce |

| By Price Range | Premium/Professional Mid-range Economy/Mass Value Packs/Refills |

| By Brand Type | International Professional Brands Domestic/Russian Professional Brands Private Labels Indie/Emerging Brands |

| By Product Formulation | Natural/Plant-based Organic/Certified Synthetic/Conventional Clean/Free-from |

| By Application | Coloring & Bleaching Styling & Finishing Care & Repair (Shampoo/Condition/Treat) Straightening/Texture Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Salon Owners and Managers | 120 | Salon Owners, Salon Managers |

| Haircare Product Distributors | 90 | Distribution Managers, Sales Representatives |

| Consumer Focus Groups | 60 | Regular Salon Visitors, Haircare Product Users |

| Market Analysts and Experts | 40 | Industry Analysts, Market Researchers |

| Retail Sector Insights | 70 | Retail Managers, Beauty Product Buyers |

The Russia Salon Haircare Market is valued at approximately USD 2 billion, reflecting a significant growth trend driven by increased consumer spending on personal grooming and a rising demand for premium haircare products.