Region:Europe

Author(s):Dev

Product Code:KRAA0407

Pages:94

Published On:August 2025

By Type:The market is segmented into various types of services that address diverse logistical needs. The subsegments include Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution, Supplier Management Outsourcing Services, Purchasing Management Outsourcing Services, Order Processing Outsourcing Services, Freight Forwarding, and Others. Among these, Domestic Transportation Management is currently the leading subsegment, driven by the high volume of goods transported within the country and the growth of the retail and manufacturing sectors .

By End-User:The end-user segmentation includes Consumer and Retail, Automotive and Manufacturing, Energy and Chemicals, Life Sciences and Healthcare, Food Processing Industry, Electronics and Semiconductors, and Others. The Consumer and Retail sector is the dominant segment, propelled by the rapid growth of e-commerce and the increasing demand for efficient logistics solutions to meet evolving consumer expectations .

The Russia Supply Chain Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DPD Russia, CDEK, RZD Logistics, SberLogistics, Russian Post, Kuehne + Nagel Russia, DB Schenker Russia, FM Logistic Russia, PEK (First Expeditionary Company), Major Express, Itella Russia, A1 Logistics, Delovye Linii, Ozon Logistics, Wildberries Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia supply chain outsourcing market appears promising, driven by the ongoing digital transformation and the increasing need for agile logistics solutions. As businesses adapt to changing consumer behaviors and market dynamics, the integration of advanced technologies will play a crucial role in enhancing supply chain efficiency. Moreover, the focus on sustainability and green logistics practices is expected to shape the industry's evolution, encouraging companies to adopt eco-friendly solutions while optimizing their operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Management International Transportation Management Value-added Warehousing and Distribution Supplier Management Outsourcing Services Purchasing Management Outsourcing Services Order Processing Outsourcing Services Freight Forwarding Others |

| By End-User | Consumer and Retail Automotive and Manufacturing Energy and Chemicals Life Sciences and Healthcare Food Processing Industry Electronics and Semiconductors Others |

| By Industry Vertical | E-commerce Healthcare Construction Aerospace Chemicals Textiles Others |

| By Service Model | On-Demand Services Contract Logistics Managed Services Integrated Services Others |

| By Geographic Coverage | Domestic Market International Market Regional Distribution Urban vs Rural Others |

| By Technology Utilization | IoT in Supply Chain AI and Machine Learning Robotics Process Automation Cloud Computing Others |

| By Customer Segment | Small Enterprises Medium Enterprises Large Enterprises Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Outsourcing | 100 | Supply Chain Managers, Operations Directors |

| Retail Logistics and Distribution | 60 | Logistics Coordinators, Retail Operations Managers |

| E-commerce Fulfillment Services | 50 | eCommerce Operations Managers, Warehouse Supervisors |

| Third-party Logistics Providers | 40 | Business Development Managers, Account Executives |

| Public Sector Supply Chain Management | 45 | Government Procurement Officers, Policy Analysts |

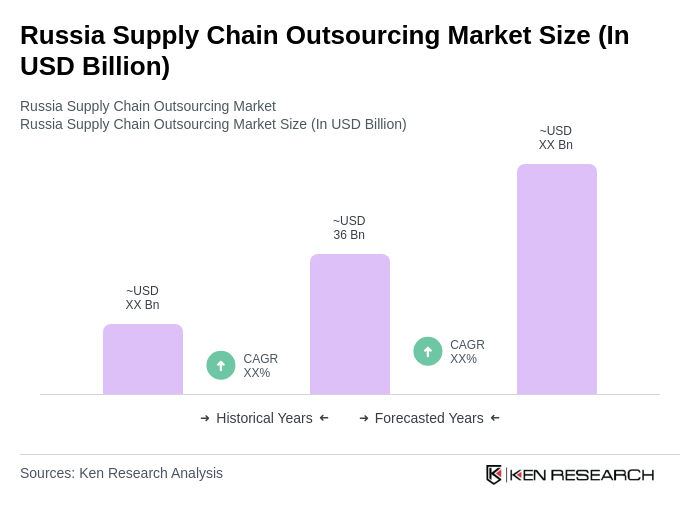

The Russia Supply Chain Outsourcing Market is valued at approximately USD 36 billion, reflecting a five-year historical analysis. This growth is driven by the demand for efficient logistics solutions and the expansion of e-commerce.