Region:Middle East

Author(s):Shubham

Product Code:KRAD3528

Pages:84

Published On:November 2025

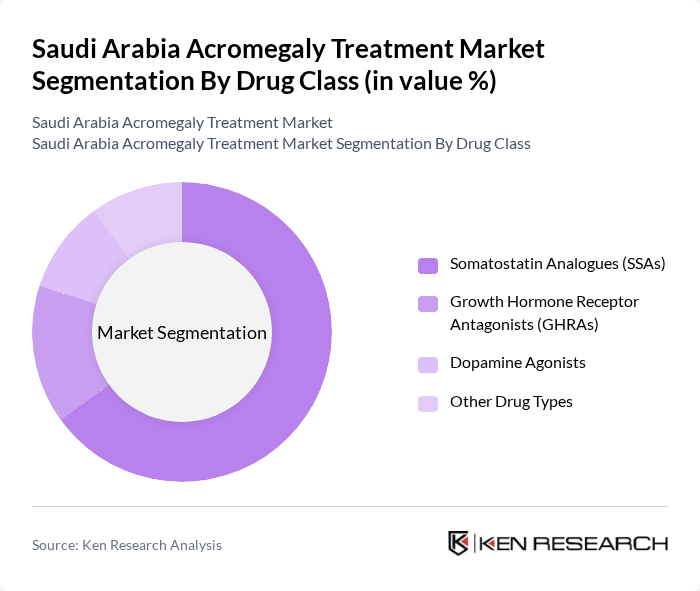

By Drug Class:The drug class segmentation includes Somatostatin Analogues (SSAs), Growth Hormone Receptor Antagonists (GHRAs), Dopamine Agonists, and Other Drug Types. Among these, Somatostatin Analogues (SSAs) are the leading subsegment due to their effectiveness in controlling growth hormone levels and their widespread acceptance among healthcare providers. The increasing adoption of these therapies is driven by their proven efficacy, long-acting formulations, and favorable safety profiles, making them the preferred choice for treating acromegaly .

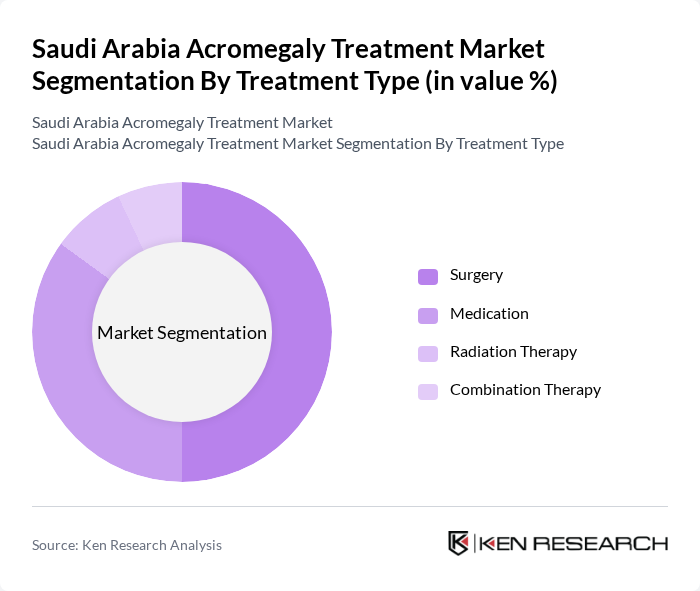

By Treatment Type:The treatment type segmentation encompasses Surgery, Medication, Radiation Therapy, and Combination Therapy. Surgery remains the dominant treatment type, as it is often the first-line approach for patients with acromegaly, particularly for those with pituitary tumors. The effectiveness of transsphenoidal surgical intervention in achieving biochemical remission and the availability of specialized neurosurgical centers in major Saudi cities drive its preference among healthcare providers, leading to a significant share in the treatment landscape .

The Saudi Arabia Acromegaly Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, Ipsen S.A., Pfizer Inc., Sun Pharmaceutical Industries Ltd., Wockhardt Ltd., Dauntless Pharmaceuticals, Ionis Pharmaceuticals Inc., Sandoz International GmbH, Teva Pharmaceutical Industries Ltd., Sanofi S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acromegaly treatment market in Saudi Arabia appears promising, driven by ongoing advancements in medical technology and increased healthcare investments. The government’s commitment to enhancing healthcare infrastructure is expected to facilitate better access to specialized care. Additionally, the integration of telemedicine and digital health solutions will likely improve patient engagement and monitoring, fostering a more patient-centric approach to acromegaly management in future.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Somatostatin Analogues (SSAs) Growth Hormone Receptor Antagonists (GHRAs) Dopamine Agonists Other Drug Types |

| By Treatment Type | Surgery Medication Radiation Therapy Combination Therapy |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Clinics |

| By Treatment Setting | Inpatient Outpatient Home Care Telemedicine |

| By Healthcare Provider Type | Endocrinologists General Practitioners Neurosurgeons Specialty Endocrinology Centers |

| By Region | Central Region (Riyadh) Eastern Region (Dammam) Western Region (Jeddah) Southern Region (Abha) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologist Insights | 45 | Endocrinologists, Medical Directors |

| Patient Experience Surveys | 80 | Acromegaly Patients, Caregivers |

| Healthcare Administrator Feedback | 40 | Hospital Administrators, Health Policy Makers |

| Pharmaceutical Sales Data | 40 | Sales Representatives, Market Analysts |

| Clinical Research Insights | 40 | Clinical Researchers, Medical Researchers |

The Saudi Arabia Acromegaly Treatment Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of acromegaly and advancements in treatment options.