Region:Middle East

Author(s):Rebecca

Product Code:KRAD6296

Pages:100

Published On:December 2025

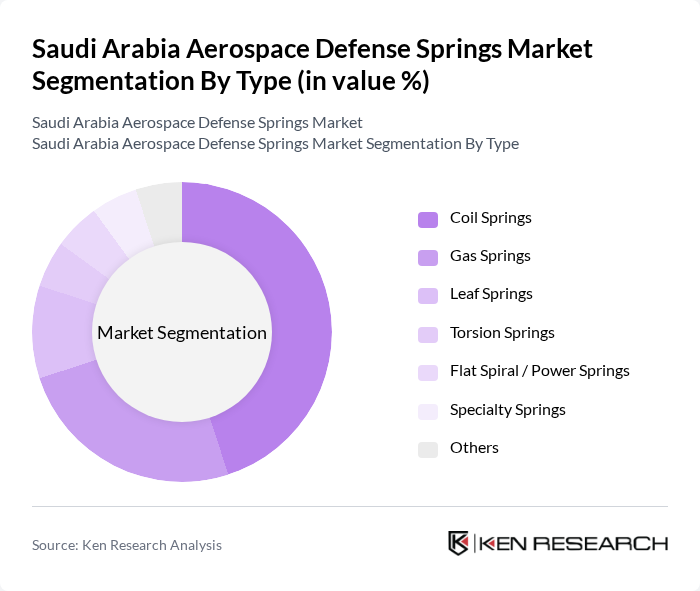

By Type:

The market is segmented into various types of springs, including Coil Springs, Gas Springs, Leaf Springs, Torsion Springs, Flat Spiral / Power Springs, Specialty Springs, and Others. Among these, Coil Springs are the most dominant due to their widespread application in various aerospace systems, including landing gear and actuation mechanisms. The versatility and reliability of Coil Springs make them a preferred choice for manufacturers, driving their significant market share. Gas Springs are also gaining traction, particularly in commercial aircraft applications, due to their lightweight and efficient performance.

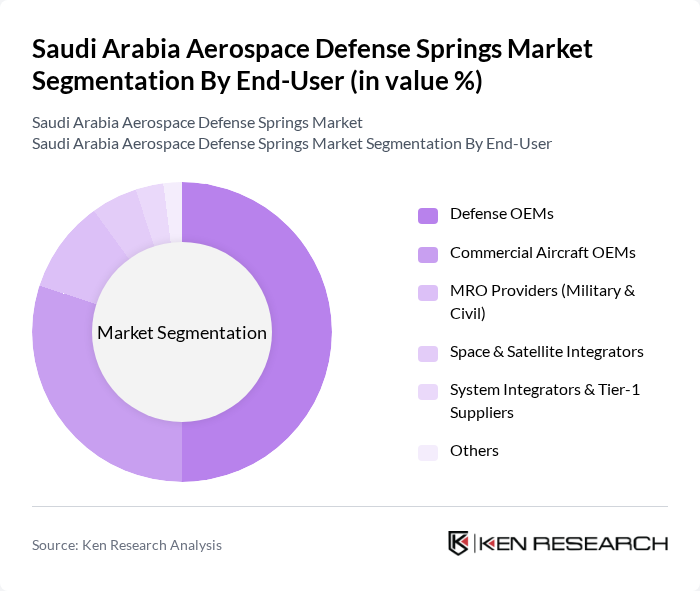

By End-User:

This market is segmented by end-users, including Defense OEMs, Commercial Aircraft OEMs, MRO Providers (Military & Civil), Space & Satellite Integrators, System Integrators & Tier-1 Suppliers, and Others. Defense OEMs hold a significant share due to the increasing demand for military aircraft and defense systems. The growth in military spending and the modernization of defense capabilities are key factors driving the demand from this segment. Additionally, the commercial aircraft sector is expanding, leading to increased requirements for aerospace components, including springs.

The Saudi Arabia Aerospace Defense Springs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Military Industries (SAMI), SAMI Aerospace Systems, Advanced Electronics Company (AEC), National Company for Mechanical Systems (NCMS), Middle East Specialized Cables Co. (MESC) – Precision Components Division, Al Salam Aerospace Industries, Boeing Saudi Arabia, Lockheed Martin Saudi Arabia, Raytheon Saudi Arabia (Raytheon Saudi Arabia LLC), BAE Systems Saudi Arabia, Airbus Saudi Arabia, Leonardo Saudi Arabia, Thales Saudi Arabia, NHK Spring Co., Ltd., Lesjöfors AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia aerospace defense springs market appears promising, driven by increasing defense budgets and a focus on local manufacturing, aligned with the objective to localize half of overall defense spending in future. The government aims to enhance its defense capabilities significantly in future, fostering innovation and technological advancements. Additionally, the rise of private sector participation in defense projects, supported by the General Authority for Military Industries and Saudi Arabian Military Industries initiatives, is expected to create new opportunities for local manufacturers, leading to a more robust and self-sufficient aerospace industry that can meet both domestic and international demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Coil Springs Gas Springs Leaf Springs Torsion Springs Flat Spiral / Power Springs Specialty Springs Others |

| By End-User | Defense OEMs Commercial Aircraft OEMs MRO Providers (Military & Civil) Space & Satellite Integrators System Integrators & Tier-1 Suppliers Others |

| By Application | Flight Control & Actuation Systems Landing Gear & Braking Systems Engine & Powerplant Systems Missiles, Guided Weapons & Defense Systems Seating & Cabin Interior Systems Ground Support & Auxiliary Equipment Others |

| By Material | Stainless Steel Alloys Nickel-based Superalloys Titanium Alloys Composite & Advanced Materials Others |

| By Manufacturing Process | Cold Coiling Hot Coiling CNC & Precision Machining Additive Manufacturing Others |

| By Distribution Channel | Direct Sales to OEMs Direct Sales to MROs Distributors & Stockists Online & E-procurement Platforms Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing | 90 | Production Managers, Quality Assurance Leads |

| Defense Electronics | 70 | R&D Engineers, Product Development Managers |

| Military Procurement | 100 | Procurement Officers, Contract Managers |

| Missile Systems Development | 60 | Project Managers, Systems Engineers |

| Defense Policy Analysis | 50 | Policy Analysts, Defense Strategists |

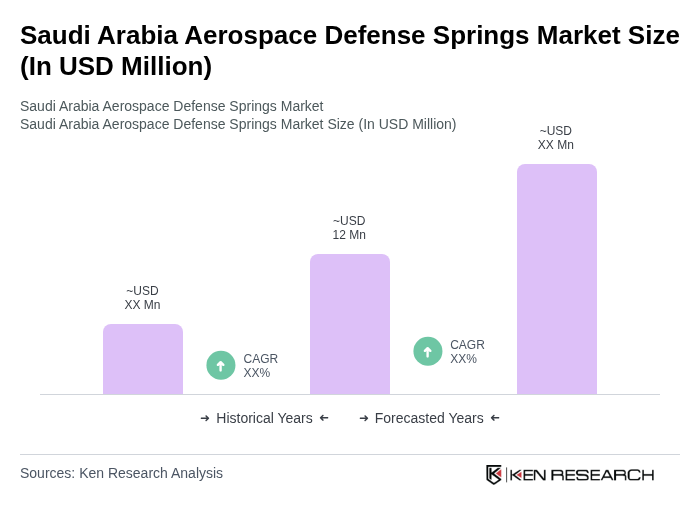

The Saudi Arabia Aerospace Defense Springs Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by increased defense spending and the modernization of military capabilities within the aerospace sector.