Region:Middle East

Author(s):Rebecca

Product Code:KRAB3526

Pages:99

Published On:October 2025

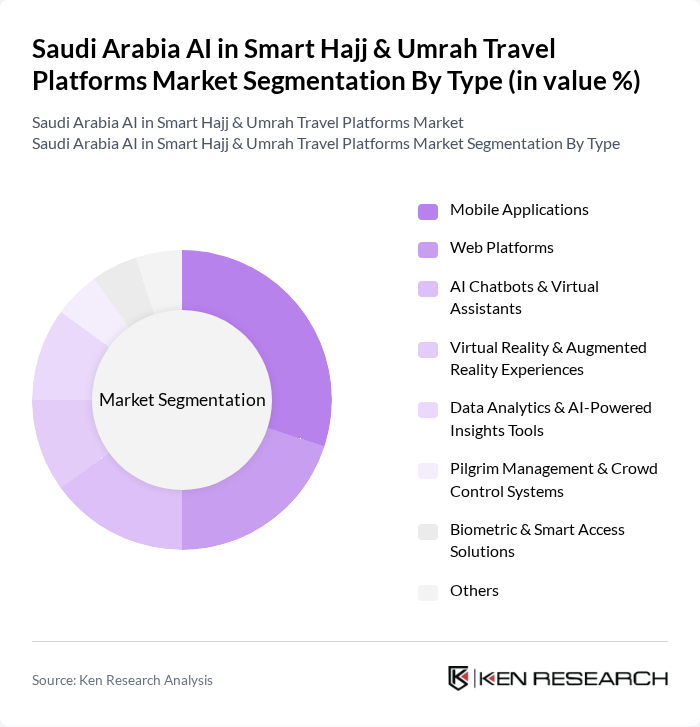

By Type:The market is segmented into various types, including mobile applications, web platforms, AI chatbots and virtual assistants, virtual reality and augmented reality experiences, data analytics and AI-powered insights tools, pilgrim management and crowd control systems, biometric and smart access solutions, and others. Among these,mobile applications and AI chatbotsare gaining significant traction due to their convenience, multilingual support, and user-friendly interfaces, catering to the needs of tech-savvy pilgrims. The adoption of AI-powered crowd management, biometric access, and real-time analytics is also accelerating as authorities prioritize safety and operational efficiency .

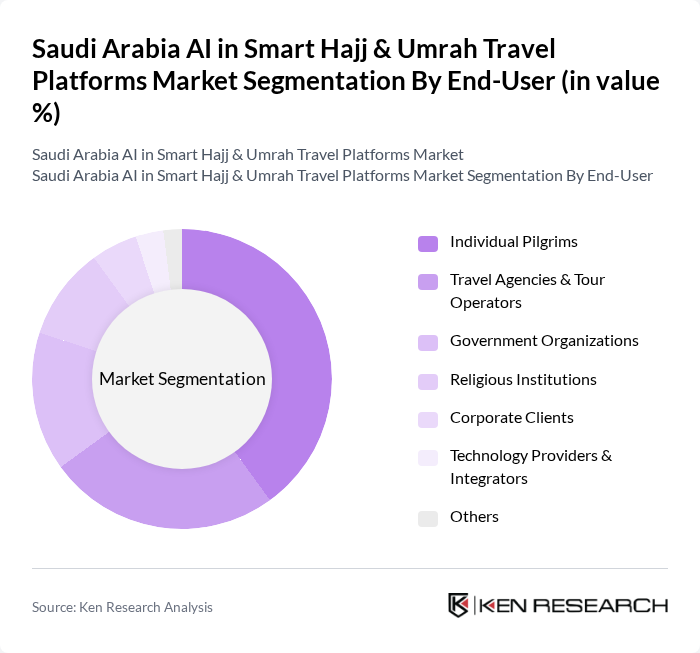

By End-User:The end-user segmentation includes individual pilgrims, travel agencies and tour operators, government organizations (e.g., Ministry of Hajj and Umrah, Saudi Data and AI Authority), religious institutions, corporate clients, technology providers and integrators, and others.Individual pilgrims and travel agenciesare the primary users, as they seek efficient, personalized, and digitally enabled services to enhance their pilgrimage experience. Government organizations and technology providers play a pivotal role in deploying and maintaining these platforms, while religious institutions and corporate clients increasingly leverage digital tools for group management and compliance .

The Saudi Arabia AI in Smart Hajj & Umrah Travel Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nusuk (Ministry of Hajj and Umrah Digital Platform), Wosol (????) Smart Hajj & Umrah Platform, Baseer (Saudi Data and AI Authority & Ministry of Interior), Digital Mutawwif (General Authority for the Care of the Grand Mosque and the Prophet’s Mosque), Smart Enrichment Assistant (Agency for Religious Affairs at the Prophet’s Mosque), Manarah 2 (Multilingual Robot Guidance Platform), Makkah Route Initiative (Saudi Ministry of Interior), Zamzam.com (Online Hajj & Umrah Booking Platform), Mawasim (Seera Group’s Hajj & Umrah Division), Flynas (Pilgrim-focused Digital Airline Services), AlMosafer (Online Travel Agency, Seera Group), Al Rajhi Takaful (Digital Hajj & Umrah Insurance Solutions), Careem (Pilgrim Mobility & Smart Transport Solutions), Saudi Arabian Airlines (Saudia) – Digital Pilgrim Services, Tawakkalna (Saudi Data and AI Authority – Pilgrim Health & Safety App) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia AI in Smart Hajj and Umrah travel platforms market appears promising, driven by ongoing digital transformation and government support. As the number of international pilgrims is expected to rise, the demand for innovative travel solutions will increase. Enhanced AI capabilities will likely lead to more personalized experiences, while partnerships with local agencies can further expand service offerings. The focus on sustainability will also shape future developments, aligning with global trends in responsible tourism.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Applications Web Platforms AI Chatbots & Virtual Assistants Virtual Reality & Augmented Reality Experiences Data Analytics & AI-Powered Insights Tools Pilgrim Management & Crowd Control Systems Biometric & Smart Access Solutions Others |

| By End-User | Individual Pilgrims Travel Agencies & Tour Operators Government Organizations (e.g., Ministry of Hajj and Umrah, Saudi Data and AI Authority) Religious Institutions Corporate Clients Technology Providers & Integrators Others |

| By Service Type | Accommodation Booking & Management Transportation & Mobility Services Guided Tours & Digital Mutawwif Services Visa & Regulatory Services (e.g., eVisa Platforms) Health & Safety Monitoring Solutions Others |

| By Payment Method | Credit/Debit Cards Mobile Wallets Bank Transfers Cash Payments Others |

| By Customer Segment | Domestic Pilgrims International Pilgrims Group Travelers Solo Travelers Elderly & Special Needs Pilgrims Others |

| By Marketing Channel | Online Marketing Offline Marketing Social Media Advertising Influencer Partnerships Others |

| By Region | Makkah Madinah Jeddah Riyadh Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI-Driven Travel Platforms | 100 | Product Managers, Technology Officers |

| Hajj & Umrah Service Providers | 80 | Operations Managers, Business Development Executives |

| Pilgrim Experience Feedback | 120 | Recent Pilgrims, Travel Coordinators |

| Travel Agency Insights | 70 | Agency Owners, Marketing Directors |

| Technology Adoption in Travel | 90 | IT Managers, Digital Transformation Leads |

The Saudi Arabia AI in Smart Hajj & Umrah travel platforms market is valued at approximately USD 1.1 billion, reflecting significant growth driven by digital technology adoption and government initiatives aimed at enhancing pilgrimage experiences.