Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8176

Pages:83

Published On:November 2025

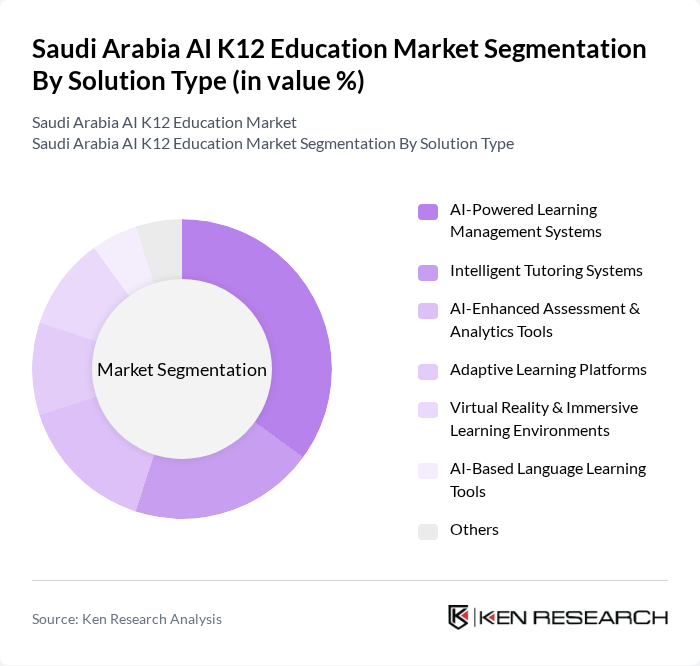

By Solution Type:The solution type segmentation includes various AI-driven educational tools that enhance learning experiences. The subsegments are AI-Powered Learning Management Systems, Intelligent Tutoring Systems, AI-Enhanced Assessment & Analytics Tools, Adaptive Learning Platforms, Virtual Reality & Immersive Learning Environments, AI-Based Language Learning Tools, and Others. Among these,AI-Powered Learning Management Systemsare leading the market due to their ability to streamline educational processes and provide personalized learning experiences .

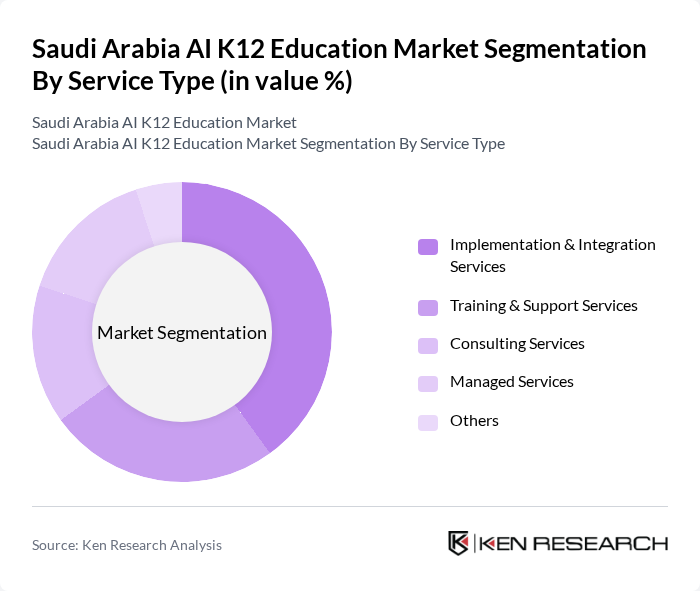

By Service Type:The service type segmentation encompasses various support services that facilitate the implementation and use of AI in education. This includes Implementation & Integration Services, Training & Support Services, Consulting Services, Managed Services, and Others. Among these,Implementation & Integration Servicesare the most significant, as educational institutions increasingly seek expert assistance to effectively integrate AI technologies into their existing systems .

The Saudi Arabia AI K12 Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as iSchool, Noon Academy, Classera, Alef Education, Edraak, Rwaq, Madrasati (Ministry of Education Platform), Mawhiba (King Abdulaziz & His Companions Foundation for Giftedness & Creativity), Al-Falak Electronic Equipment & Supplies Co., Smart Learning, Maktabati, Future Generation Schools, Dar Al-Fikr Schools, Al-Hekma International School, Knowledge International School, Al-Faisal International Academy, Al-Bayan International School, Al-Jazeera Academy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia AI K12 education market appears promising, driven by ongoing government initiatives and increasing adoption of technology in classrooms. In future, it is anticipated that over 70% of schools will implement AI-driven solutions, enhancing personalized learning experiences. Additionally, the collaboration between educational institutions and tech companies is expected to foster innovation, leading to the development of more effective educational tools. This evolving landscape will likely create a more dynamic and responsive educational environment for students across the nation.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | AI-Powered Learning Management Systems Intelligent Tutoring Systems AI-Enhanced Assessment & Analytics Tools Adaptive Learning Platforms Virtual Reality & Immersive Learning Environments AI-Based Language Learning Tools Others |

| By Service Type | Implementation & Integration Services Training & Support Services Consulting Services Managed Services Others |

| By End-User | Public Schools Private Schools Online Learning Platforms International Schools Educational NGOs Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Machine Learning Applications Natural Language Processing Tools Computer Vision Solutions Data Analytics Platforms Robotics in Education Others |

| By Application | Classroom Learning Enhancements Administrative Automation Student Performance Tracking Curriculum Development Personalized Learning Pathways Others |

| By Investment Source | Government Funding Private Investments International Grants Public-Private Partnerships Others |

| By Policy Support | Educational Grants Tax Incentives for EdTech Subsidies for AI Tools Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public School Administrators | 100 | Principals, Education Directors |

| Private School Educators | 80 | Teachers, Curriculum Coordinators |

| EdTech Solution Providers | 60 | Product Managers, Sales Executives |

| Parents of K12 Students | 90 | Parents, Guardians |

| Students in K12 Schools | 70 | High School Students, Middle School Students |

The Saudi Arabia AI K12 Education Market is valued at approximately USD 3.3 million, reflecting a significant growth driven by the adoption of digital learning tools and government initiatives aimed at enhancing educational quality.