Region:Middle East

Author(s):Rebecca

Product Code:KRAB8142

Pages:86

Published On:October 2025

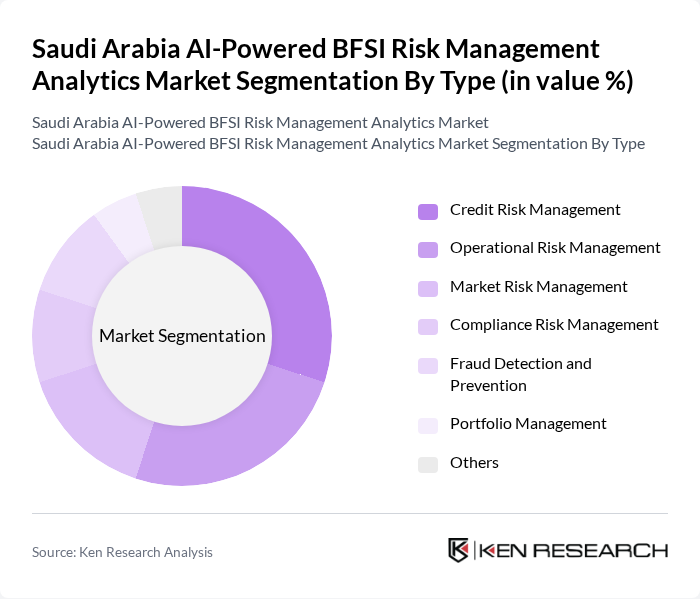

By Type:The market is segmented into various types, including Credit Risk Management, Operational Risk Management, Market Risk Management, Compliance Risk Management, Fraud Detection and Prevention, Portfolio Management, and Others. Each of these segments plays a crucial role in addressing specific risk management needs within the BFSI sector.

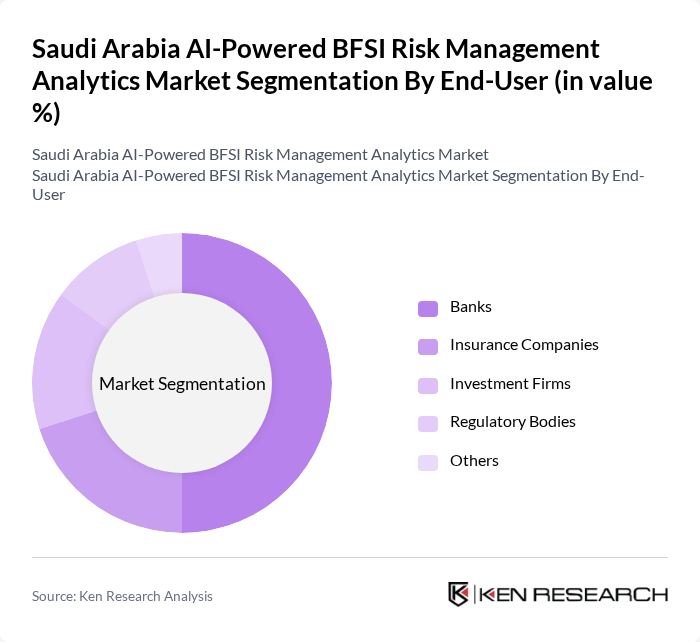

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Regulatory Bodies, and Others. Each segment reflects the diverse applications of AI-powered risk management analytics across different financial sectors.

The Saudi Arabia AI-Powered BFSI Risk Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAS Institute Inc., Oracle Corporation, FICO, SAP SE, RiskMetrics Group, Moody's Analytics, Axioma, Inc., Palantir Technologies, Accenture, Deloitte, PwC, KPMG, EY, TCS (Tata Consultancy Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI-powered BFSI risk management analytics market in Saudi Arabia appears promising, driven by technological advancements and increasing digitalization. As organizations continue to embrace AI and machine learning, the focus will shift towards enhancing predictive analytics capabilities and real-time data processing. Furthermore, the rise of automated compliance solutions will streamline regulatory adherence, allowing financial institutions to allocate resources more efficiently. This evolving landscape will foster innovation and create a competitive edge for early adopters in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Credit Risk Management Operational Risk Management Market Risk Management Compliance Risk Management Fraud Detection and Prevention Portfolio Management Others |

| By End-User | Banks Insurance Companies Investment Firms Regulatory Bodies Others |

| By Application | Risk Assessment Risk Mitigation Compliance Monitoring Reporting and Analytics Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Risk Management | 150 | Risk Managers, Compliance Officers |

| Insurance Sector Analytics | 100 | Data Analysts, Underwriting Managers |

| Investment Firms AI Integration | 80 | Portfolio Managers, Financial Analysts |

| Fintech Innovations in Risk Assessment | 70 | Product Managers, Technology Officers |

| Regulatory Compliance in BFSI | 90 | Legal Advisors, Regulatory Affairs Specialists |

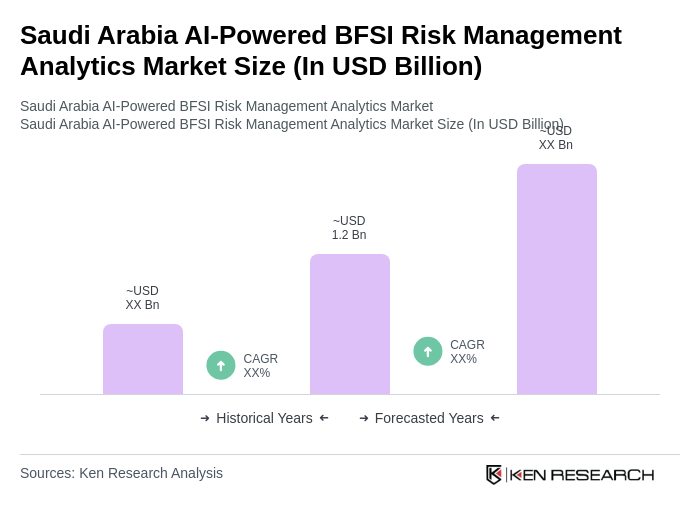

The Saudi Arabia AI-Powered BFSI Risk Management Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in banking, financial services, and insurance sectors.