Region:Middle East

Author(s):Rebecca

Product Code:KRAB7980

Pages:94

Published On:October 2025

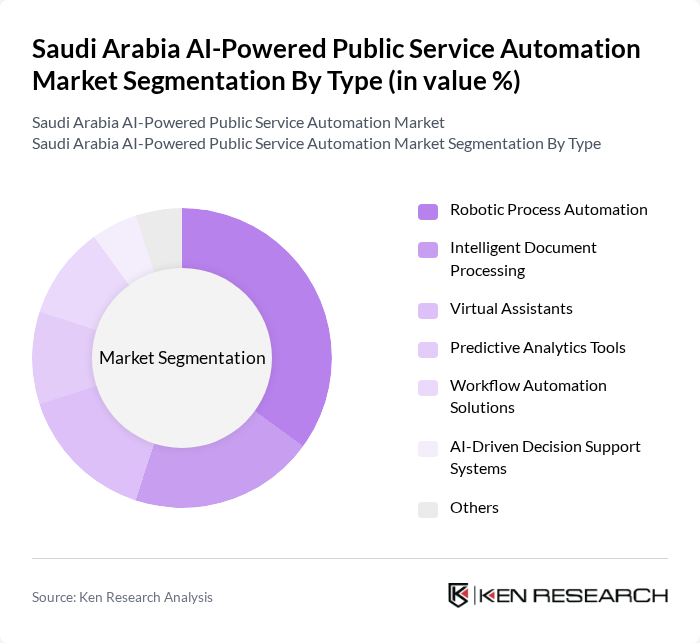

By Type:The market is segmented into various types, including Robotic Process Automation, Intelligent Document Processing, Virtual Assistants, Predictive Analytics Tools, Workflow Automation Solutions, AI-Driven Decision Support Systems, and Others. Among these, Robotic Process Automation (RPA) is leading due to its ability to streamline repetitive tasks, significantly reducing operational costs and improving service delivery efficiency. The increasing demand for automation in government processes is driving the growth of RPA, making it a preferred choice for many public sector organizations.

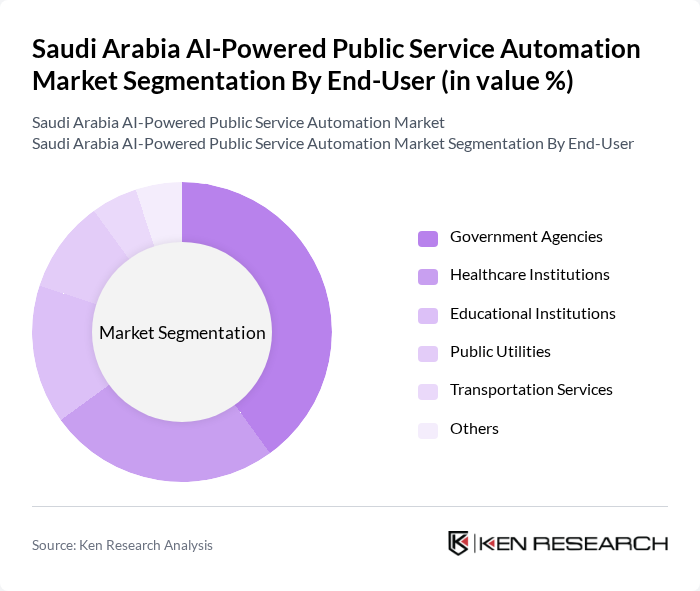

By End-User:The end-user segmentation includes Government Agencies, Healthcare Institutions, Educational Institutions, Public Utilities, Transportation Services, and Others. Government Agencies are the dominant end-users, driven by the need for enhanced efficiency and transparency in public service delivery. The increasing pressure to improve citizen services and reduce operational costs has led to a significant investment in AI-powered solutions by government entities, making them the largest segment in this market.

The Saudi Arabia AI-Powered Public Service Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, IBM Corporation, Microsoft Corporation, Oracle Corporation, Accenture PLC, Infosys Limited, Deloitte Touche Tohmatsu Limited, Cisco Systems, Inc., ServiceNow, Inc., UiPath Inc., Automation Anywhere, Inc., Blue Prism Group PLC, Pega Systems Inc., WorkFusion, Inc., Kofax Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia AI-powered public service automation market appears promising, driven by ongoing government initiatives and technological advancements. As the nation progresses towards its Vision 2030 goals, the integration of AI in public services is expected to enhance operational efficiency and citizen engagement. Furthermore, the collaboration between public and private sectors will likely foster innovation, leading to the development of more sophisticated AI applications tailored to meet the evolving needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotic Process Automation Intelligent Document Processing Virtual Assistants Predictive Analytics Tools Workflow Automation Solutions AI-Driven Decision Support Systems Others |

| By End-User | Government Agencies Healthcare Institutions Educational Institutions Public Utilities Transportation Services Others |

| By Application | Citizen Services Administrative Processes Compliance and Regulatory Services Emergency Response Services Public Safety and Security Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) |

| By Integration Type | API Integration Custom Integration Third-Party Integration |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Implementation | 100 | Healthcare Administrators, IT Directors |

| Education Sector Automation | 80 | School Principals, Educational Technology Coordinators |

| Smart City Initiatives | 90 | Urban Planners, Government Policy Makers |

| Public Safety AI Solutions | 70 | Law Enforcement Officials, Emergency Response Managers |

| Citizen Engagement Platforms | 85 | Public Relations Officers, Community Engagement Specialists |

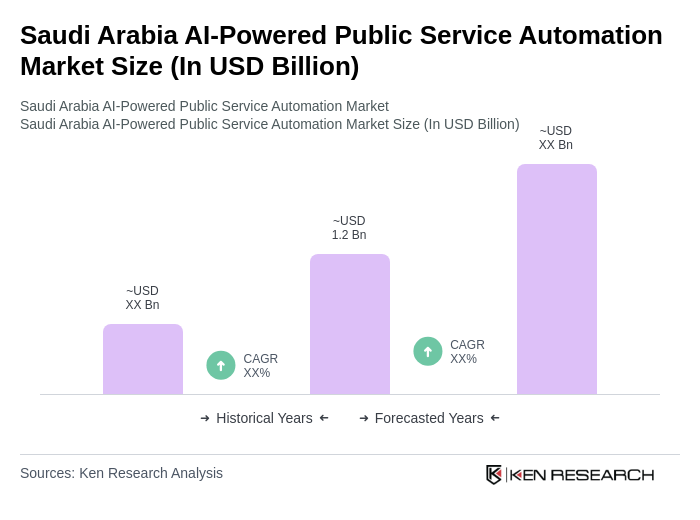

The Saudi Arabia AI-Powered Public Service Automation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in public services aimed at enhancing operational efficiency and citizen engagement.