Region:Middle East

Author(s):Dev

Product Code:KRAD0408

Pages:84

Published On:August 2025

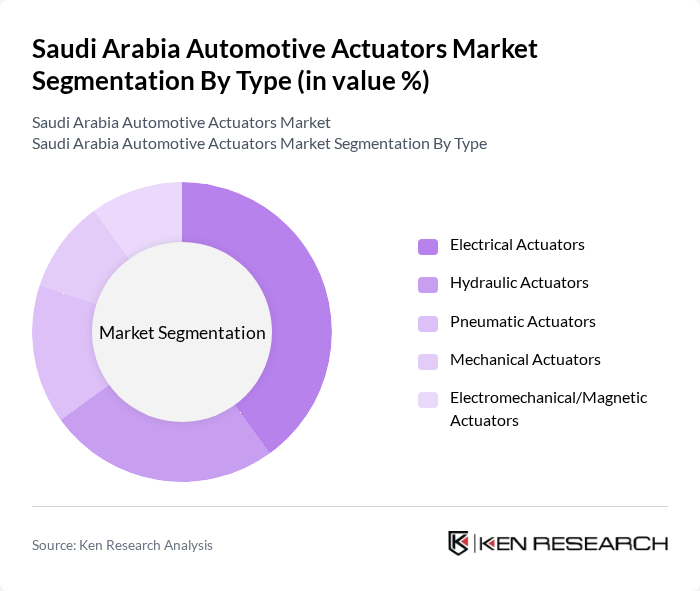

By Type:The market is segmented into various types of actuators, including Electrical Actuators, Hydraulic Actuators, Pneumatic Actuators, Mechanical Actuators, and Electromechanical/Magnetic Actuators. Among these, Electrical Actuators are gaining significant traction due to their efficiency and compatibility with modern vehicle systems; industry analyses consistently indicate electric/electromechanical actuators as the leading and fastest-growing categories because of precise control, energy efficiency, and integration with electronic control units. The increasing adoption of electric vehicles and the growth of ADAS and comfort features are further propelling demand for Electrical Actuators, making them the leading subsegment in this category.

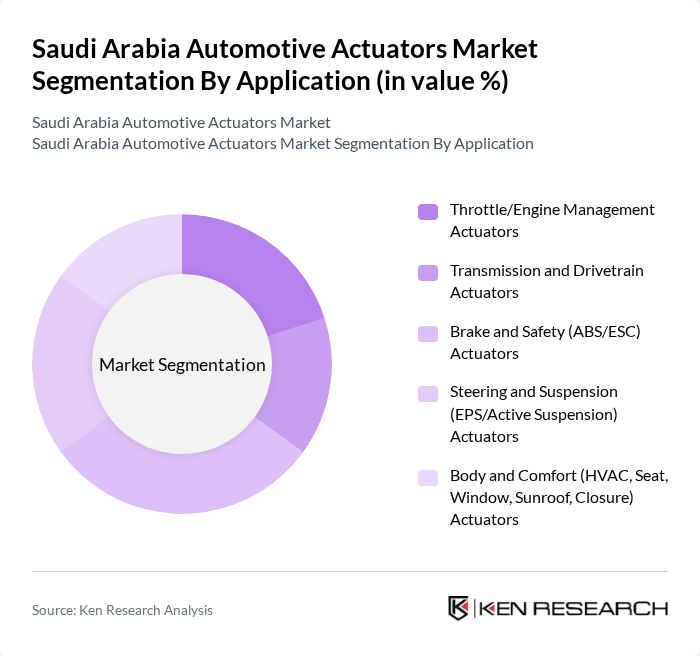

By Application:The applications of automotive actuators include Throttle/Engine Management Actuators, Transmission and Drivetrain Actuators, Brake and Safety (ABS/ESC) Actuators, Steering and Suspension (EPS/Active Suspension) Actuators, and Body and Comfort (HVAC, Seat, Window, Sunroof, Closure) Actuators. The Brake and Safety Actuators are particularly prominent due to the increasing emphasis on vehicle safety technologies and regulatory alignment with international safety standards, which promotes fitment of ABS/ESC and related systems.

The Saudi Arabia Automotive Actuators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, DENSO Corporation, ZF Friedrichshafen AG, Valeo SE, Aisin Corporation, Hitachi Astemo, Ltd., Johnson Electric Holdings Limited, Mitsubishi Electric Corporation, Nidec Corporation, Magna International Inc., Schaeffler AG, BorgWarner Inc., HELLA GmbH & Co. KGaA (FORVIA), Parker Hannifin Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive actuators market in Saudi Arabia appears promising, driven by increasing investments in electric vehicle infrastructure and technological advancements. As the government continues to support the transition to electric vehicles, the demand for innovative actuators is expected to rise. Additionally, collaborations between automotive manufacturers and technology firms will likely foster innovation, enhancing product offerings and market competitiveness, ultimately leading to a more robust automotive sector in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrical Actuators Hydraulic Actuators Pneumatic Actuators Mechanical Actuators Electromechanical/Magnetic Actuators |

| By Application | Throttle/Engine Management Actuators Transmission and Drivetrain Actuators Brake and Safety (ABS/ESC) Actuators Steering and Suspension (EPS/Active Suspension) Actuators Body and Comfort (HVAC, Seat, Window, Sunroof, Closure) Actuators |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric and Hybrid Vehicles |

| By Sales Channel | OEM Aftermarket |

| By Component | Motors and Gear Trains Sensors and Position Feedback Controllers/ECUs Housings, Connectors, and Linkages Seals and Bearings |

| By Price Range | Economy Mid Premium |

| By Technology | Conventional (Hydraulic/Pneumatic) Electric (12V/48V) Smart/Networked (LIN/CAN-enabled) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Actuator Manufacturers | 100 | Product Development Engineers, R&D Managers |

| Commercial Vehicle Actuator Suppliers | 80 | Supply Chain Managers, Procurement Specialists |

| Automotive Component Distributors | 70 | Sales Managers, Distribution Coordinators |

| Automotive Assembly Plants | 90 | Operations Managers, Quality Assurance Leads |

| Automotive Technology Innovators | 60 | Technology Officers, Innovation Managers |

The Saudi Arabia Automotive Actuators Market is valued at approximately USD 260 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for advanced automotive technologies and government initiatives under Vision 2030.