Region:Middle East

Author(s):Rebecca

Product Code:KRAD6311

Pages:83

Published On:December 2025

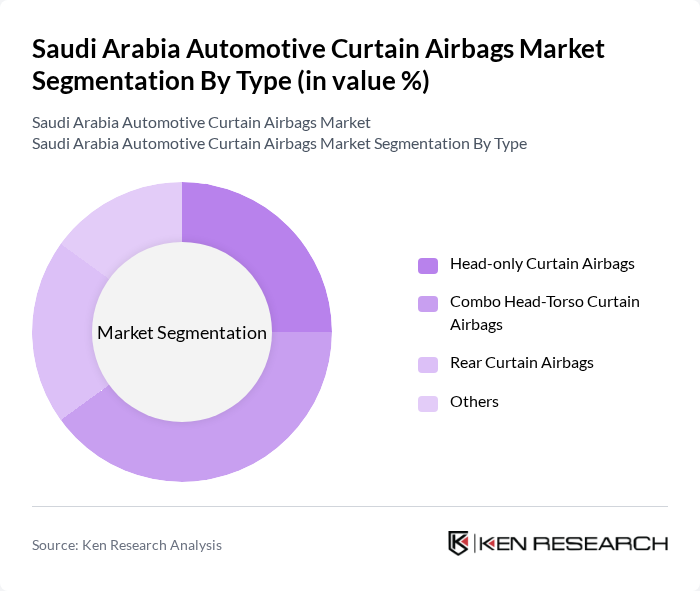

By Type:The market is segmented into various types of curtain airbags, including Head-only Curtain Airbags, Combo Head-Torso Curtain Airbags, Rear Curtain Airbags, and Others. Among these, the Combo Head-Torso Curtain Airbags segment is currently leading the market due to its comprehensive protection capabilities, which are increasingly favored by consumers and manufacturers alike. The growing emphasis on passenger safety and the integration of advanced safety features in vehicles are driving the demand for this sub-segment.

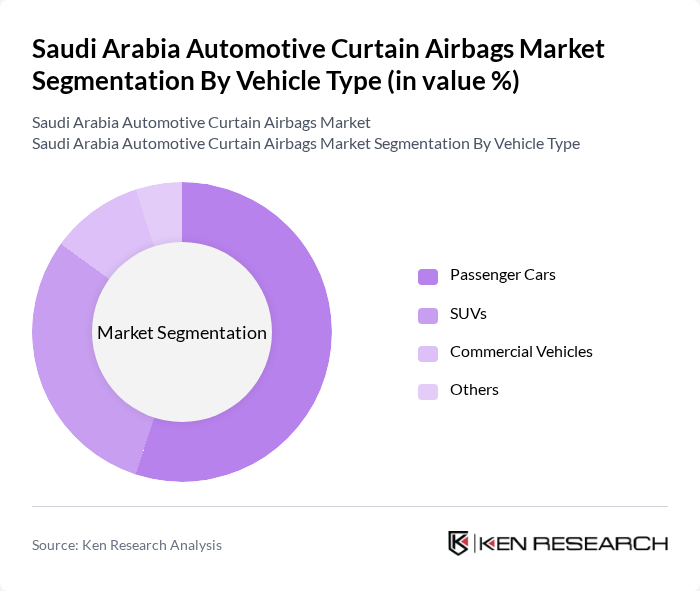

By Vehicle Type:The market is categorized into Passenger Cars, SUVs, Commercial Vehicles, and Others. The Passenger Cars segment holds the largest share, driven by the increasing demand for personal vehicles and the growing trend of urbanization. Consumers are increasingly opting for vehicles equipped with advanced safety features, including curtain airbags, which enhances the overall safety profile of passenger cars.

The Saudi Arabia Automotive Curtain Airbags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autoliv Inc., ZF Friedrichshafen AG, Joyson Safety Systems, Hyundai Mobis, Continental AG, Toyoda Gosei Co., Ltd., Denso Corporation, Aisin Corporation, Bosch Group, Yanfeng Automotive Interiors, Magna International Inc., Daicel Corporation, Kolon Industries, Inc., Ashimori Industry Co., Ltd., Key Safety Systems (KSS) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive curtain airbags market in Saudi Arabia appears promising, driven by ongoing advancements in safety technologies and increasing regulatory pressures. As manufacturers innovate and integrate smart technologies into airbag systems, consumer demand for enhanced safety features is expected to rise. Additionally, the growing trend towards electric and hybrid vehicles will likely create new opportunities for curtain airbags, as these vehicles often come equipped with advanced safety systems, further propelling market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Head-only Curtain Airbags Combo Head-Torso Curtain Airbags Rear Curtain Airbags Others |

| By Vehicle Type | Passenger Cars SUVs Commercial Vehicles Others |

| By Distribution Channel | OEMs Aftermarket Franchised Dealerships Others |

| By Material Type | Nylon Polyester Others |

| By Technology | Pyrotechnic Inflators Hybrid Inflators Others |

| By End-User Segment | Individual Consumers Fleet Operators Government Agencies Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 45 | Product Development Managers, Safety Compliance Officers |

| Component Suppliers | 40 | Sales Managers, Technical Engineers |

| Regulatory Bodies | 35 | Policy Makers, Safety Inspectors |

| Automotive Safety Experts | 40 | Consultants, Research Analysts |

| Consumer Insights | 50 | Car Owners, Automotive Enthusiasts |

The Saudi Arabia Automotive Curtain Airbags Market is valued at approximately USD 45 million, driven by increasing vehicle production, consumer safety awareness, and stringent government regulations aimed at enhancing road safety.