Region:Middle East

Author(s):Geetanshi

Product Code:KRAB9109

Pages:97

Published On:October 2025

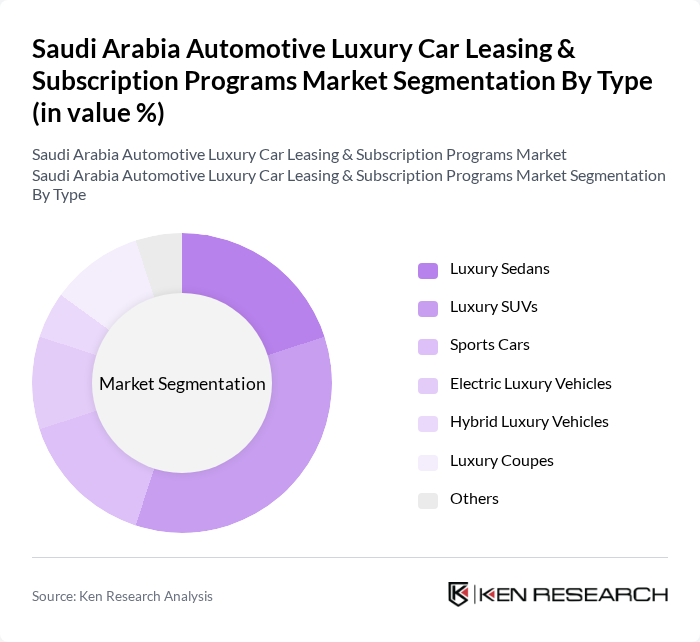

By Type:The market is segmented into various types of luxury vehicles, including Luxury Sedans, Luxury SUVs, Sports Cars, Electric Luxury Vehicles, Hybrid Luxury Vehicles, Luxury Coupes, and Others. Among these, Luxury SUVs are currently dominating the market due to their popularity among affluent consumers who prefer spacious and versatile vehicles. The trend towards family-oriented luxury vehicles, combined with the growing interest in off-road capabilities, has led to a significant increase in demand for this segment.

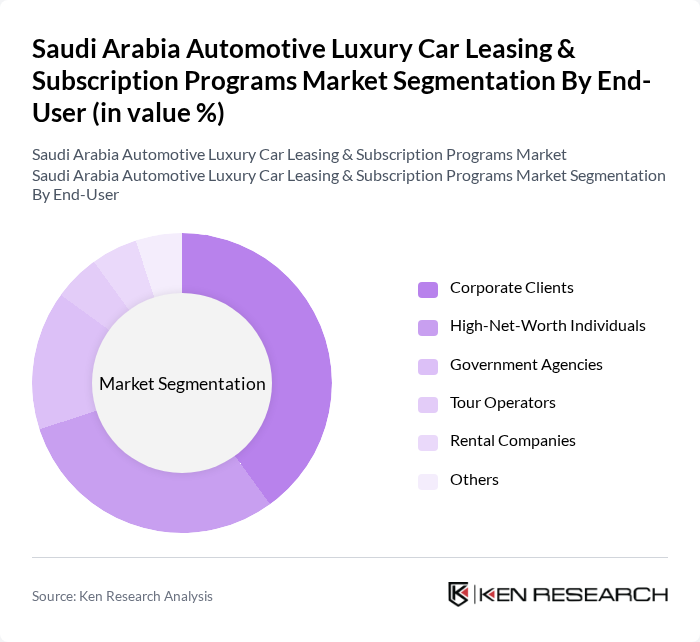

By End-User:The end-user segmentation includes Corporate Clients, High-Net-Worth Individuals, Government Agencies, Tour Operators, Rental Companies, and Others. Corporate Clients are the leading segment, driven by the need for premium vehicles for business travel and client engagements. The increasing trend of companies offering luxury car leasing as part of employee benefits further solidifies this segment's dominance in the market.

The Saudi Arabia Automotive Luxury Car Leasing & Subscription Programs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Abdul Latif Jameel Automotive, Al Habtoor Group, Al-Muhaidib Group, Al-Jazira Vehicles, United Motors Company, Al-Mansour Automotive, Al-Tayyar Group, Al-Muhaidib Group, Al-Faisaliah Group, Al-Suwaidi Group, Al-Mahmal Group, Al-Muhaidib Group, Al-Mansour Group, Al-Jazira Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive luxury car leasing and subscription market in Saudi Arabia appears promising, driven by increasing consumer interest in flexible ownership models and the expansion of urban infrastructure. As digital platforms continue to evolve, they will enhance customer engagement and streamline leasing processes. Additionally, the growing emphasis on sustainability will likely lead to a rise in electric and hybrid luxury vehicles, further shaping consumer preferences and market dynamics in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Sedans Luxury SUVs Sports Cars Electric Luxury Vehicles Hybrid Luxury Vehicles Luxury Coupes Others |

| By End-User | Corporate Clients High-Net-Worth Individuals Government Agencies Tour Operators Rental Companies Others |

| By Duration of Lease | Short-Term Leasing Long-Term Leasing Subscription Services Others |

| By Payment Model | Fixed Monthly Payments Pay-As-You-Go Flexible Payment Plans Others |

| By Distribution Channel | Direct Leasing Companies Online Platforms Dealerships Brokers Others |

| By Customer Segment | Individual Consumers Corporate Clients Government Entities Others |

| By Geographic Coverage | Major Cities Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Car Leasing Providers | 100 | CEOs, Business Development Managers |

| Subscription Service Operators | 80 | Product Managers, Marketing Directors |

| Potential Luxury Car Customers | 150 | Affluent Individuals, Corporate Executives |

| Automotive Industry Experts | 60 | Consultants, Analysts |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Saudi Arabia Automotive Luxury Car Leasing & Subscription Programs Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing demand for luxury vehicles and a shift towards flexible ownership models among affluent consumers.