Region:Middle East

Author(s):Rebecca

Product Code:KRAC4690

Pages:97

Published On:October 2025

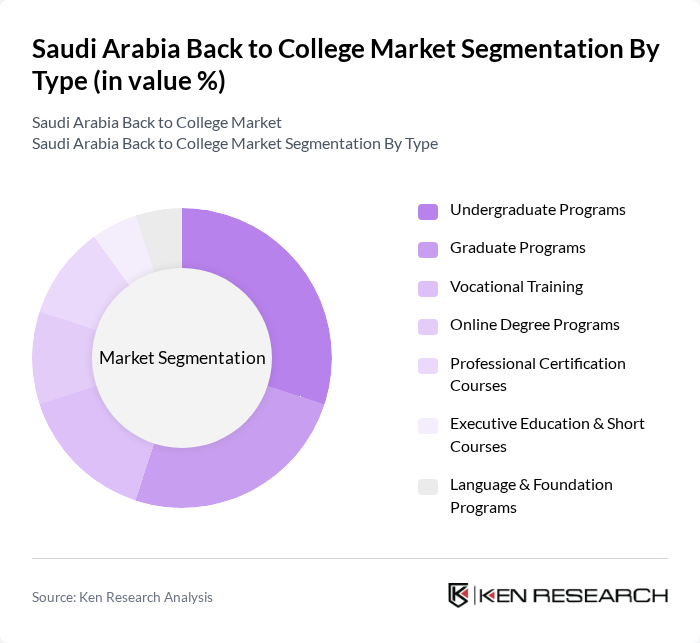

By Type:The market is segmented into diverse educational offerings, including Undergraduate Programs, Graduate Programs, Vocational Training, Online Degree Programs, Professional Certification Courses, Executive Education & Short Courses, and Language & Foundation Programs. Undergraduate and graduate programs remain the largest segments, reflecting strong demand for academic credentials among Saudi youth and professionals. Vocational training and professional certification courses are experiencing accelerated growth due to industry partnerships and government initiatives aimed at workforce development. Online degree programs and executive education are expanding rapidly, driven by digital transformation and flexible learning preferences .

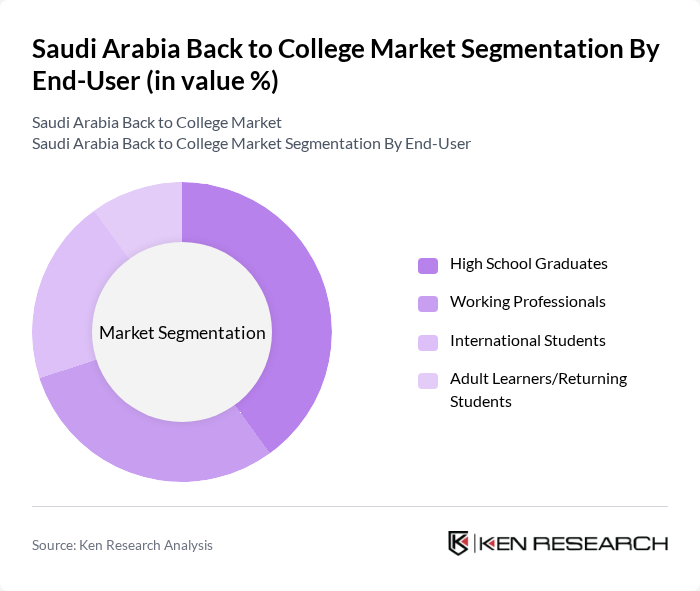

By End-User:The end-user segmentation includes High School Graduates, Working Professionals, International Students, and Adult Learners/Returning Students. High school graduates represent the largest share, driven by the demographic youth bulge and increasing transition rates to higher education. Working professionals and adult learners are increasingly pursuing upskilling and reskilling opportunities, while international students are attracted by Saudi Arabia’s expanding academic offerings and scholarship programs .

The Saudi Arabia Back to College Market is characterized by a dynamic mix of regional and international players. Leading participants such as King Saud University, King Abdulaziz University, Prince Sultan University, Alfaisal University, University of Jeddah, Imam Abdulrahman Bin Faisal University, Dar Al-Hekma University, Effat University, Al Yamamah University, Imam Mohammad Ibn Saud Islamic University, AlMaarefa University, Jouf University, Taif University, Najran University, Qassim University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia back to college market appears promising, driven by ongoing government investments and a growing emphasis on educational quality. As the demand for skilled professionals continues to rise, institutions are likely to adapt by enhancing their curricula and adopting innovative teaching methods. Furthermore, the integration of technology in education will play a pivotal role in shaping learning experiences, making education more accessible and tailored to individual needs, thus fostering a more skilled workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Undergraduate Programs Graduate Programs Vocational Training Online Degree Programs Professional Certification Courses Executive Education & Short Courses Language & Foundation Programs |

| By End-User | High School Graduates Working Professionals International Students Adult Learners/Returning Students |

| By Application | Academic Advancement Skill Development & Upskilling Career Change/Professional Certification |

| By Sales Channel | Direct Institutional Enrollment Online Education Platforms Education Agents & Consultants |

| By Distribution Mode | On-Campus (In-Person) Learning Online/Distance Learning Blended/Hybrid Learning |

| By Price Range | Budget Programs Mid-Tier Programs Premium Programs |

| By Policy Support | Government Scholarships & Subsidies Tax Incentives for Education Providers Student Loan & Grant Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Undergraduate Student Enrollment | 120 | Current Students, Prospective Students |

| Graduate Program Interest | 60 | Working Professionals, Recent Graduates |

| Parental Support Dynamics | 50 | Parents of College Students, Guardians |

| Financial Aid Awareness | 40 | Students Seeking Financial Assistance, Financial Aid Officers |

| Online Learning Preferences | 45 | Students Interested in Online Courses, Educational Technology Users |

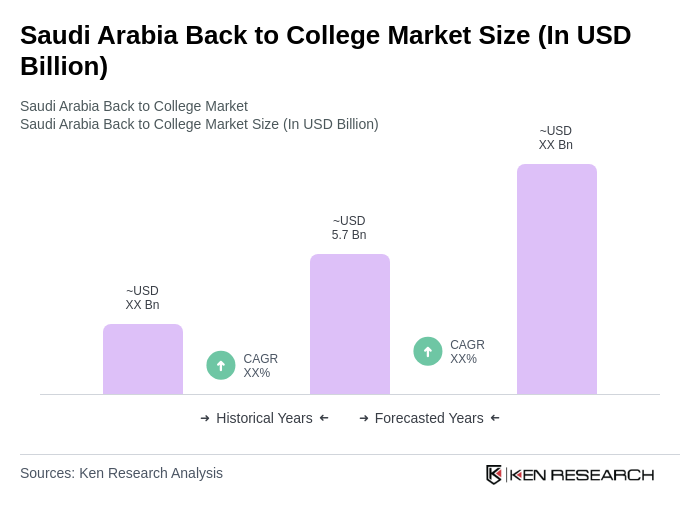

The Saudi Arabia Back to College Market is valued at approximately USD 5.7 billion, reflecting significant growth driven by increased enrollment rates, government investments in education, and a focus on vocational training and digital learning initiatives.