Saudi Arabia Beauty And Personal Care Market Overview

- The Saudi Arabia Beauty and Personal Care Market is valued at USD 4.6 billion, based on a five-year historical analysis. Growth is primarily driven by increasing consumer spending on personal grooming, rising awareness of skincare, and the influence of social media on beauty trends. The market has seen a surge in demand for both premium and mass-market products, reflecting a diverse consumer base with varying preferences. The popularity of natural, organic, and halal-certified products is also increasing, as is the impact of digital platforms and e-commerce on purchasing behavior .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their large populations and urbanization. Riyadh, as the capital, serves as a hub for international brands and retail outlets, while Jeddah's coastal location attracts a younger demographic interested in beauty and personal care products. The affluent population in these cities further drives the demand for high-quality beauty products. Expansion of retail infrastructure and the growing expatriate population are additional contributors to market growth in these urban centers .

- In 2023, the Saudi government implemented regulations to enhance the safety and quality of beauty and personal care products. This includes mandatory compliance with international standards for cosmetic ingredients and labeling, aimed at protecting consumer health and promoting transparency in the market. Such regulations are expected to foster consumer trust and encourage the growth of local brands. The regulatory environment increasingly supports the introduction of halal-certified and clean-label products .

Saudi Arabia Beauty And Personal Care Market Segmentation

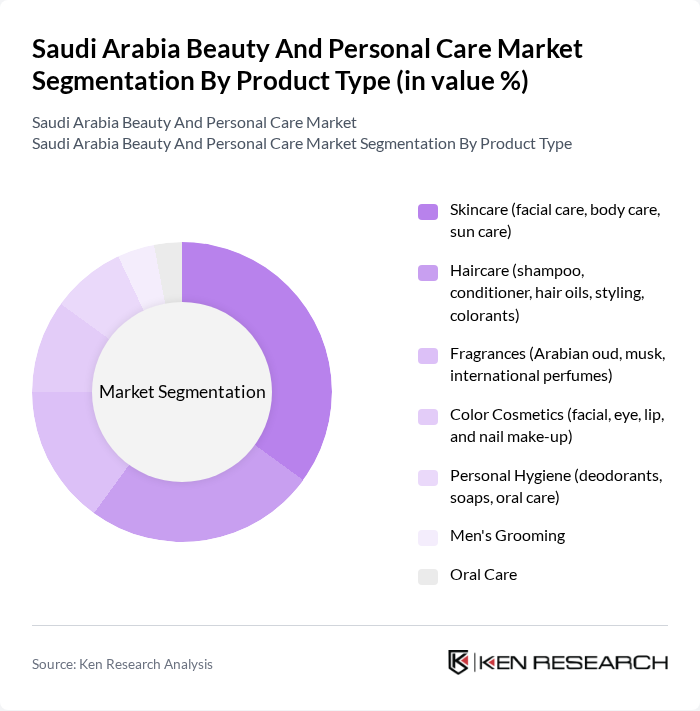

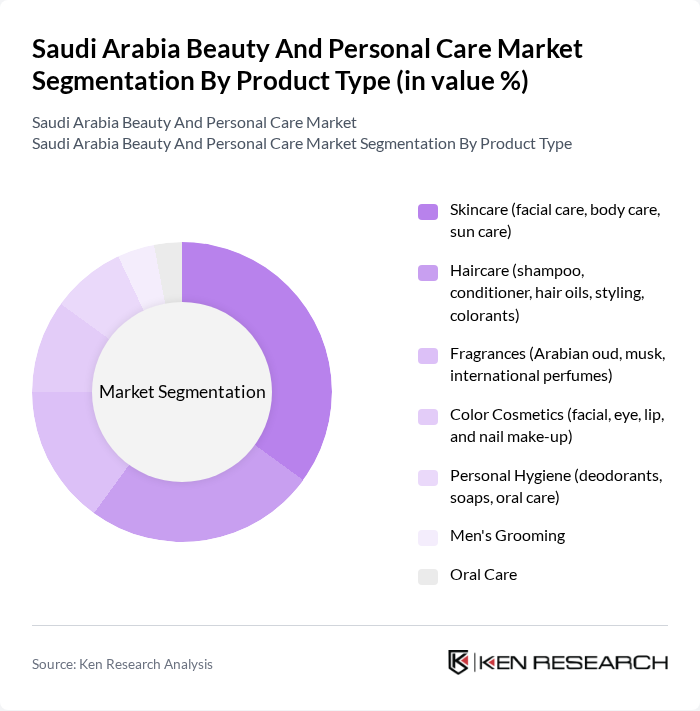

By Product Type:The product type segmentation includes various categories such as skincare, haircare, fragrances, color cosmetics, personal hygiene, men's grooming, and oral care. Among these, skincare products, particularly facial care, have gained significant traction due to increasing awareness of skincare routines, the importance of sun protection, and a preference for products tailored to local climate and skin types. Haircare products also hold a substantial market share, driven by demand for specialized treatments, styling products, and solutions addressing hair concerns related to local environmental conditions. The market also sees rising demand for natural and organic variants across all product types ; .

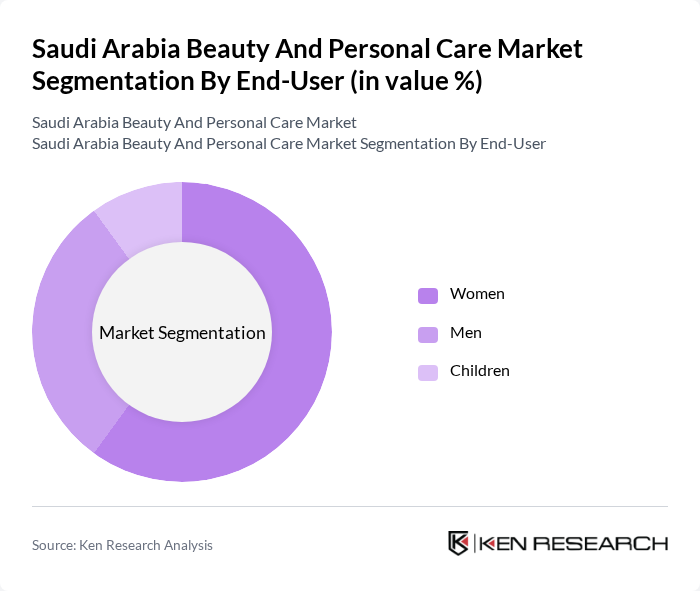

By End-User:The end-user segmentation includes women, men, and children. Women represent the largest consumer group in the beauty and personal care market, driven by a wide range of products tailored to their needs and a strong cultural emphasis on personal grooming. Men's grooming is also on the rise, with increasing acceptance of personal care routines among men and a growing product portfolio targeting male consumers. Children's products are gaining traction due to growing parental awareness of safe and effective products for kids, with a focus on gentle and dermatologically tested formulations ; .

Saudi Arabia Beauty And Personal Care Market Competitive Landscape

The Saudi Arabia Beauty And Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Abdul Samad Al Qurashi, Al Nahdi Medical Company, L'Oréal Middle East, Procter & Gamble Arabia, Unilever Arabia, Estée Lauder Companies Inc., Beiersdorf AG, Johnson & Johnson Middle East, Coty Inc., Shiseido Company, Limited, Revlon, Inc., Mary Kay Inc., Avon Products, Inc., Oriflame Cosmetics S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Beauty And Personal Care Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Saudi Arabia is projected to reach approximately SAR 90,000 (USD 24,000) per capita in future, reflecting a 5% increase from previous year. This rise in income enables consumers to allocate more funds towards beauty and personal care products, driving market growth. As disposable income increases, consumers are more likely to invest in premium and luxury beauty items, enhancing overall market dynamics and encouraging brand diversification.

- Rising Awareness of Personal Grooming:A significant cultural shift towards personal grooming has been observed, with 75% of Saudi consumers now prioritizing beauty and grooming routines. This trend is supported by increased access to beauty education and workshops, leading to a surge in demand for skincare and cosmetic products. The growing emphasis on personal appearance, particularly among younger demographics, is expected to further fuel market expansion as consumers seek to enhance their grooming habits.

- Growth of E-commerce Platforms:E-commerce sales in the beauty and personal care sector in Saudi Arabia are anticipated to exceed SAR 6 billion (USD 1.6 billion) in future, marking a 20% increase from previous year. The convenience of online shopping, coupled with the rise of digital payment solutions, has made beauty products more accessible. This shift towards e-commerce is reshaping consumer purchasing behavior, allowing brands to reach a broader audience and adapt to changing market demands effectively.

Market Challenges

- Intense Competition Among Brands:The Saudi beauty and personal care market is characterized by fierce competition, with over 600 brands vying for market share. This saturation leads to price wars and aggressive marketing strategies, which can erode profit margins. Established brands face challenges from emerging local brands that cater to specific consumer preferences, making it essential for companies to innovate continuously and differentiate their offerings to maintain a competitive edge.

- Regulatory Compliance Issues:Navigating the regulatory landscape in Saudi Arabia poses significant challenges for beauty brands. Compliance with the Saudi Food and Drug Authority (SFDA) regulations requires extensive documentation and testing, which can delay product launches. In future, it is estimated that compliance costs could reach SAR 1.2 million (USD 320,000) for new entrants, creating barriers to entry and hindering market growth for smaller companies lacking resources to meet these stringent requirements.

Saudi Arabia Beauty And Personal Care Market Future Outlook

The future of the Saudi Arabia beauty and personal care market appears promising, driven by evolving consumer preferences and technological advancements. As the market continues to embrace personalization and clean beauty trends, brands are expected to innovate their product lines to meet these demands. Additionally, the integration of augmented reality in online shopping experiences is likely to enhance consumer engagement, making beauty products more accessible and appealing to a broader audience, thus fostering sustained growth in the sector.

Market Opportunities

- Expansion of Organic and Natural Products:The demand for organic and natural beauty products is on the rise, with sales projected to reach SAR 2.5 billion (USD 667 million) in future. This trend is driven by increasing consumer awareness of health and environmental issues, presenting a lucrative opportunity for brands to develop eco-friendly product lines that cater to this growing segment of health-conscious consumers.

- Increasing Demand for Men's Grooming Products:The men's grooming segment is expected to grow significantly, with sales projected to reach SAR 2 billion (USD 533 million) in future. This growth is fueled by changing societal norms and increased marketing efforts targeting male consumers. Brands that focus on developing tailored products for men can capitalize on this emerging market, enhancing their portfolio and driving overall sales growth.