Region:Middle East

Author(s):Shubham

Product Code:KRAB0762

Pages:93

Published On:August 2025

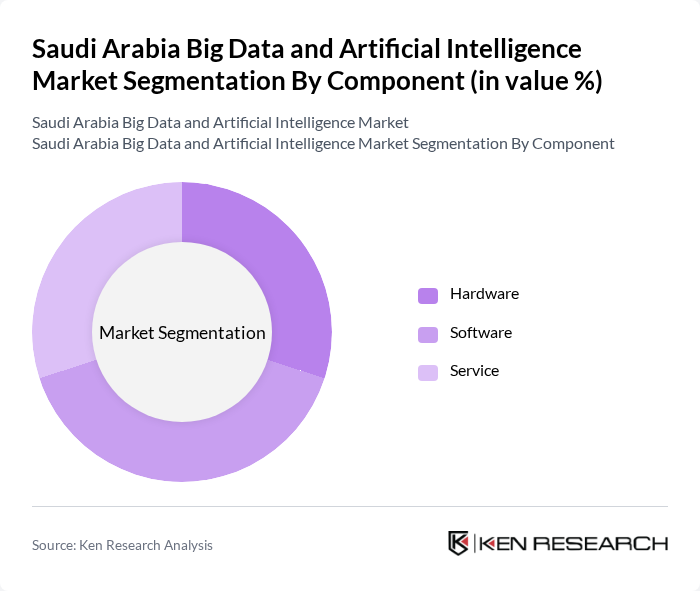

By Component:The market is segmented into hardware, software, and services. Thehardwaresegment includes physical devices and infrastructure necessary for data processing and storage. Thesoftwaresegment encompasses applications and platforms that facilitate data analysis, AI functionalities, and business intelligence. Theservicessegment involves consulting, implementation, managed services, and technical support that assist organizations in deploying and optimizing big data and AI solutions. The increasing adoption of cloud-based services and managed analytics is driving growth in the services segment.

By Organization Size:The market is divided into SMEs and large enterprises.SMEsare increasingly adopting big data and AI solutions to enhance operational efficiency, customer engagement, and innovation, supported by government initiatives and cloud-based offerings that lower entry barriers.Large enterprisesleverage these technologies for strategic decision-making, automation, and maintaining a competitive edge in digital transformation. The trend of digital transformation among SMEs is accelerating their adoption of AI-driven analytics and business intelligence solutions.

The Saudi Arabia Big Data and Artificial Intelligence Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group, SAP Saudi Arabia, IBM Saudi Arabia, Microsoft Arabia, Oracle Saudi Arabia, SAS Institute, Cisco Systems Saudi Arabia, Huawei Technologies Saudi Arabia, Dell Technologies Saudi Arabia, Accenture Saudi Arabia, Infosys Saudi Arabia, Wipro Saudi Arabia, Tata Consultancy Services Saudi Arabia, Zain KSA, Mobily, Intelmatix, Nybl, Omdena Inc., Google Cloud Saudi Arabia, Amazon Web Services Saudi Arabia, Digital Energy, and Gleac contribute to innovation, geographic expansion, and service delivery in this space.

The future of the big data and AI market in Saudi Arabia appears promising, driven by ongoing government support and increasing private sector investments. As organizations continue to embrace digital transformation, the integration of AI technologies into business operations will become more prevalent. Furthermore, advancements in data analytics and machine learning will enhance decision-making capabilities, fostering innovation across various sectors. The focus on ethical AI practices will also shape the regulatory landscape, ensuring responsible technology deployment in the Kingdom.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software Service |

| By Organization Size | SMEs Large Enterprises |

| By End-User | IT and Telecom Retail Public and Government Institutions BFSI (Banking, Financial Services, and Insurance) Healthcare Energy Construction and Manufacturing Others (Education, Tourism, Transportation, etc.) |

| By Application | Customer Experience Management Fraud Detection Predictive Maintenance Risk Management Supply Chain Optimization Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Data Source | Social Media IoT Devices Transactional Data Public Data Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go License-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Applications | 100 | Healthcare IT Managers, Data Analysts |

| Financial Services Big Data Solutions | 80 | Chief Data Officers, Risk Management Executives |

| Retail Analytics and AI Integration | 90 | Marketing Directors, E-commerce Managers |

| Manufacturing AI Implementation | 70 | Operations Managers, Production Engineers |

| Telecommunications Data Management | 50 | Network Engineers, Data Scientists |

The Saudi Arabia Big Data and Artificial Intelligence Market is valued at approximately USD 1.3 billion, driven by digital transformation initiatives across various sectors, including finance, healthcare, and retail, along with strong government support for AI technologies.