Region:Middle East

Author(s):Shubham

Product Code:KRAA8872

Pages:99

Published On:November 2025

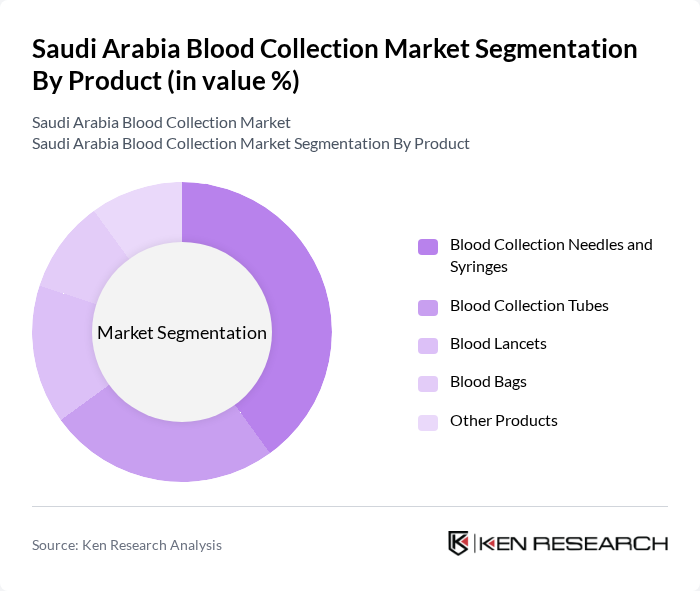

By Product:The product segmentation includes various items essential for blood collection. The subsegments are Blood Collection Needles and Syringes, Blood Collection Tubes, Blood Lancets, Blood Bags, and Other Products. Among these, Blood Collection Needles and Syringes are the most widely used due to their critical role in the blood collection process, ensuring safety and efficiency. The increasing number of diagnostic tests and procedures requiring blood samples has further propelled the demand for these products.

By Application:The application segmentation encompasses Diagnostics and Therapeutic uses of blood collection. Diagnostics is the leading application segment, driven by the rising demand for laboratory tests and the need for timely disease diagnosis. The increasing prevalence of infectious diseases and the growing emphasis on preventive healthcare have significantly contributed to the expansion of this segment.

The Saudi Arabia Blood Collection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Red Crescent Authority, King Faisal Specialist Hospital & Research Centre, National Guard Health Affairs, Ministry of Health, Saudi Arabia, Al Nahdi Medical Company, Al-Dawaa Pharmacies, Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Becton, Dickinson and Company (BD), Terumo Corporation, Grifols S.A., Fresenius Kabi AG, Haemonetics Corporation, Bio-Rad Laboratories, Inc., Medtronic plc, Siemens Healthineers, Abbott Laboratories, Nipro Corporation, Greiner Bio-One GmbH, FL Medical, Qiagen N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia blood collection market is poised for significant growth, driven by increasing demand for blood transfusions and advancements in technology. The government's commitment to enhancing healthcare services will likely lead to improved infrastructure and public awareness initiatives. As mobile blood collection units become more prevalent, accessibility will increase, encouraging higher donor participation. Overall, the market is expected to evolve rapidly, adapting to the needs of a growing population and advancing healthcare standards.

| Segment | Sub-Segments |

|---|---|

| By Product | Blood Collection Needles and Syringes Blood Collection Tubes Blood Lancets Blood Bags Other Products |

| By Application | Diagnostics Therapeutic |

| By End-User | Hospitals and Diagnostic Centres Blood Banks Other End Users |

| By Collection Site | Venous Capillary |

| By Collection Method | Manual Collection Automated Collection |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Blood Collection Practices | 100 | Blood Bank Managers, Transfusion Medicine Specialists |

| Community Blood Donation Drives | 60 | Event Coordinators, Volunteer Organizers |

| Public Awareness Campaigns | 50 | Healthcare Marketers, Public Health Officials |

| Regulatory Compliance in Blood Collection | 40 | Compliance Officers, Quality Assurance Managers |

| Donor Experience and Feedback | 70 | Blood Donors, Healthcare Survey Respondents |

The Saudi Arabia Blood Collection Market is valued at approximately USD 60 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of chronic diseases, increased awareness of blood donation, and advancements in blood collection technologies.