Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7221

Pages:88

Published On:December 2025

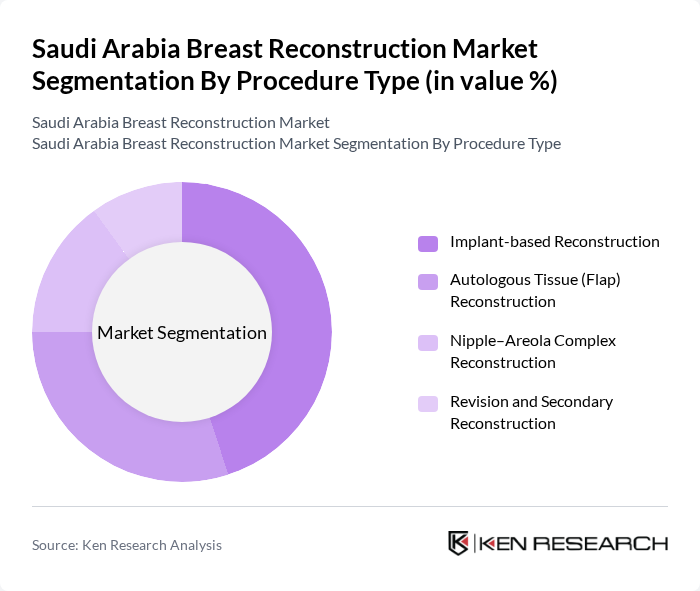

By Procedure Type:The procedure type segmentation includes various methods of breast reconstruction, each catering to different patient needs and preferences. The dominant sub-segment is Implant-based Reconstruction, which is favored for its shorter recovery time and less invasive nature compared to autologous tissue methods. Autologous Tissue (Flap) Reconstruction is also significant, particularly among patients seeking more natural results. Nipple–Areola Complex Reconstruction and Revision and Secondary Reconstruction are essential for completing the aesthetic outcome and addressing previous surgical results.

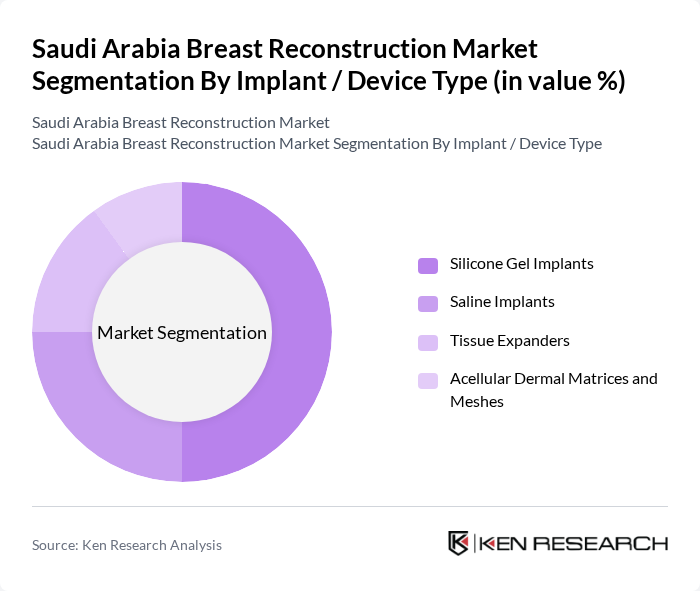

By Implant / Device Type:This segmentation focuses on the types of implants and devices used in breast reconstruction. Silicone Gel Implants dominate the market due to their natural feel and appearance, making them the preferred choice among patients. Saline Implants are also popular, particularly for their adjustable volume. Tissue Expanders are crucial for preparing the breast area for permanent implants, while Acellular Dermal Matrices and Meshes are increasingly used to enhance surgical outcomes and support tissue integration.

The Saudi Arabia Breast Reconstruction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (Mentor Worldwide LLC), AbbVie Inc. (Allergan Aesthetics), Establishment Labs Holdings Inc., GC Aesthetics plc, Sientra Inc., POLYTECH Health & Aesthetics GmbH, Motiva Saudi (Local Distribution Partner Network), Dr. Sulaiman Al Habib Medical Services Group, Saudi German Health (Saudi German Hospital Group), King Faisal Specialist Hospital & Research Centre, King Fahad Medical City, National Guard Health Affairs (King Abdulaziz Medical Cities), International Medical Center (IMC), Jeddah, King Saud Medical City, Dallah Health Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the breast reconstruction market in Saudi Arabia appears promising, driven by increasing awareness and advancements in technology. As the government continues to invest in healthcare infrastructure, the accessibility of specialized services is expected to improve. Additionally, the integration of digital health technologies will enhance patient engagement and post-operative care. With a growing emphasis on personalized treatment plans, the market is likely to witness a shift towards more tailored solutions that cater to individual patient needs.

| Segment | Sub-Segments |

|---|---|

| By Procedure Type | Implant-based Reconstruction Autologous Tissue (Flap) Reconstruction Nipple–Areola Complex Reconstruction Revision and Secondary Reconstruction |

| By Implant / Device Type | Silicone Gel Implants Saline Implants Tissue Expanders Acellular Dermal Matrices and Meshes |

| By Stage of Reconstruction | Immediate Post?Mastectomy Reconstruction Delayed Post?Mastectomy Reconstruction Reconstruction After Breast?Conserving Surgery |

| By Provider Type | Tertiary Care Government Hospitals Private Multi?Specialty Hospitals Specialized Plastic & Reconstructive Surgery Centers Day?care / Ambulatory Surgery Centers |

| By Patient Profile | Post?Mastectomy Breast Cancer Patients Prophylactic (High Genetic Risk) Patients Post?Trauma / Congenital Deformity Patients |

| By Payer Type | Government Insurance (e.g., MOH, governmental schemes) Cooperative Health Insurance Council (CHIC)–regulated Private Insurers Self?pay Patients Others (Charity, Corporate Plans) |

| By Region | Riyadh (Central Region) Makkah & Madinah (Western Region) Eastern Province Northern & Southern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastic Surgeons | 80 | Board-certified plastic surgeons specializing in breast reconstruction |

| Patients Post-Surgery | 120 | Women who have undergone breast reconstruction in the last 5 years |

| Healthcare Administrators | 60 | Hospital administrators overseeing surgical departments |

| Oncologists | 50 | Oncologists involved in breast cancer treatment and patient referrals |

| Medical Device Suppliers | 40 | Suppliers of breast reconstruction implants and surgical materials |

The Saudi Arabia Breast Reconstruction Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness of breast cancer and advancements in surgical techniques.